The Job Cost Allocation feature is generally used by service companies that want to allocate indirect costs such as general and administrative expenses, or shop expenses, etc. by the revenue producing jobs in order to more accurately reflect results of operations. The allocation entries are usually summary entries.

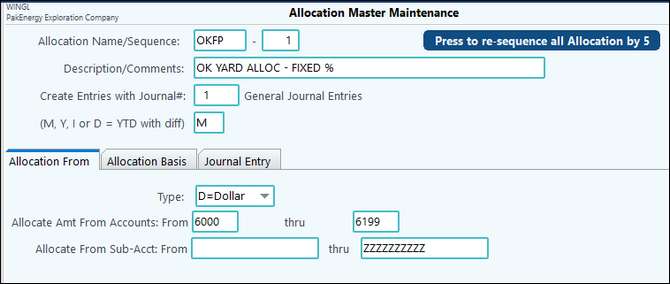

This screen found in General Ledger > Master File Maintenance > Allocation, is used to setup how you want ranges of expenses/costs allocated. A company might want to allocate their indirect costs from office, shop & yard, trucking, etc. to the individual jobs based on gross income from each job or to different departments or leases based on a set percentage. The job could be a well drilled, an air conditioner installation, custom home built, etc.

NOTE: Use the "Find" button to find the Allocation Name/Sequence needed via the drop-down menu.

Allocation Setup

Allocation Name/Sequence |

Each allocation should have a unique name. Typically, you would have one series of allocations setup for the end of month. (Example: Name: EOM, a different sequence number would be used for each cost center to be allocated.) |

|---|---|

Description/Comments |

Enter a brief description of what this allocation is used for |

Create Entries with Journal# |

Enter a journal number for the allocation entries |

(M, Y, I, or D = YTD with diff) |

Choose the period the system should look to as the basis of the allocation. Available options are: Month, Year, ITD, or YTD with difference (which will compute from account with YTD then compare resulting allocation to what is already in the allocated account. It will only create an entry for the difference.) |

Allocation From Tab |

|

Type |

Select the From Allocation type. Available choices are: D = Dollar - accumulates the dollar amount from the base account S = Quantity - accumulates the quantities from the base account B = Budget Dollar - accumulates the budgeted amount from the base account U = Budget Quantity - accumulates the budgeted quantities from the base account |

Allocate Amt From Accounts: From/Thru / Sub-Acct From/Thru |

Account / Sub-Account range that determines the amount to be allocated |

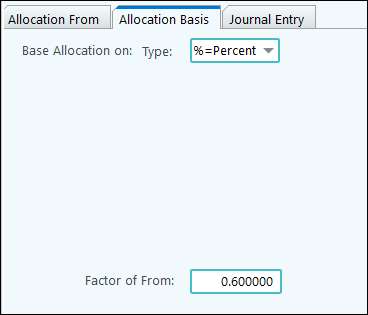

Allocation Basis Tab |

|

Base Allocation on: Type: |

Select the To Allocation Type. Available choices are: D = Dollar - accumulates the dollar amount posted to the base account S = Quantity - accumulates the quantities posted to the base account B = Budget Dollar - accumulates the budgeted amount for the base account U = Budget Quantity - accumulates the budgeted quantities for the base account % = Percentage - the percentage of the factor |

Factor of From: |

Factor used with the Allocation Type % = Percentage |

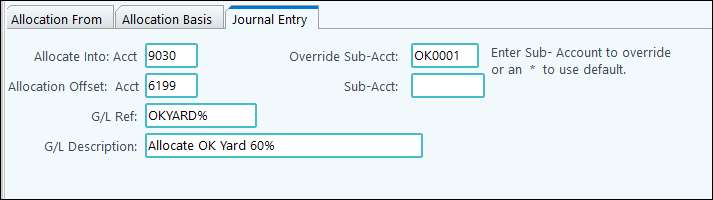

Journal Entry Tab |

|

Allocate Into: Acct |

The account to allocate Into |

Override Sub-Acct: |

* is the Default to keep the same Sub-Account. Or you can override the Sub-Account so all allocated entries will be posted into this Sub-Account |

Allocation Offset: Acct/Sub-Acct |

The account/Sub-Account the allocation will credit. This is the clearing account for the entry. If the offset account requires a Sub-Account then fill it in as well. |

G/L Ref: |

Reference number that will be used for this allocation |

G/L Description |

Description to fill in on the allocation |

Once the Job Cost Allocation has been defined, use the Create Allocation Entries Screen to create the entries.