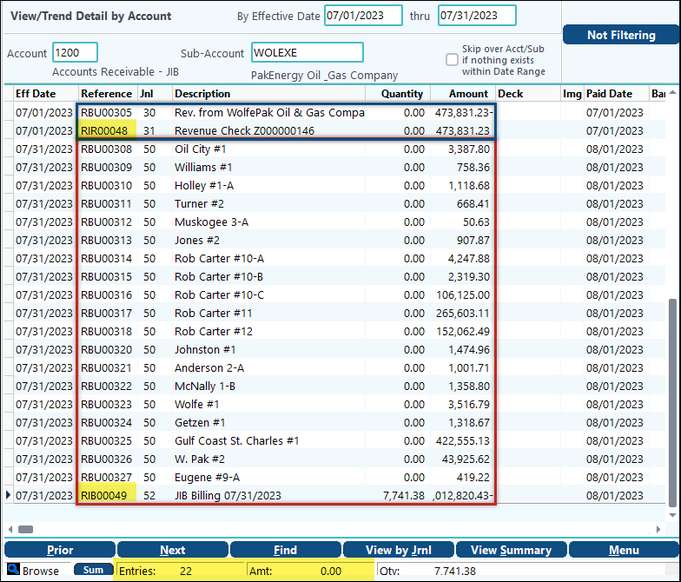

After the cycle, look in View/Trend at your owner’s A/R Account. You will see several entries. The Reference column will give you clues as to where the entries came from.

•RBU indicates entries came from the cycle itself. These entries are hitting this account because of the Owner Maintenance Setup.

•RIR indicates Revenue Investor Interface entries.

•RIB indicates Billing Investor Interface entries.

If all is set up correctly, the RIR and RIB entries from Investor Interface will offset the RBU entries, creating a zero balance. If the entries do not zero out, double-check the Account offset setups in Owner Maintenance and Investor Interface.

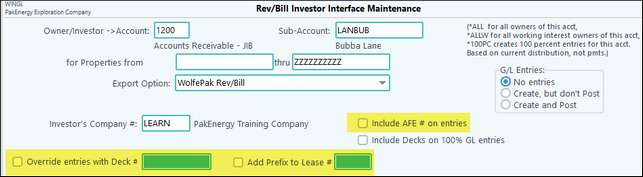

WolfePak Rev/Bill Only

When Export option WolfePak Rev/Bill is selected, notice more options appear below the Investor’s Company #. These options allow you to override entries with Deck #, Add Prefix to Lease # and Include AFE # on the entries. You can use all of them or one of them if needed.

NOTE: When sending entries to another set of books, the system is looking to that company to pull in Accounts, Sub-Accounts, and such. It’s NOT using the items in the current company.

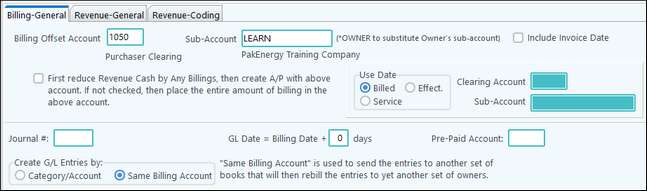

Billing-General Tab:

These options are the same as previously discussed. Typically, when sending entries to another set of books to redistribute use the option same Billing Acct. If you notice your Billing-Category and Billing-Acct tabs are gone. The system will automatically use the same Billing Accounts as the Operator when booking to the Subsidiary for Rev/Bill.

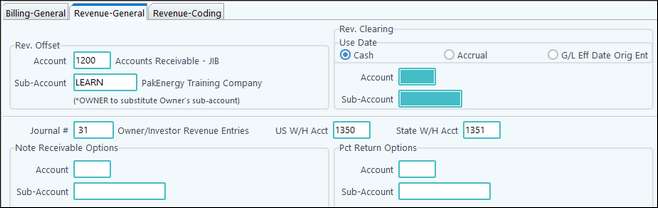

Revenue-General Tab:

Very similar to what was discussed previously.

Rev. Offset Account/Sub-Account: Defines the account for Revenue to be offset to. This typically is a clearing account; this can be cash, but should be used in association with ACH/Direct Deposit processing.

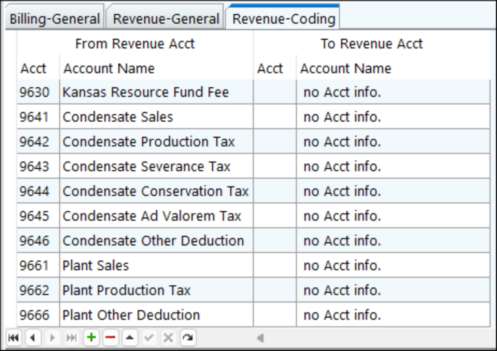

Revenue-Coding Tab:

When you use the Rev/Bill Export option your Revenue-Coding tab is very simple. Either you can leave it blank or the system will automatically use the same Revenue Accounts as the Operators when booking to the Subsidiary for Rev/Bill, or you can set up the From Revenue Acct with all Revenue type of Accounts that the Subsidiary will be getting paid/charged for, and then enter the To Revenue Acct that you need in the Subsidiary’s books.