Pak Accounting offers the ability to record transactions in a primary or secondary currency. This is an optional add-on. Financial reporting can be done in one currency only. However, two reports can be generated, one in the primary currency and one in the foreign currency, for comparative purposes.

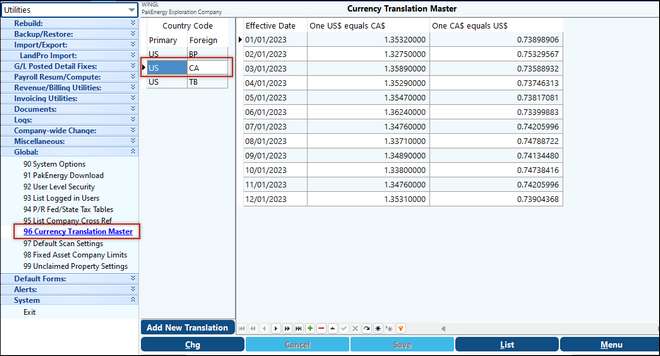

1.In Utilities > Global > Currency Translation Master, enter a two digit foreign country code of your choice (CA for Canadian Dollar in our example). Then, enter the effective date and the exchange rate for the foreign currency as it relates to the US dollar. As the exchange rate changes you will need to update this grid. You can set up as many translations as you need.

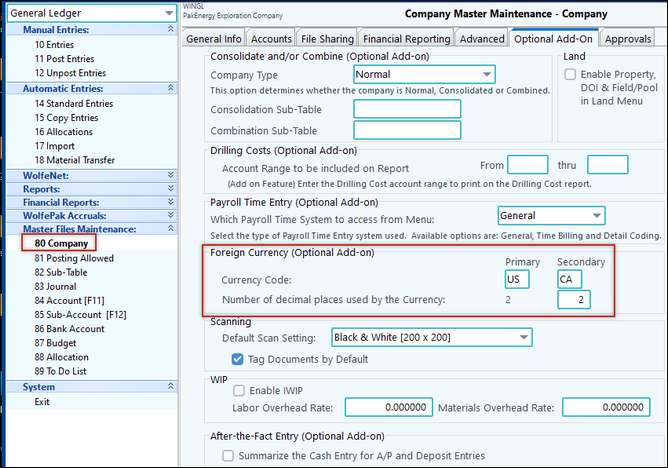

2. In General Ledger > Master Files Maintenance > Company Options > Optional Add-On, enter the two digit code setup in step one. NOTE: Only one foreign currency can be selected at a time.

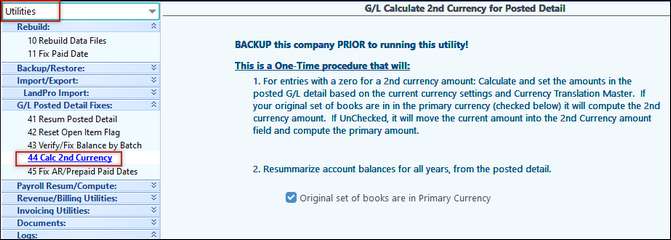

NOTE: If you are setting up foreign currency after you already have posted detail in Pak Accounting's General Ledger, and you would like to apply the translation to the previously entered detail, you must resummarize the posted detail at Utilities > GL Posted Detail Fixes > Calc 2nd Currency.

|

Using Dual (Foreign) Currency

When first entering Pak Accounting (or by selecting the F8 hotkey if you are already in the system) specify either Primary Currency or Secondary Currency to use as Company Default Currency when entering data into Pak Accounting.

Accounts Payable

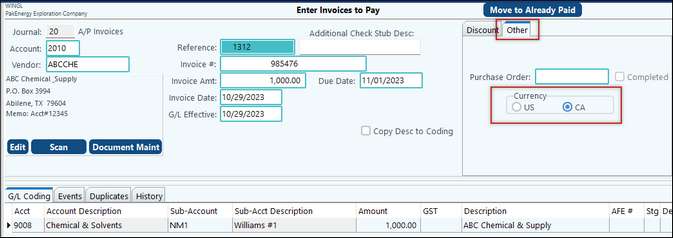

When purchasing goods or services from a foreign country, enter the invoice into Accounts payable enter invoices to Pay. There will be an option for you to select if the invoice is in US or in the foreign currency.

