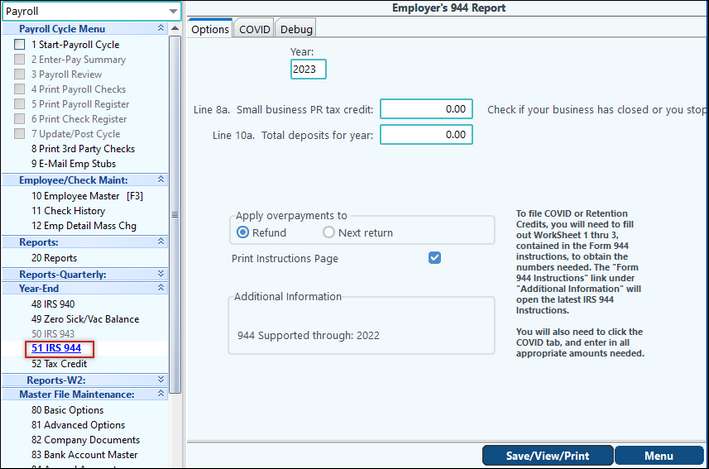

This form is for companies that have less than $1,000 tax liability in a single year (a startup company, or very small companies). The menu item will only be available if you have marked the company as a 944 in Basic Options.

If your company is a 944 company, the IRS will inform you. Otherwise, assume your company is a 941 company. Enter the total amount of deposits for the year.You can select to not print the instructions page. If money is owed, a voucher will print.

COVID tab: This tab allows you to easily enter amounts for Worksheet 1 thru 3 on the Form 944 regarding COVID or Retention credits. Use the Form 944 instructions link on the Options tab for more information.