Setup and Items to Review

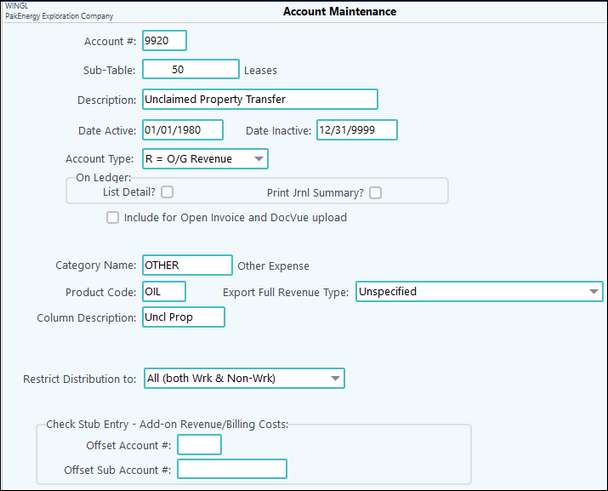

1.![]() Setup a Revenue Unclaimed Property Transfer Clearing Account

Setup a Revenue Unclaimed Property Transfer Clearing Account

Use F11 (Account Maintenance).

|

2.![]() Bank Reconciliation for all Accounts

Bank Reconciliation for all Accounts

Pak Accounting is an integrated system! Bank Reconciliation is a huge part of the Unclaimed Property Reporting Process. Make sure the bank accounts have been reconciled at least through November (escheating usually begins in January of each year), and revenue checks that are older than 6 months should be voided and returned to suspense. Do NOT void any old Payroll or Accounts Payable checks; the software will automatically flag any of these old checks as “Pending Unclaimed” if they become old enough to be escheated to the state. The cutoff dates vary based on state and type of check. Any revenue checks that have been outstanding for more than 3 years as of the end of December will prevent the unclaimed property reporting process from running and force the user to void or clear the checks before allowing the start year process to complete. |

3.![]() Review Owner/Vendor/Employee address

Review Owner/Vendor/Employee address

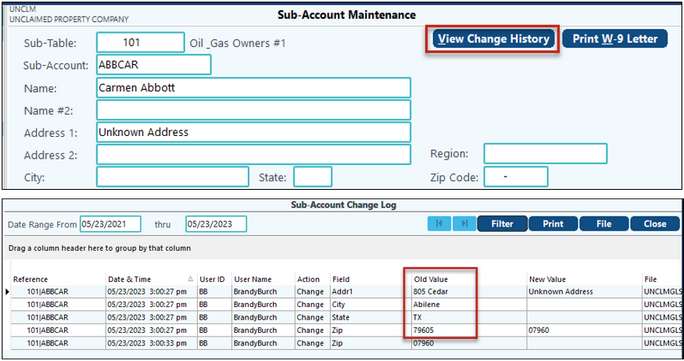

Use F12 Sub-Account Maintenance. Pak Accounting assumes that the address in the system is the last known address. This is a critical requirement for the escheat funds to be sent to the correct state and to protect companies from any future liabilities for misfiling Unclaimed Property. •When the unclaimed funds are sent to the state, the owner’s last known address is also reported. The state coded in that address determines which state’s rules to use when processing the unclaimed property reporting. •Do not delete bad addresses. Instead, indicate in the notes field that the address is bad and change the vendor to a Do Not Pay status. •For an owner with an unknown address, change their DOI to have a Legal suspense code that indicates a Bad Address instead of changing their address. If, for some reason, the address was changed to “Returned by Post Office” or to something else of that nature, then address cleanup is necessary to ensure that the Unclaimed Property files will contain the most accurate information possible. As part of the Due Diligence for most states, holders are required to send a letter to the last known address. If the address for owners/vendors/employees that is on file is a known bad address, the letters should still be mailed to the bad address, and then, the letter with “undeliverable” stamps should be saved for future reference.

Tip: Use the View Change History button on the Owner Master/Sub-Account Maintenance to see what the previous address was to be able to change back to. Pak Accounting maintains two years of Sub-Account change history.

