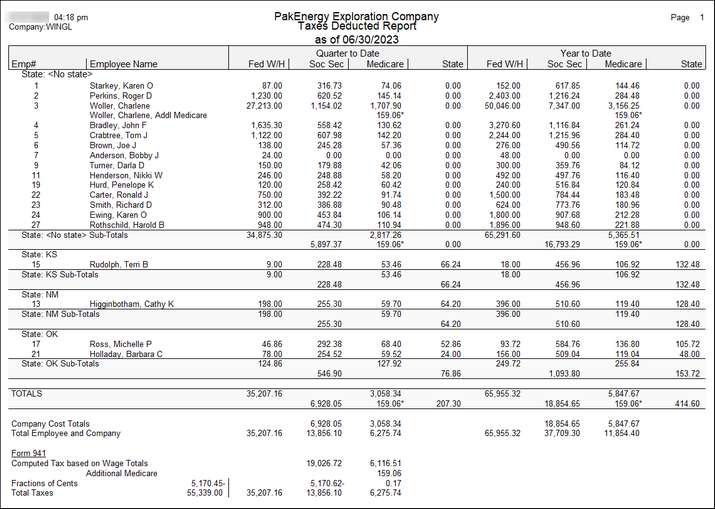

Fill out the following information to get the report below

Enter the Quarter, (Enter the quarter as a 1-digit number: 1 - for first quarter information (Jan - March); 2 - for second quarter (April - June); 3 - third quarter reports (July - Sept); 4 - last quarter (Oct - Dec); Year and Report Type (Quarter to date only - summary for current quarter; Year to date only - summary for year; Both - prints both YTD and QTD)

Include only state: To limit the report to a single state, enter the 2-character state code. The default value of -- (two dashes) prints all states.

NOTE: Company Totals section was added to the bottom of this report as a means to double check the Forms 941, 943 or 944.