TERP Tax (Surcharge) Setup in Pak Accounting

What is TERP tax (surcharge)?

TERP stands for Texas Emissions Reduction Plan. This is a surcharge for Off-Road, Heavy-Duty Diesel Equipment that applies to the sale, use, lease, or rental of said equipment based on the sale, lease, or rental amount. The tax is collected by the seller and remitted to the Comptroller.

~ https://comptroller.texas.gov/taxes/motor-vehicle/terp-offroad.php

How can the TERP tax/surcharge be set up in Pak Accounting?

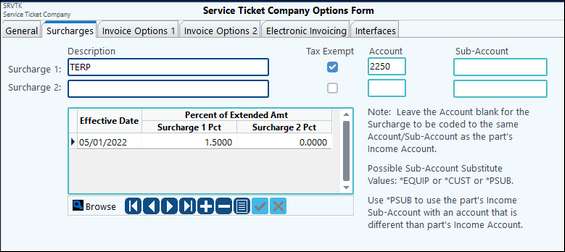

In Service Ticket > Master Files Maintenance > Company > Surcharges tab:

1.Enter the Surcharge Description in Surcharge 1 or Surcharge 2. Mark the “Tax Exempt” check box and enter the account that the entry for the TERP surcharge should post to. This could be any account but is typically a liability account that would accrue what is invoiced out for the surcharge. The Sub-Account field can be subbed out if needed and Sub-Account Substitutes (*EQUIP, *CUST, or *PSUB) can be used. NOTE: To use the various Sub-Account Substitutes, the account must have the applicable Sub-Table attached to it in Account Maintenance (F11).

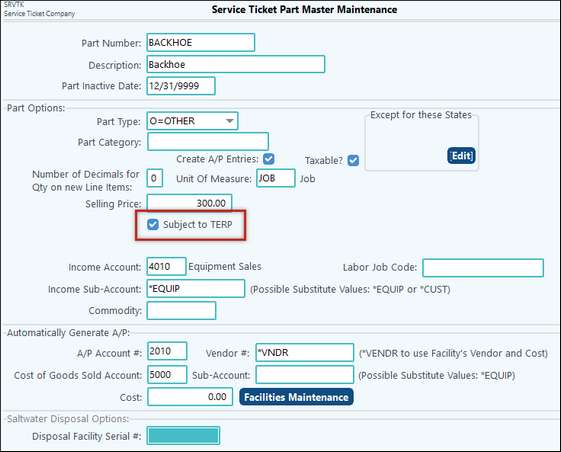

2.All parts that are subject to the TERP surcharge should be marked in the Parts and Facilities menu item.

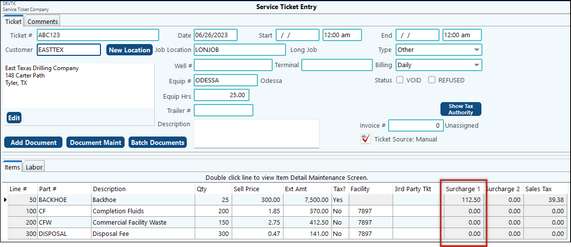

3.When a ticket is entered using a part that is subject to TERP, the surcharge will automatically calculate.

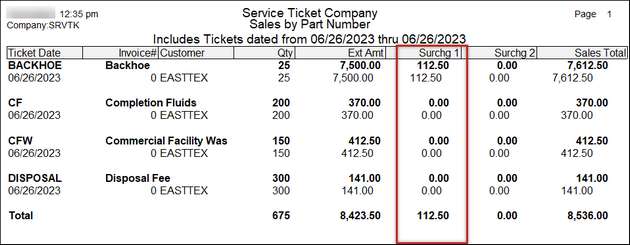

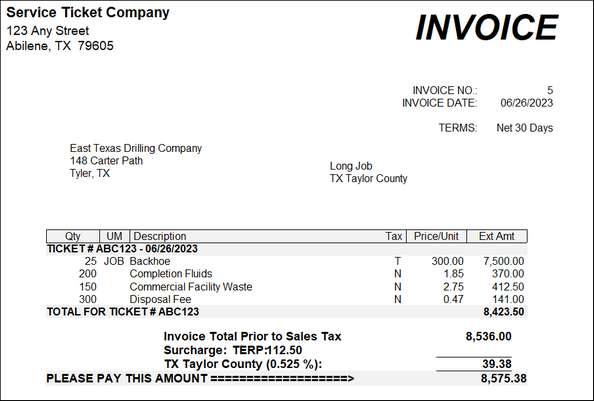

4.Invoice with TERP Surcharge (Invoice Format shown is Detail by Ticket - Summarized)

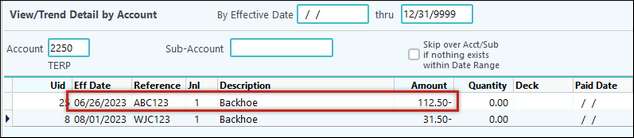

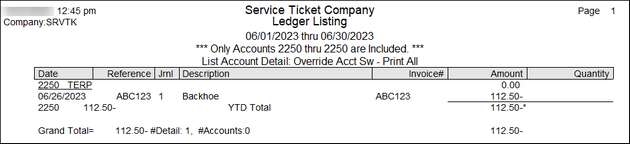

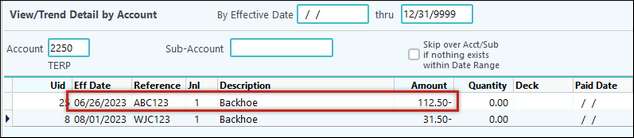

5.Entries to the liability account for the TERP surcharge.

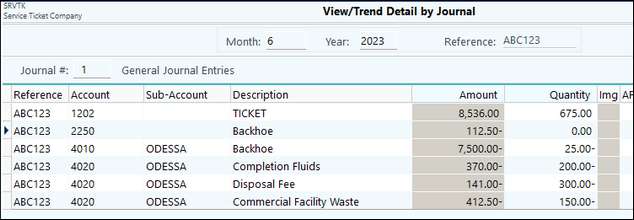

Drill down to see all entries for the invoice:

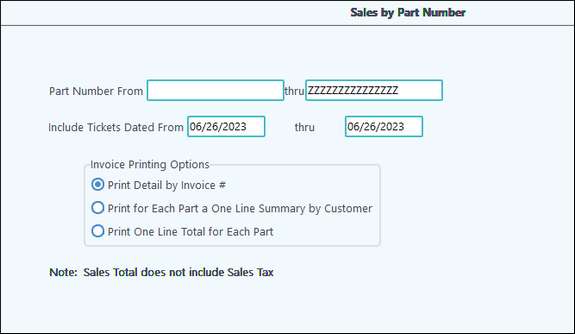

6.Report from Service Ticket to tie to GL account for TERP surcharge:

The Invoices > Sales by Part Number will provide the total surcharge for all parts for a given time frame.