|

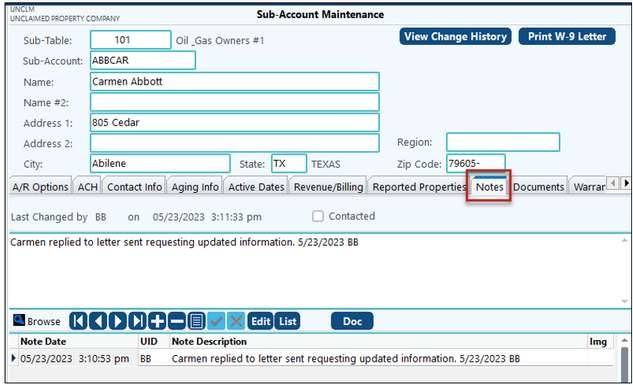

Notes on the owner or vendor can help to determine or prove whether as part of the Due Diligence for most states, holders are required to send a letter to the last known address. If the addresses for owners/vendors/employees that is on file is a known bad address the letters should still be mailed to the bad address, and then, the letter with “undeliverable” stamps should be saved for future reference. However, notes may also be used for logging when Due Diligence letters were sent out, if it was returned with a bad address, or to log the different methods that were used to attempt to locate the owner. All notes may be listed and printed at a future date and when scanning is a part of the software package images may even be attached to the notes.

|

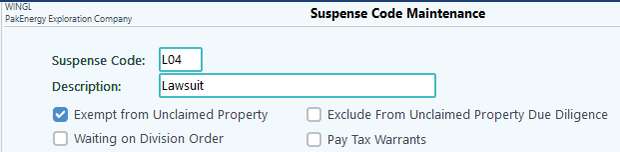

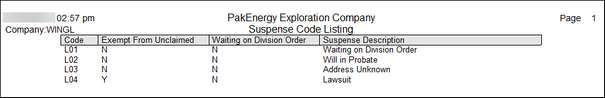

Pak Accounting assumes that all owners in suspense are “unclaimed” and, as such, are subject to being escheated to the state. If some owners should not be reported, then use a different Suspense Code to represent these interests and code the suspense code as “exempt”. Be sure to check the rules for the state in which the owner(s) live before coding interests to this “exempt” suspense code to ensure that legal requirements have been met. Review Suspense Codes by running a List in Revenue/Billing-Company Maintenance-Suspense Code Maintenance. If needed, define any new Suspense codes, or change Exempt flags.

|

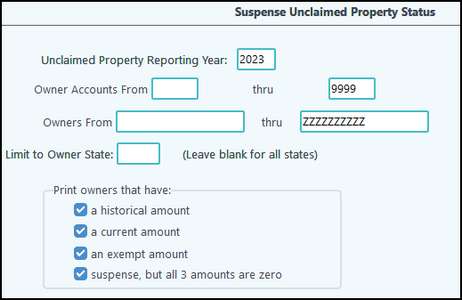

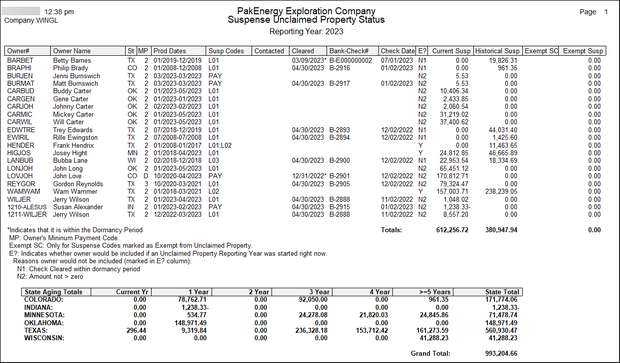

6.![]() Review the Suspense Unclaimed Property Status

Review the Suspense Unclaimed Property Status

This report provides suspense amounts by owner for a designated unclaimed property reporting year. Filters may be set to include owners that have a historical amount, a current amount, an exempt amount, or suspense but all 3 amounts are zero. All options may be selected if desired. The generated report includes the owner's minimum pay code, suspense codes, current and historical suspense amounts, check information, and whether the owner would be included in a cycle if started now. The report is currently located in the Revenue/Billing Module > Reports >Suspense >Suspense Unclaimed Prop. Status. (Legend to assist with reading the report follows below.)

|

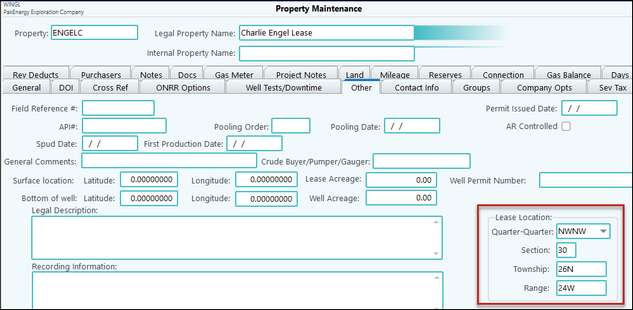

7.![]() Oklahoma and Arkansas Lease Location

Oklahoma and Arkansas Lease Location

Oklahoma and Arkansas require a record for each property that is reporting with TR-CODE 8. This code has the legal description (section, township & range), property name, owner percentage, and the amount being reported for the property. We have added the “Lease Location” options for the legal description to the “Other” tab in Property Maintenance. The NAUPA file will pull in the section, township, and range from this location on the property maintenance (see below):

The ownership percentage will pull from the most recent suspense record for that property regardless of previous percentages.

