Also see: Financial Reporting Overview for more information on tabs and menu items at the bottom of the screen.

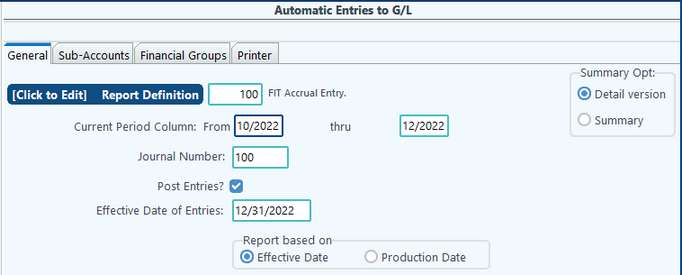

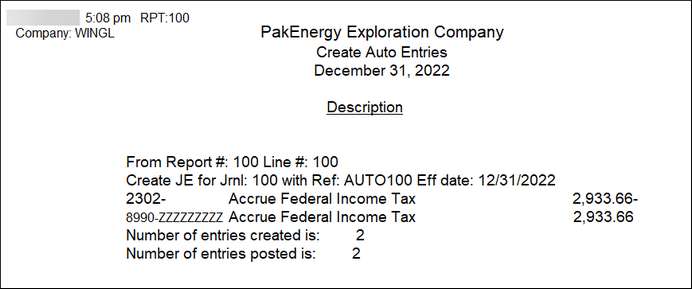

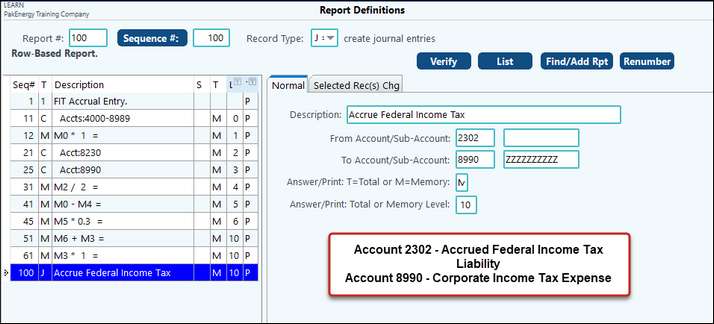

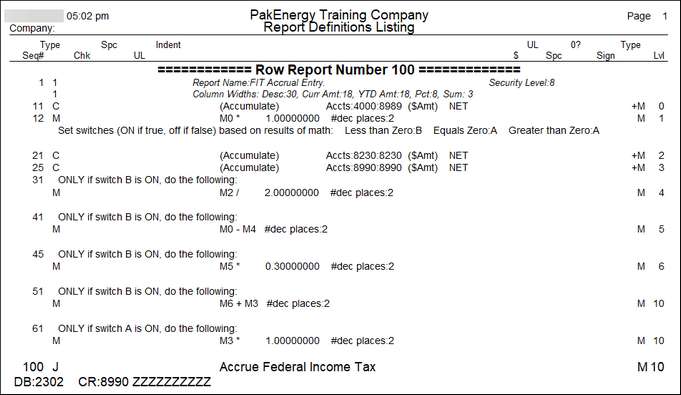

Automatic Entries to G/L provides the ability to make adjusting journal entries automatically based on a specialized report definition. Report definition record type “J”, is used to create journal entries using Automatic Entries to G/L Financial report (see sequence #100 on Report 100-FIT Accrual Entry as an example. This report can be imported from WINGL).

Examples where to use:

•Compute Provision for Federal Income Tax

•Allocate overhead cost center to various profit centers.

•Compute depletion

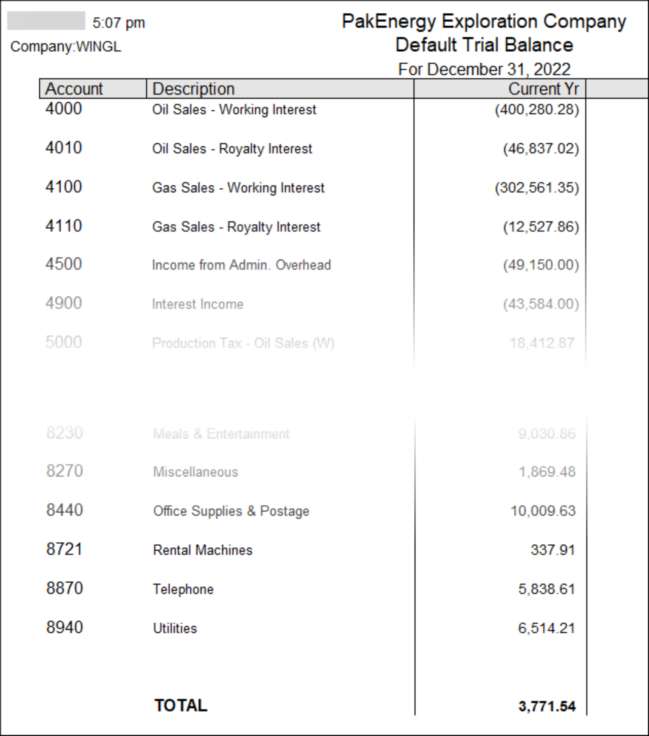

Example: You would like to accrue an effective federal income tax rate of 30% each month. Since, this is created by a financial report definition, you can customize the accrual.

•One customization is to not calculate accrued taxes if taxable income is less than zero. Logic switches will be used to accomplish this feature. Each month we accrue YTD and make an adjustment for any previous months accrual.

•Another modification is you can adjust the meals and entertainment deduction by 50%. We will use math record types and Memory levels to do the calculation.

Seq # |

Sequence Description |

|---|---|

11 |

Accumulate period profit and loss |

12 |

Set up a logic switch for the result in seq #11. If less than zero (profit), use switch B, if equal or greater than zero (loss), use switch A. |

21 |

Accumulate Meals and Entertainment |

25 |

Accumulate YTD accrued tax expense |

31 |

If switch B, divide M & E by 2. |

41 |

If switch B, adjust current year profit by seq #31 (50% of M & E) |

45 |

If switch B, multiply seq #41 by 30% |

51 |

If switch B, adjust calculated taxes by previous accrual (put into memory level 10) |

61 |

If switch A, multiply seq #21 by 1 (to put into memory level 10) |

100 |

J record, creates a journal entry using seq #51 and the case of a calculated profit, and seq #61 in the case of a loss (will reverse any previous accruals). |