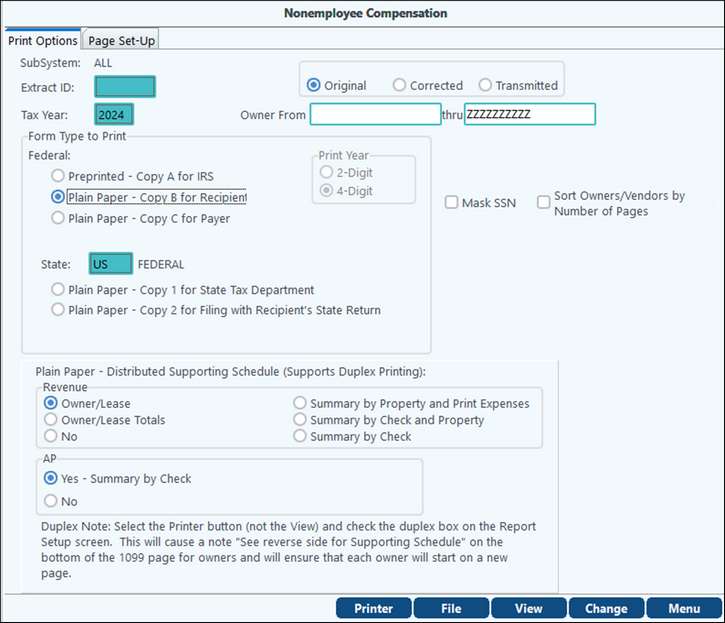

Click on Print Form and select the sub-system you want to work on. Selecting All will allow you to print the 1099 for every sub-system extracted. You can also choose to separate the printing of the sub-systems if you have different employees handling each of the 1099 sub-systems. Separating the printing of the 1099s for the different sub-systems is typically the way the process is handled to ensure that errors are caught.

Form Types to Print

You will then need to choose whether to print to Plain Paper or Pre-Printed forms.

Federal

•Copy A is a preprinted IRS form that must be purchased. PakEnergy’s Forms Department can handle any of these requests. The information for the 1099’s will print on this form. Mask SSN should NOT be used.

•Copy B for the Recipient and Copy C for Payer can both be printed on plain paper.

•Things to Remember:

oCopy B - Mask SSN should be used with this option

oCopy C - Instructions do not print. Two recipients will be printed on one page.

•What if the recipient has withholding for 3 or more states?

oCopy B - Boxes 15-17 will say “See Attached” and a State Withholding Schedule will print on the next page.

oCopy C will also say “See Attached” in Boxes 15-17, but the State Withholding Schedule will print on the same page as the 1099.

State

State Forms only include Owner Revenue and do not come with supporting schedule options. In the State field, select the specific state for the forms, the selected either Copy 1 for State Tax Department or Copy 2 for Filing with Recipient’s State Return.

Note – the system currently does not support A/P 1099-MISC paper forms for state filing purposes. For electronic filing, if the state participates in the Combined State/Federal filing program then A/P information is supported. However, if the state does not participate in the Combined State/Federal filing program, then A/P 1099 information is not supported in electronic format for state filing purposes. State filing is not supported because currently there is no way to indicate in the system where the work was actually done. The state can be overridden via the Payee Maintenance and state transmittal files or forms created. However, if a new extract is performed the information will not be saved.

Supporting Schedules

Plain Paper also provides the option to print a supporting schedule for both Revenue and A/P. This can be duplexed if your printer supports duplexing.

Please note that if you are looking at JUST the Accounts Payable sub-system, only the AP section for printing the supporting schedule will show.

NOTES:

•See Sub-Account Maintenance /Name #2 if the Sub-Account is for joint owners or for a trust since the Name and Name #2 fields may flip.

Important things to note for Supporting Schedules:

All amounts for the 1099-MISC and the 1099-NEC will show on the supporting schedules printed from the MISC or NEC section.

The PakEnergy Accounting Forms department can help you with anything you need. Contact our Forms Department today!

Other Print Form 1099 Options

•Sort Owners/Vendors by Number of Pages - Owners/Vendors with 1 page will print first, then Owners/Vendors with 2 pages etc.

•Create PDF’s - creates a separate PDF with the Owners/Vendors name on the file.

•Mask SSN - if checked will only print the last four digits of a Payee’s SSN. If unchecked, will print Payee’s entire SSN. EIN numbers will always print the entire number regardless of setting.

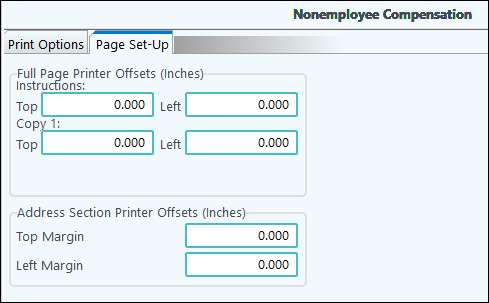

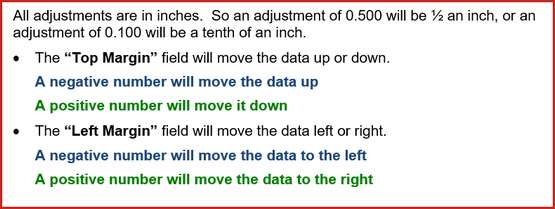

Page Set-Up Tab

Full Page Printer Offset:

•Instructions will move just the instructions

•Copy 1 will move the 1099 box information

Address Section Printer will move the address section so it will best fit in the envelope. This includes the from address, to address, and Important Tax information box.

This is used when printing Preprinted Forms. Not all printers print perfectly the first time, and adjustments to the printer settings may need to be made. It is recommended that when printing Preprinted forms, you print on plain paper and hold the paper up to the preprinted form until the printing aligns with the preprinted form so that forms are not wasted.

NOTE: When printing 1099's the sub-system will print in the account field on the 1099 (i.e. AP, GL, REV, PR).