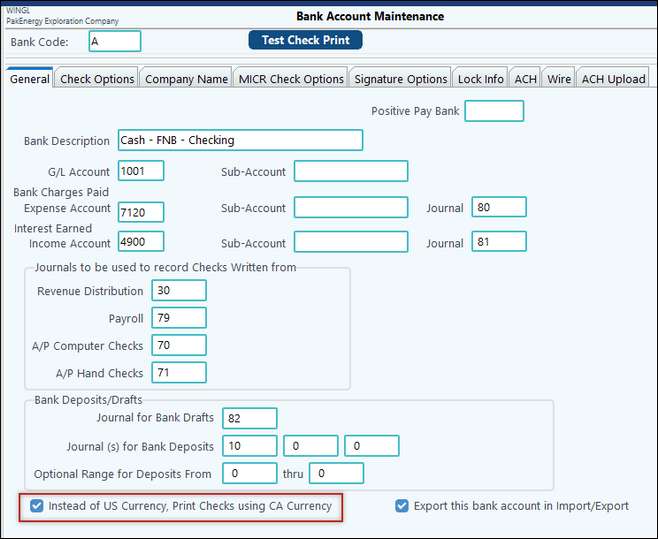

When paying the invoice, determine if the check is to be written in US or foreign currency. If paying in the Foreign currency, check the box “Instead of US Currency, Print Checks using the foreign Currency” in the Bank Account Master. If printing checks in US dollars, then uncheck this option.

NOTE: When voiding A/P Checks this option must be the same as when the check was cut.

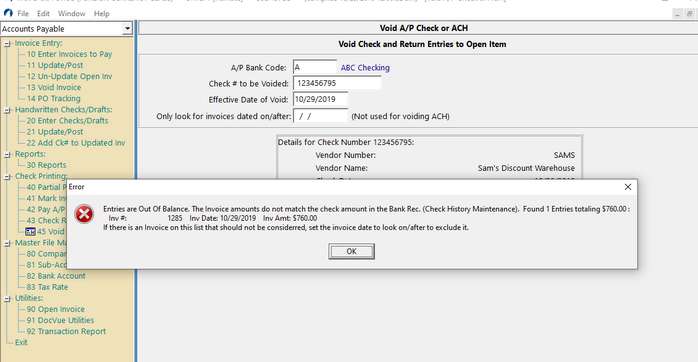

For example: I had the box checked so I could cut a check using CA Currency, then I unchecked the box since most of my checks should be in US Currency. However, later I needed to void the CA check. If I don’t recheck the box, I would get the following error.

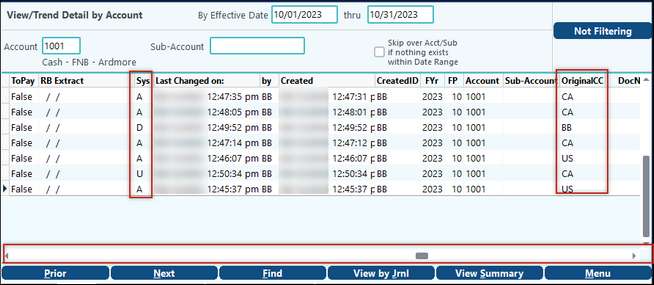

To check what it was go into View/Trend. On the Detail by Account screen scroll to the right to see more column, towards the end you will see a column called “OriginalCC”. On AP entries will either be Primary (US in this example) or Secondary (CA in this example). Look at the Sys column for the module. In this example A = A/P, D = Deposit Entry.

US = box was not checked. CN = box was checked

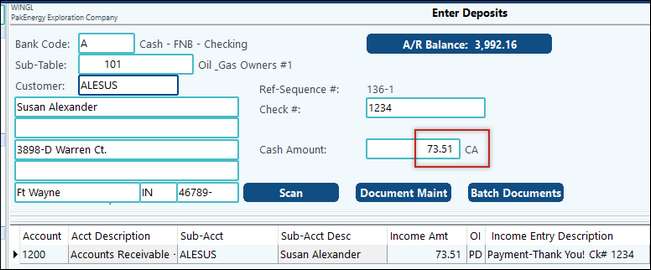

Deposit Entry

Deposit entry is similar to Accounts payable, if the box is checked in bank account master (see above) for the selected bank code, the system will record the deposit amount in the Foreign Currency.

