The Payee Maintenance screen is used to verify the amounts for each payee by clicking through each 1099 or by using the "List" feature at the bottom of the screen.

A sub-system selection window will appear. You will need to select the Sub-System to print: AP, Revenue, G/L, and in some cases, Payroll. Click on OK after you have made your selection.

Special warning regarding changes to the amounts in the Payee Maintenance screen.

You can change the amounts on this screen, but first you need to ask yourself WHY the amounts need to be changed.

Reasons to do corrections in the appropriate module instead of manual adjustments:

1.Manual adjustments do not correct A/P Invoices or Revenue Check History.

2.Manual adjustments will cause the 1099 amounts not to agree with the supporting documentation.

3.Manual changes are not saved in the 1099 system. If you did not make good notes about manual changes or you did not know there were manual changes made by a prior employee, and you re-extract, you would not be aware that the 1099 information did not match what was previously reported.

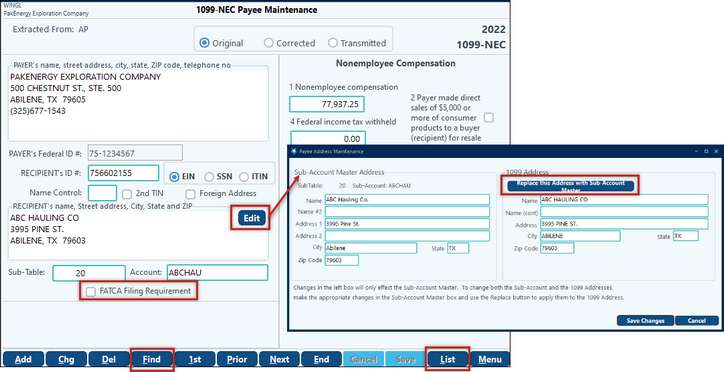

Now, let’s review some of the options on this screen. The Edit button allows you to change the address in the Sub-Account Maintenance and replace the 1099 address with the new address if desired. This may also be done in F12, but a new extract would be needed for the new address to be used.

Please see Sub-Account Maintenance > Name #2 if the Sub-Account is for a joint account or trust.

Please see A/P Sub-Account Maintenance > 1099 Address if you need the 1099 to have an address different than the primary name and/or address listed.

FATCA Filing Requirement- Foreign Account Tax Compliance Act. This box is for U.S. taxpayers holding foreign financial assets and accounts outside the United States and need to have those assets reported to the IRS. This box will need to be manually checked, because the information is not validated during the extract and will not be remembered for next year. It is up to the client to know whether or not they need to mark any vendor or owner as needing to file FACTA.

Find button- The Find button on the bottom of the screen allows a lookup display of all the extracted records. A Sub-Account code or a “contains” type lookup can be easily done.

List button- The List button on the bottom of the screen prints the recipient information with the amounts.

NOTES

•Social Security Numbers that start with a "9" will be allowed so that vendors with an ITIN# can be reported. An ITIN# is an identification number available to resident and non-resident aliens that are not eligible for U.S. Employment but are eligible to receive a 1099.

•CORRECTED 1099's and CORRECTED 1099 FILES

oIf you are making corrections to 1099's, mark them as "Corrected" at the top of the screen in "Payee Maintenance 1099-MISC", in "Print Form 1099-MISC", and "Print Form 1096-MISC".

oTo export a "Corrected" 1099 file, choose "Corrected" at the top of the "Export 1099-MISC Transmittal" screen. Once the Corrected 1099's are exported to an EDI file, The system automatically changes the 1099's marked as "Corrected" to being marked as "Transmitted."