How do I set up a net revenue check percentage deduction?

Sometimes it is required to deduct a certain percentage of a revenue owner’s net check each cycle. Net check would be after all other deductions including federal/state backup withholding or deductions for netting of JIB (accounts receivable). You may be allowing a working interest owner to pay off a notes receivable created by an IRS code section 1031 like kind exchange or perhaps for general business reasons. Another application is to create a owner level reserve for future drilling activities.

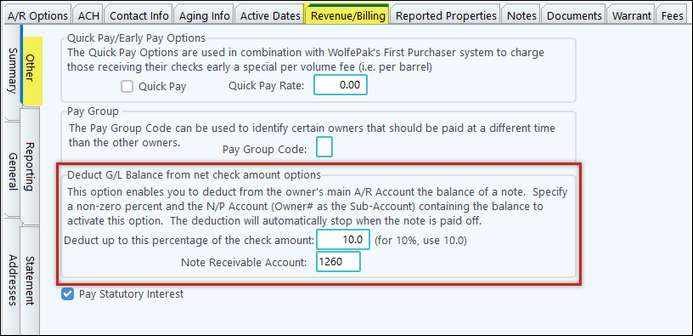

In our example we are deducting 10% of an owner’s net check each cycle to apply to a notes receivable.

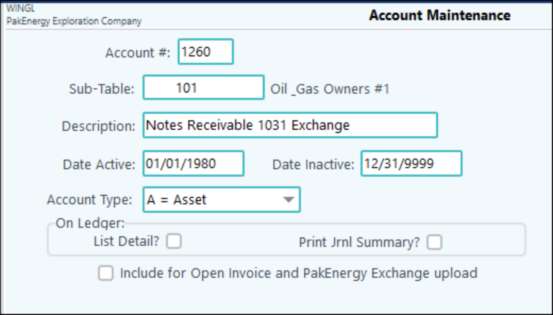

Step 1: Set up an account in the Chart of Accounts.

The Revenue/Billing primary Owner Sub-Table must be attached.

Step 2: Set up the revenue/billing owner’s deduction percentage and notes receivable account. Go to the owner's Sub-Account > Revenue/billing Tab > Other sub tab.

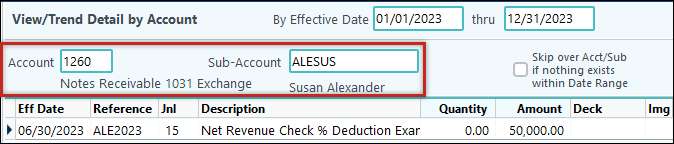

Step 3: Enter a Notes Receivable transaction into the 1260/Owner Sub-Account

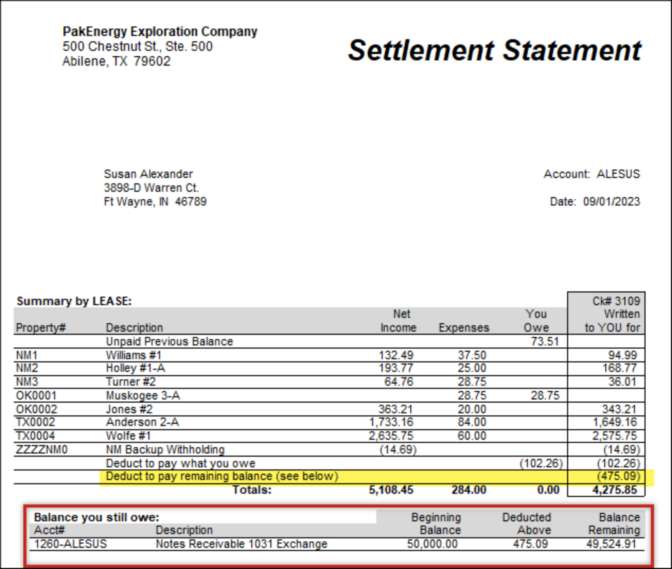

Step 4: Run your normal cycle.

Revenue |

5,108.45 |

|---|---|

Less JIB/Previous Balance |

357.51 |

Net Revenue |

$4,750.94 |

10% Deduction |

$475.09 |