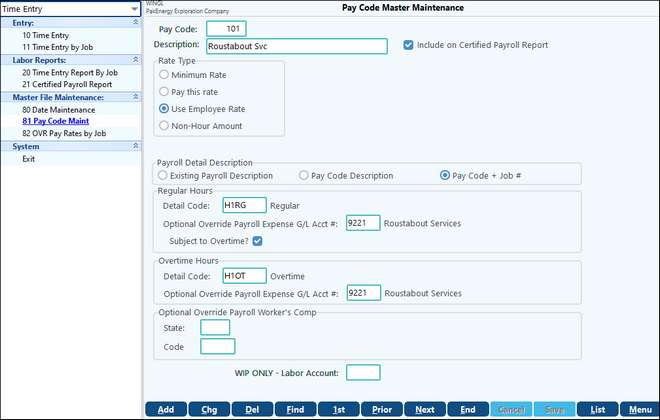

Pay code master maintenance is where you set up the Pay codes for the company to pay employees and to bill to jobs.

Note: Expense reimbursements create by using the Create A/P entries option are sent to Accounts Payable to be paid.

Pay Code |

Unique, 6 digit alphanumeric code |

Description |

Description of code |

Include on Certified Payroll Report |

Check to include on the Certified Payroll Report |

Rate Type |

Minimum Rate - the rate is the minimum allowed for this code Pay this rate - Pay this rate, regardless of amounts set in payroll Use Employee Rate - Use the rate set up on the employee master for the Regular hours detail code Non-hour Amount - Code is for expense reimbursement or non hour amount |

Billing is by the: |

Check if billing is by the hour or by the day for this pay code |

Income G/L Acct # |

Enter the income account to record the billing in the General Ledger |

Standard Billing Rate / Markup |

Enter the standard billing rate for this code to be recorded on the billing |

Payroll Detail Description |

Description for detail in payroll, Existing payroll descriptions, Pay Code Description or Pay Code + job # |

Detail Code Reg/Overtime |

Detail code set up in Payroll for Regular and Overtime Hours |

Optional override Expense G/L Acct# |

The expense account to which this code will post in the general ledger. There is a separate field to put overtime if you use a different g/l account for overtime pay |

Subject to Overtime? |

On/Off, if overtime is allowed for this pay code |

Worker's Comp |

Workers comp codes for this pay code. Overrides the payroll Workers comp code |