Pak Accounting has the ability to create “correcting” ACA files if your original file was “Accepted with Errors”. You will need the following information:

1)The Receipt ID of the submission file that rejected with reason “Accepted with Errors”.

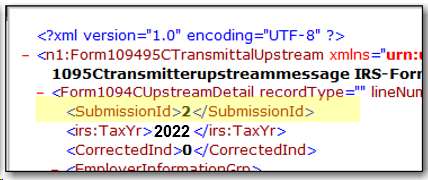

2)You need to know the “Submission ID” that was on the original file. You can open the original FORMS file (the original file that does not say manifest in the name,) and look for the field “SubmissionID” to find that number. It will be close to the top of the file.

3)You will also need to click the “Download” button on the IRS AIR status screen for the file. This will download an XML file that you can open. This file lists each error, along with the employee and the original Record ID for the employee. You need the employee as well as the original Record ID for the correction file.

Once you have the above information, you will need to “correct” the error on the employee(s).

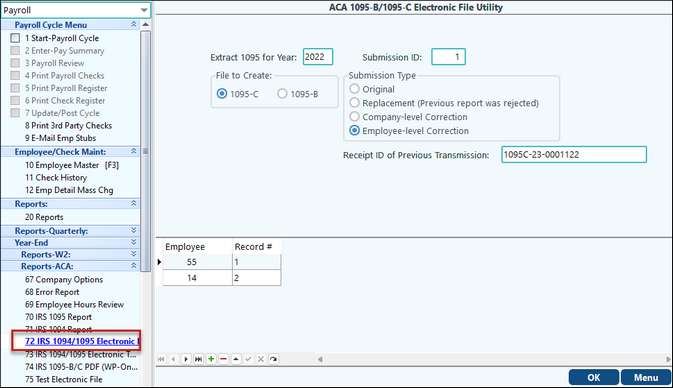

After making all the corrections, you will go back to Payroll > YearEnd > Reports-ACA > IRS 1094/1095 Electronic File menu. On this menu you will see the option to change the “Submission Type”. You can choose the “Employee-level Correction”. You will need to make sure the “Submission ID” matches what was sent on the original file, and enter the “Receipt ID” of the original file.

Once you choose the “Employee-level Correction” option, the Employee section at the bottom of the screen will appear. You will need to click the “+” (plus) sign at the bottom of the screen to add each employee that needs to send a correction to the IRS. You will enter the employee number, and the original Record ID for the employee in the “Record #” field.

When you have finished adding the employees that need to be corrected, you will click the “OK” field to create a new set of files (the Manifest and Forms files.) These will need to be uploaded to the IRS AIR website. You will need to check the status on the file to make sure it is accepted.

See ACA Helpful links for more information regarding the ACA Reporting process.

See Folder Transfer/Compare if needing to transfer files from WPA.