Most payroll companies are 941 companies (not 943 or 944.) The 941 is filed quarterly.

So, the final 941 the year will use the current form. The 1st Quarter of the new year is not typically released until Mid-to end of March..

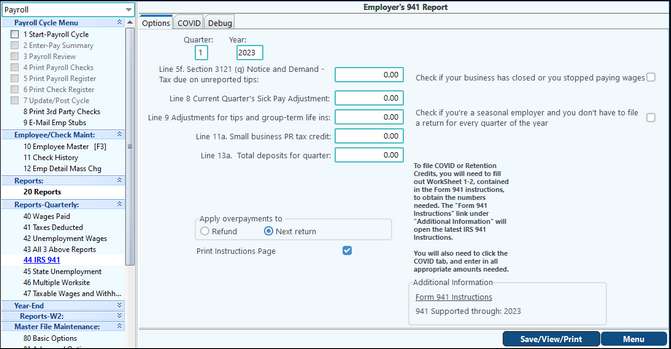

The 941 menu is under Reports Quarterly - # 44 IRS 941. The form is a 2-page form. If the company owes money, a voucher will print. If the company is a semi-weekly depositor, a Schedule B will be printed.

Enter in the amount of the quarterly deposits in the Line 11 line on the menu. You can select to not print the instructions.

SPECIAL NOTE: The amount of taxes due and reported are based on the check date, not the date of the tax deposit. The 941 wants to know how much taxes were accrued and paid for the quarter being reported. Often people (especially those that print the Schedule B) expect this to balance to the tax deposits or drafts from their accounts. It does not; the report is showing how much tax was owed for the check dates in that quarter.

How to handle situations where employees participating in COBRA health insurance receive a 65% federal subsidy, where the employer pays the employee’s insurance in full and receives credit for the 65% subsidy amount on their IRS form 941 Quarterly Report.

In this example below, the ex-employee’s TOTAL insurance cost for COBRA is assumed to be $1,000.00 per month ($350.00 paid by the employee, $650.00 paid by government subsidy).

|