How to setup a Texas Exempt Tax Code for a Texas severance tax exemption to be reported on the Texas Severance Tax EDI Report.

Below are examples of some of the State of Texas exemptions and current rates.

Oil Exemptions

03 = Two Year Inactive Well Exemption Rate = .000

05 = Enhanced Oil Recovery Exemption (EOR) Rate = .023

Gas Exemptions

03 = Two Year Inactive Well Exemption Rate = .000

04 = Flared Gas Exemption Rate = .000

05 = High-Cost Gas Reduced Tax Rate Rate = .000 to .074

In order to report this exemption for a property on the Texas Severance Tax EDI file, a tax exempt severance tax code has to be setup. The code for this exemption should be setup with the exemption code as the last 1 or 2 digits of the severance tax code. (1 if the code is 2-9 and 2 if the code is 03-09.)

NOTE: All codes will show up on an original file but Code 11. Code 11's are only on the corrected files.

For Example:

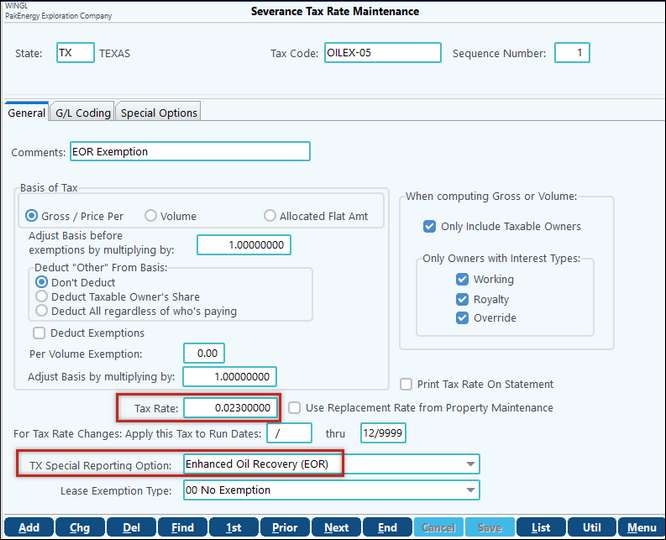

If the exemption is for 05 = Enhanced Oil Recovery Exemption ….

Then the tax code could be something like OILEX-05, OILEXMP-05, etc…

As long as the last two characters of the code are numeric, the system will add the 8065 record with the 05 exemption code to the EDI file.

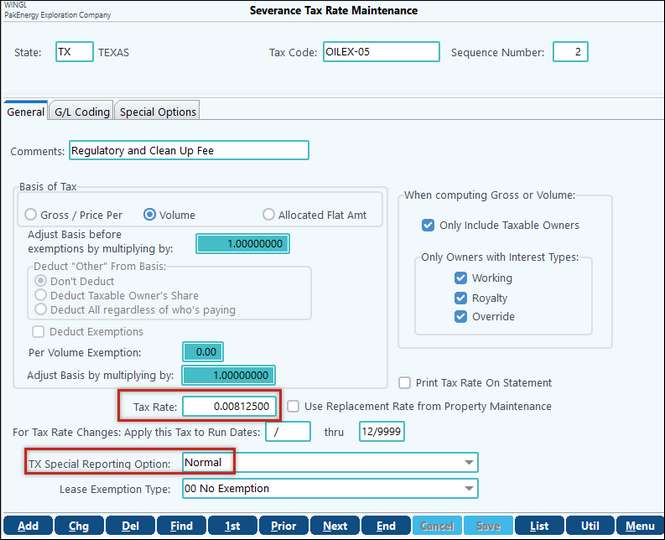

When the severance tax code is setup, there should be a sequence with the reduced tax rate and another sequence for the Clean-Up Fee for Oil properties or Regulatory Fee for Gas properties, with the corresponding tax rate. If the reduced tax rate is .000, then there is no need for a reduced tax rate sequence. In that case, the first sequence will be the Clean-Up Fee or Regulatory Fee rate. In order for the code to work, there has to be a tax being calculated.

Below is an example of setting up the Oil EOR Exemption, Code 05 Severance Tax Rate.

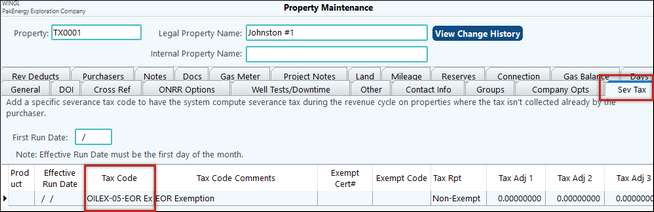

Once the code is setup, then it can be assigned to the properties that have this exemption, under the severance tax tab in Property Maintenance. See the example below.