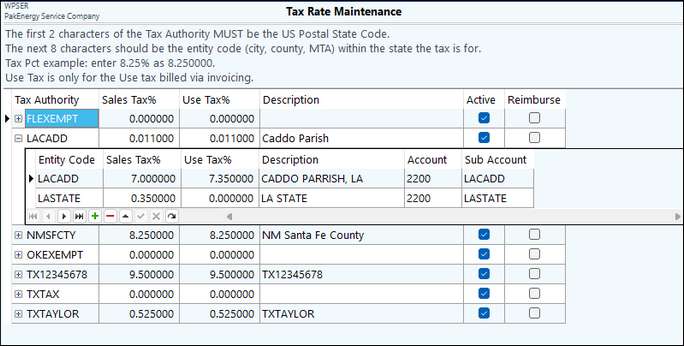

If charging sales tax on tickets, enter the tax rate for each state/county under Tax Rate maintenance.

A sales tax consists of the standard tax imposed by a city, county, and/or state. Pak Accounting allows for multiple sales taxes and taxing authorities. The most common tax rate can be entered in the Invoicing Option, to minimize data entry.

Setting up Sales Taxes and Taxing Authorities

| 1. | Make sure a sales tax payable account exists in the General Ledger. This should be the same account number entered on the Company Maintenance screen in G/L. |

| 2. | Set up the tax rates in Tax Rate Maintenance. The taxing authority represents the agency or governing body to which the sales tax is paid. Enter the Tax authority, the tax rate associated with that authority and a brief description. Tax Pct can be split out by State, County, and City tax. Use the Entity code to specify location to print summary on Tax report. |

NOTE: The first 2 digits of the Tax Authority must be the US Postal State Code (i.e. TX, NM, WY). The G/L entry will detail will only record the first 2 digits to help distinguish between state to submit the tax.

Also see: Service Ticket Overview and Setup