The IRS 943 form is the tax filing form for Agricultural Companies. This is only filed once per year. (This would take the place of filing the 941 form quarterly.)

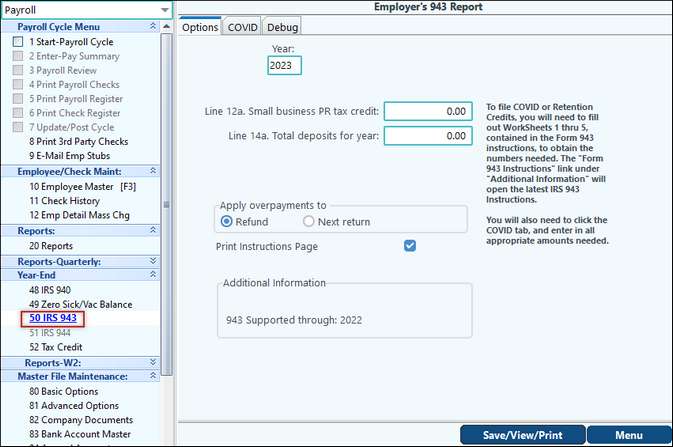

The 943 menu is found under Year End > IRS 943. The menu item will only be available if you have marked the company as a 943 in Basic Options.

You must enter the amount in the “Total Deposits for year” in the menu. You can select to not print the instructions page. The report is one page. If the company owes taxes, a voucher will be printed. If the company is a semi-weekly depositor, a Schedule 943-A will also print.

COVID tab: This tab allows you to easily enter amounts for Worksheet 1 thru 3 on the Form 943 regarding COVID or Retention credits. Use the Form 943 instructions link on the Options tab for more information.