Pak Accounting’s Unclaimed Property Reporting

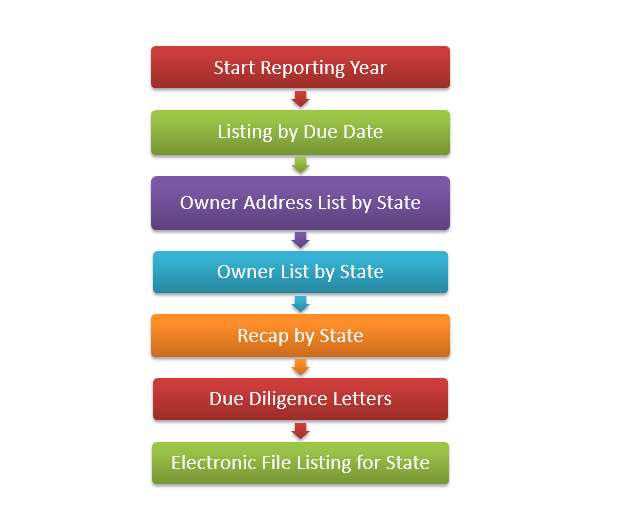

Start Reporting Year

On or around January 1st, Start a New Reporting Year. This is a one-time process for all states, each reporting year. The Unclaimed Property Reporting Process starts by identifying all owners that have funds in suspense long enough determined by the owner’s escheat state (last known address, and if none, by the company’s incorporated state) and the state’s cut-off date and dormancy period. Locate the Unclaimed Property Reporting process in the Bank Reconciliation module menu, expand the menu by using the (+), and select the start new reporting year.

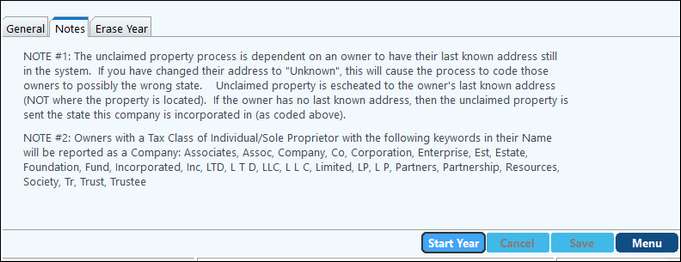

The most frequent problem that users have experienced have all been caused by either the owner’s name not being split out between First name & Last, or Non-Owner Address information in the Owner’s address fields.

•The Owner’s Address List should be run and reviewed in detail. If an owner’s address was replaced with “Bad Address” when their mail was returned, then there is a good chance they are being escheated to the wrong state.

•Plan on taking some time and reviewing these addresses! Any owner listed as “Company” should be reviewed to verify that it is true company name and not an individual.

See Special Considerations for Escheat in Sub-Account Maintenance for more information on how to correctly setup the Name and Address.

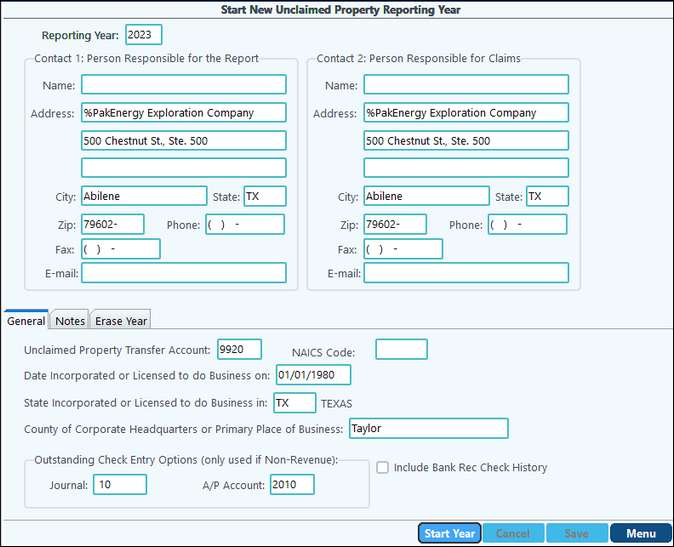

Important key fields include:

Reporting Year |

This is the current year. The process is done once a year on/around January 2nd of each reporting year (Example: in January of 2023 you will run this report for reporting year 2023-not the previous year). |

Date Incorporated or Licensed to do Business on |

Enter the date the company was incorporated or licensed to do business. |

Unclaimed Property Transfer Account |

Accounts should be in your Revenue type account range as an “OTHER” deduction category. The Unclaimed process will use this account as it is transferring the suspense monies from the owner’s suspense to the state's suspense and to offset cash for Payroll and Accounts Payable checks that have been marked for "Pending Unclaimed". |

NAICS Code |

This free forms field allows you to enter your 2-6 digit code. See https://www.census.gov/naics/ for more information. Use the links under Reference Files to find the appropriate code for your company. |

State Incorporated or Licensed to do Business in |

Enter the state the company is incorporated in. If your company is not incorporated, then enter the state your company is “domiciled” in. Generally this would be the state where your main office is located in. This becomes the reporting state for owners where there is no known last address. It is extremely important this is entered correctly. |

County for Corporate Headquarters or Primary Place of Business |

Enter the county your headquarters are located in. This is a required field for the electronic file. |

Outstanding Check Entry Options (only used if Non-Revenue) |

These two items must be defined in order to start the process, but they will only be utilized if there are no suspense funds to escheat for the company that the Unclaimed Property Process is being started in. |

Journal |

The Journal number that will be used to create the A/P invoice for funds that are being escheated in a company that does not have any suspense funds to escheat. |

A/P Account |

The Payable account that the invoice for escheat funds will post to for the a company that does not have any suspense funds to escheat. |

Include Bank Rec Check History |

An option to pull older outstanding Bank Rec checks (vendors and payroll checks only) into the escheat cycle. |

BEFORE clicking on “Start Year” – Remember this should be a one-time entry as the system will retain the information from year-to-year. |

|

Start Year |

Will start the new reporting year. The system will identify all vendors, employees, and owners that have funds in suspense that meet the requirements of the owner’s escheat state and will utilize that state’s cut-off date and dormancy period. (Pak Accounting maintains all 50 states and all US Territories’ dormancy periods and cutoff dates, but it is YOUR responsibility to double-check the states’ rules). Pak Accounting identifies the states being reported to, which should narrow down the review process. Note: Only the current year may be started until December 1st. On December 1st, the reporting year for the new year may be started if all reporting has been completed for the current year. |

Erase |

Once you have started a new process, you cannot click on "Start Year" to Start a New reporting year again unless you "Erase" the current reporting year first. Generally, the “Erase” is never done. Erasing the current reporting year will clear all data, and you will have to restart the new reporting year and redo any letters that were marked “Done”. The erase can only be done if you have not finalized (submitted any payments for the year) that you are trying to erase. A case where the erase would be used: You specified the wrong incorporated state. |