Used with WolfePak Investor G/L Only

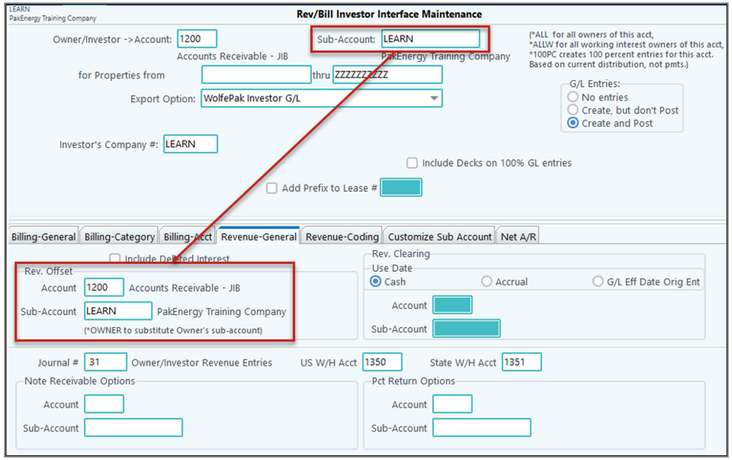

Revenue - General tab |

|

|---|---|

Revenue Offset Acct |

Our Share: the account should match the same Account/Sub that the Rev/Bill Cycle used and is defined in the DOI maintenance. Investor Share: For journal entries sent to an affiliate's books, use the Cash Clearing Acct or Inter company type account as needed. |

Revenue Clearing

|

Cash means the entries to income will be recorded using the check date for the G/L effective date. Accrual means the entries to income will be recorded using the disbursed product's production month for the G/L effective date. If Accrual is selected, enter in an account/Sub-Account clearing account for the accrual entries. G/L Eff Date means the entries to income will be recorded using the effective date of the original entries. |

Include Deleted Interest |

Checked will include deleted interest entries. |

Journal |

Journal number to record the entry (should be a unique journal). Use an “Investor Rev Entries Journal” when creating entries for the internal company. Or you can use a Deposit journal when creating entries for an affiliate set of books. |

Withholding Accounts |

Special accounts for your (or the affiliate) share of US or State withholding. Defines what Prepaid Tax Account to offset to. Typically, an Asset Account. |

Notes Receivable Options |

Rarely Used - contact your Customer Success Team for setup Define Account/Sub-Account if deducted from investor/owner. [Note: Receivable Options are defined on the owner master (Other tab), and the Pct Return Options are defined on the owner master (Fund Ded tab)] |

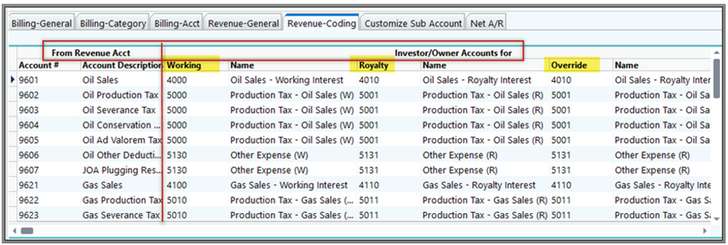

Revenue - Coding |

|

|---|---|

Accounts Working/Royalty/Override |

Set up the From Revenue Acct with all the Revenue Accounts that could be used in the cycle. However, if you add a new account later, these will need to be set up. Set up the Investor/Owner Accounts for each Interest Type. Tip: You only have to fill in what you will need to use. Example: No need to fill in the Override Interest column if your investor does not have any Override shares. |

NOTE: When a Revenue Account is missing from the Revenue Coding tab on the Investor Interface and the export option is set to go to the investor general ledger, the entries will not post. The entries will be in the General Ledger #10-Entries. The entry with the invalid account will be coded in red with the number 0002 indicating that a General Ledger Account number is missing from the coding. If the number is 0000, this indicates that a cross reference is not setup. Coding of 0001 indicated that the JIB coding reference was not specified.