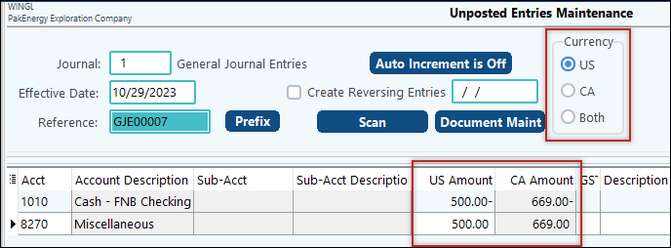

Entering Journal entries

Entries maintenance will allow you to enter journal entries in US amount, the Foreign Currency is automatically calculated. You will need to log into your company under foreign currency for these options to appear.

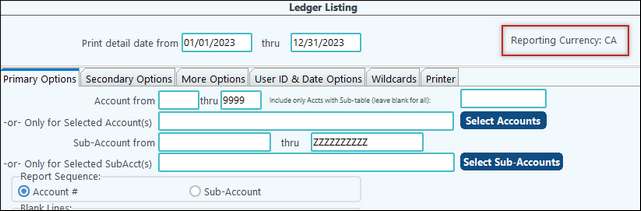

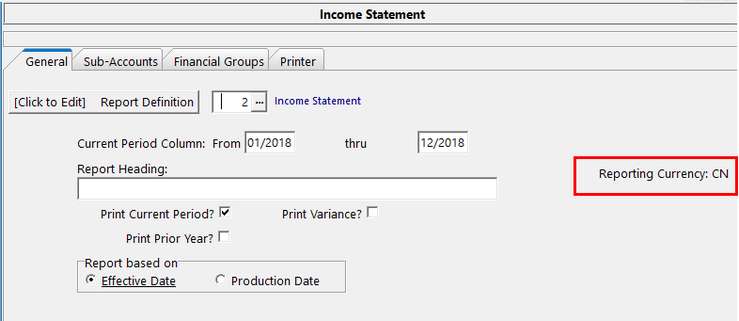

Financial Reporting in Foreign Currency

When first entering Pak Accounting (or by selecting F8 if you are already in the system) specify the default currency that will print on the financial reports.

•Selecting Secondary Currency will print the reports in the selected currency.

•Selecting US Dollars will print the reports in US Dollar

Pak Accounting does not print comparative reports with US verses Foreign Currency. You must select which currency to print on financial reports. NOTE: Once the option is selected, you will notice the foreign currency functionality on Ledgers, Journals, etc.

View Trend

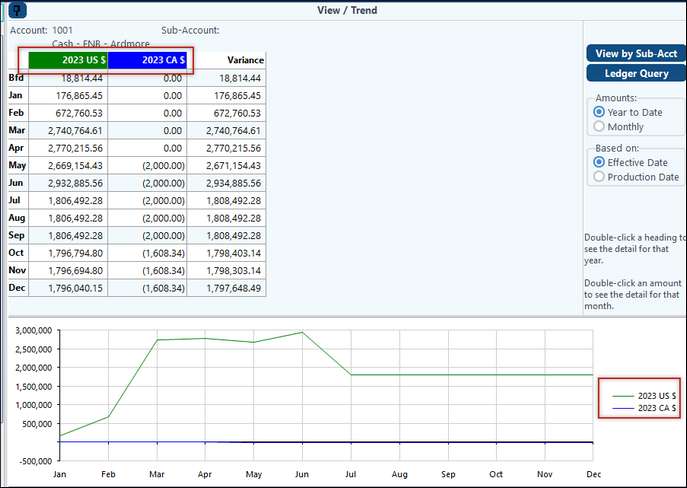

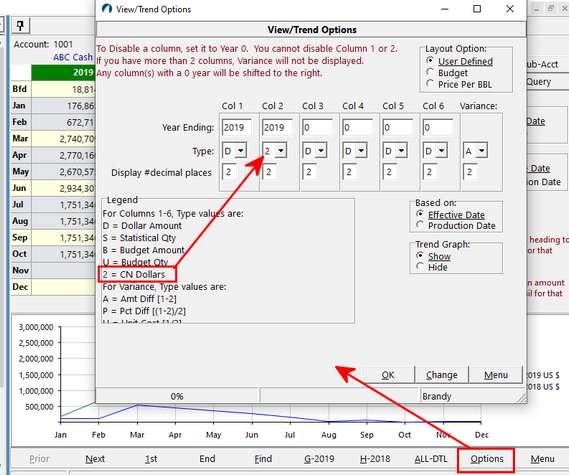

View Trend can be setup to show a comparison of US verses Foreign Currency. Select Options at the bottom of the screen. Change Column 2 to the Foreign currency.

The Comparative summary screen will show the values in both US and Foreign.