Creating Wire/ACH Payments

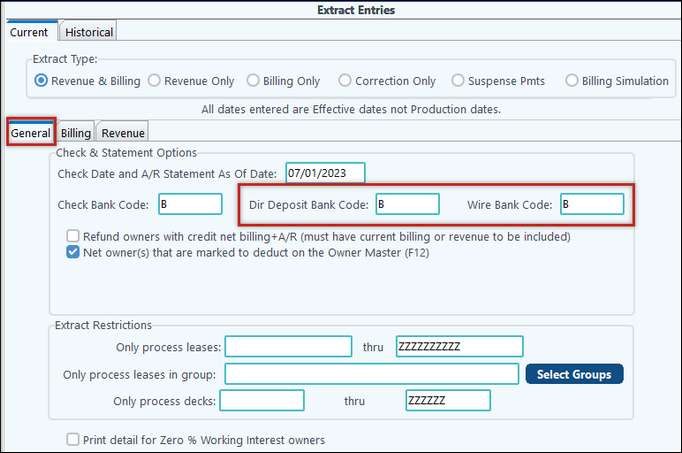

Now that you have the company option on, the owners set up for direct deposit, and the all bank accounts set up for either ACH or Wire you can start your Revenue cycle. There are a couple of new options to make sure you set on the extract screen.

On the General Tab you will see additional bank code boxes that need to be filled in, one for Dir Deposits and one for Wires. You only need to fill them in if you are using these payment methods.

On the Revenue Tab, be sure to select which payment methods you would like to pay on your cycle. There will be two new ones, Dir Deposit and Wire. If you do not select Dir Deposit or Wire, those owners coded to get either Dir Deposit or Wire will not get paid and will go into THD status, which is a temporary hold status (petty suspense). They will get paid once you run a cycle with those payment methods selected.

The check writing process has not changed, write checks like you would normally. On the Owner Summary Report R-1 in the After Check Reports, when running a cycle with owners that have payment methods of Direct Deposit and Wire you will see unique check number prefixes to identify which payment method each owner is getting paid with. For example as before “Z” check numbers indicates zero checks (the revenue was netted against the billing leaving a zero net amount). Another example is To G/L: 1200 which indicates the payment method credit account, this was changed from the GZ check number to simplify things. The new check options are “E” check number which indicates direct deposit payment methods and “W” check number which indicates wire payment methods.

The summary section will separate out each payment method to make it easy for you!

Update/Post the cycle in step 15 and then you are ready to upload the ACH/Wire files.

Note: When owners are paid for more than one interest type, a separate record will be produced for each interest type.

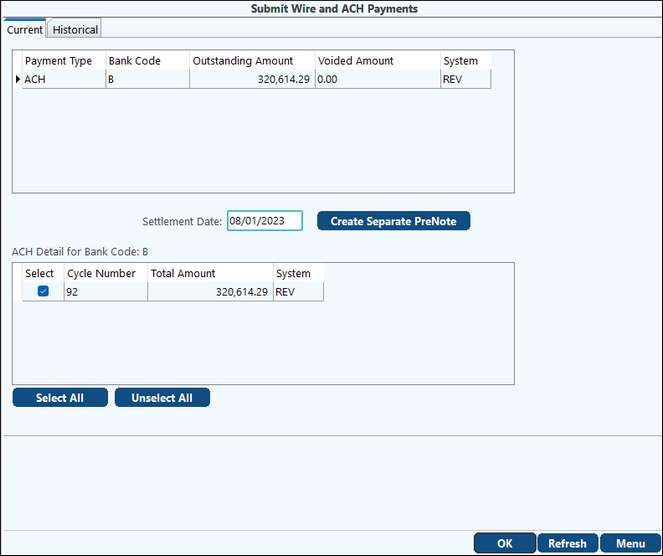

Submitting Wire/ACH Payments:

To submit your revenue cycle generated Wire/ACH payments go to the Management Dashboard module > Mgmt Functions > Submit Wire/ACH Pmts. Depending on which payment method the owners had on the Revenue cycle is what you will see on the Payment Type section as outstanding. NOTE: The ACH/Wires are not marked as cleared until they are submitted to allow one or more ACH/Wires to be voided prior to being sent to the bank.

Cycle information is stored in a secure location ensuring that there is no data manipulation without it being logged prior to being sent to the bank. This also allows for multiple cycles to be combined into one file or selected individual or multiple for a Settlement Date, for electronic payments to be voided prior to being sent, and for the latest bank information to be used when submitting. Select on the Payment Type that you would like to send then the ok button. This will create the payment file based on the Bank account setting and save it in the EDI folder. The files are labeled with the “payment type_BankCode_ChkDt_ xxxx-xx-xx.txt” to keep them identified uniquely. For example: ![]()

Once you have created the file, it is ready to send to your bank.

Future treasury controls for the submitting ACH/Wire files for Larger Banking Institutions will involve direct electronic transmittal, thus omitting any chance of data manipulation.

Pak Accounting’s internal alert system will enhance your treasury controls by sending defined users notifications of any Sub-Account name changes, any ACH changes, or even payment method changes. These Alerts can be emailed as well as set up as reminders within the system.