***TR-CODE 8 for the state of Oklahoma all owners being reported to the state of Oklahoma the legal description TR-CODE 8 must be included for each property being reported regardless of the property’s location and home state. For the state of Arkansas, the TR-CODE 8 is for only the properties located in AR. |

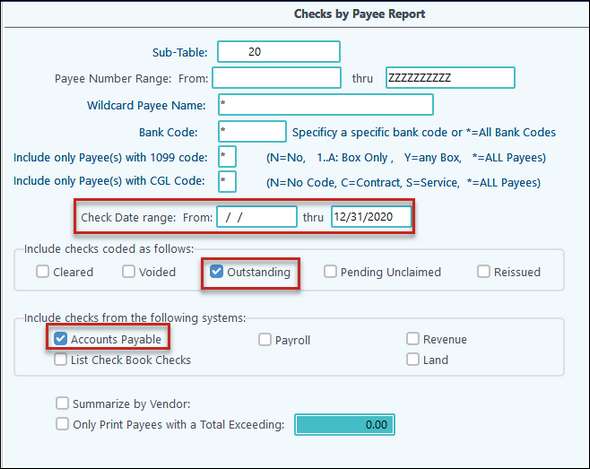

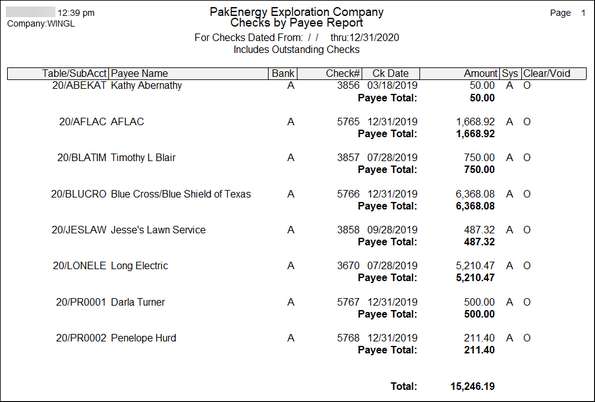

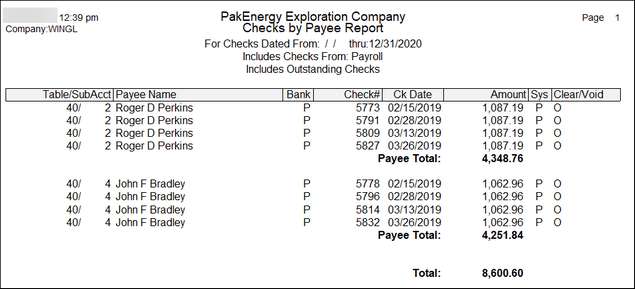

8.![]() Review the Checks by Payee Reports

Review the Checks by Payee Reports

Found in the Bank Reconciliation Module > Reports > Checks by Payee. Not as useful when there are multiple states with multiple cutoff dates. However, when the majority or all vendor checks are in the same state, this report will provide a listing of the checks eligible for the Escheat process based on the cutoff date.

|

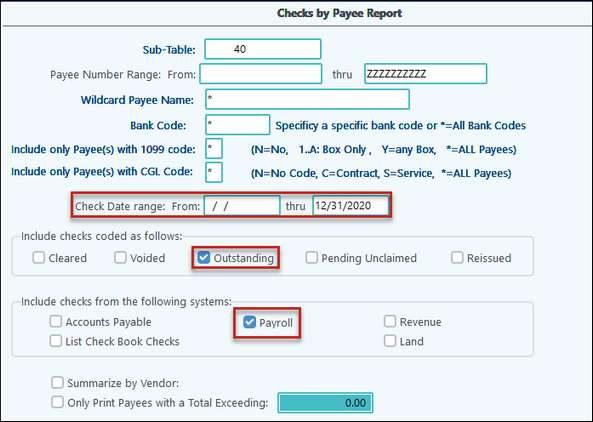

9.![]() Review Checks by Payee Report for Payroll

Review Checks by Payee Report for Payroll

This report is the same as the previous report, but when run with the Payroll parameters, below will provide a listing of Payroll checks that will be escheated. The majority of states/territories have a one-year dormancy on payroll checks. The settings below are for the 2023 reporting year:

|