This document will highlight the differences between reporting as a “self-insured” company vs reporting as a normal “group-insured” company.

What is a “self-insured” company? A self-insured company is a company that self-funds their employee’s medical claims (i.e. they do not pay an insurance company like Blue Cross). Often, companies that self-fund their insurance will NOT pay the claims directly but will hire a third party administrator to assist in the process. The first question to your 3rd party administrator is if they will be doing the ACA reporting. If not, you will be able to do it yourself in Pak Accounting, but you will have to do some basic setup and then also add the dependents to the system.

In order to complete self-insured reporting, you will need to purchase the optional add-on module for ACA Reporting of Self-Insured Companies. Please email our sales department at sales@pakenergy.com to purchase this optional module.

The first step you’ll need to do (if you haven’t already) is review the two existing ACA docs we have prepared for normal “group-insured” companies. Much of the information will remain the same for self-insured companies! These two docs are listed below, including the links to find them on our website. This current doc will supplement those two checklists with specific information on self-insured options.

Also see:

From the ACA Initial Setup Checklist Doc:

•Step 1: Complete Step #1 from the Setup Doc as normal.

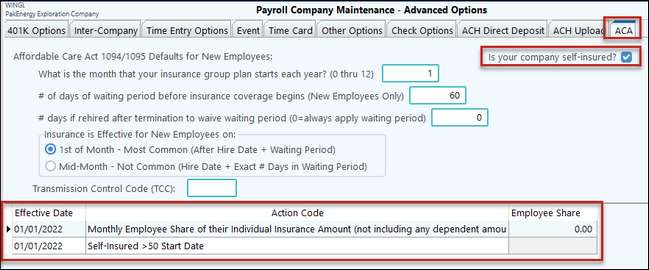

•Step 2: When setting up the Company Information, there TWO important items to setup on this screen for a self-insured company:

oYou MUST mark the box asking “Is your company self-insured?” and…

oYou MUST setup the 2 action codes shown below. There are two action codes for “Self-Insured Start Date”, one for more than 50 employees (>50) and another one for less than 50 employees (<50). This example uses the one for MORE than 50 employees.

This screen is found in Master File Maintenance/Advanced Options/ACA tab:

•Steps 3 & 4 should be completed from the ACA Initial Setup Doc as normal.

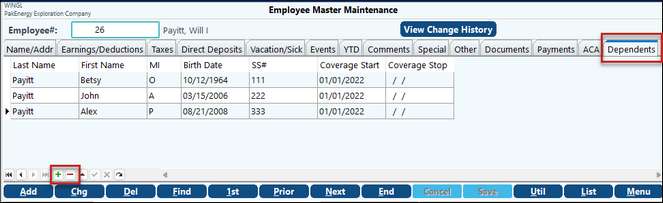

•Step 5 – Add Dependents (the dependent’s tab will become visible in employee master file maintenance after you have checked the option from the screen above that the company is self-insured).

Go to the Employee Master file and add each employee’s dependents on the new “Dependents” tab. You will need to either manually add each employee’s covered dependents on this screen or import them (from your third party administrator) through the Utilities option on this screen. DO NOT ADD THE EMPLOYEE TO THIS GRID, AS THEY WILL POPULATE AUTOMATICALLY ON THE FORM ITSELF (the employee should NOT appear on this grid at all).

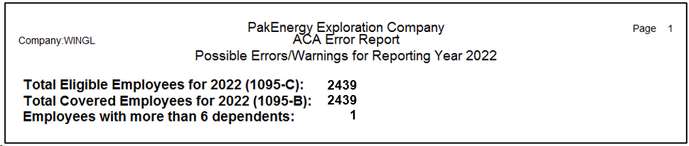

Important Note: if there are more than 6 dependents (including the employee), this employee will have 2 forms print for dependents, the 2nd sheet is referred to as an “overflow” page and you will need to make sure when ordering tax forms to also order overflow sheets if you need them. When you run this report to find out how many forms to order (ACA Reporting Checklist) it will give you a total for the overflow forms you will need to order, look for the total “Employees with more than 6 dependents” line:

Importing Dependents from your Third-Party Administrator:

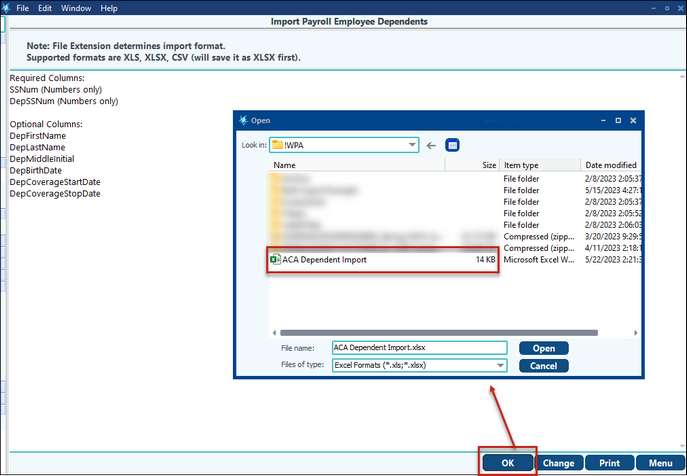

If your Third-Party Administrator gives you an Excel file to use for importing your dependents Pak Accounting has an option to import the dependents for you!

In the Employee Master Maintenance Screen, Click on “Util”, and then select “Import Dependents”, then select OK to browse to your file:

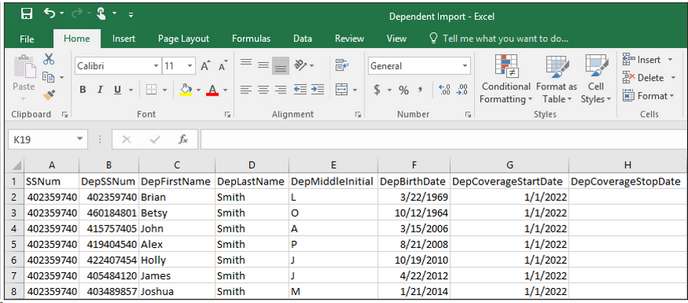

The file needs to be defined as the columns are listed on the prior screen, with the following headers, here is an example:

These columns can be in any order, but the import will match the data in the column “SSNum” (in this example happens to be Column “A”) with the Employee Master. This is how the import will know who the dependents belong to. If there are errors, you get a message and will be able to “Launch Excel” after the import to see what errors have occurred. If the Social Security # matches what is in the employee master file, for both SSNUM and DepSSNum, it will know to not add the employee themselves to the “dependent” tab in the Employee Master, but will add all the dependents that are tied to that employee’s social security #.

From the ACA Reporting Checklist Doc:

All of the steps contained in the ACA Reporting Checklist Document will be valid for a self-insured company, BUT the reports that print will look just a little different because you will be reporting dependent coverage on the 1095 report.

Dependent coverage is reported in Part IV of the 1095-B (if you have less than 50 employees) or Part III of the 1095-C (if you have more than 50 employees).

ACA Reporting for Self-Insured Companies |

||

|---|---|---|

|

Less Than 50 Employees |

More Than 50 Employees |

Employee Gets Form |

1095-B |

1095-C |

Transmittal Forms to IRS |

1095-B & 1094-B |

1095-C & 1094-C |