Hauling Contracts are contracts where you only handle the transportation of the oil. You do not buy the oil from the Lease Operator and you do not sell the oil to another party.

Company Settings:

Within the First Purchaser module\Company Maintenance\Company\First Purchaser Tab\Advanced: Designate the “Freight Bill To Account, Income Account, Income Sub- Account (if needed) and Journal #. Note new accounts and or journals may need to be setup on the General Ledger prior to completing this step.

Price Contract:

A price contract would need to be set up to document the hauling rates and properties applicable.

•Contract Number: A unique alpha and/or numeric code is required.

•Type : The product that will be hauled will need to be designated in most cases this field would be set to “OIL” or “Water”

•Name: Enter the name of the contract. The name of the operator or geographic region are commonly used.

•General Tab: All information on this tab is informational and optional. Ie. none of it is required to process hauling run tickets or statements.

•Notes Tab: Memo field that can be used to document comments or notes related to the contract. (Optional)

•Pricing Tab: All Pricing information is located on this tab.

Effective Date:

This field is optional but it is recommended to be populated so that date sensitive hauling rate change can be used. If hauling rates are not likely to change then this field can be left blank.

Purchaser:

The entity that will be sending out the hauling invoice needs to be populated here. In order to add a new purchaser press the F12 key and then add. Make sure and change the Sub-Table to “Purchasers” when adding the new entity. Note on the operator tab of the “Purchaser Type” must be set to “Run Ticket is billed by Hauling Statement”

•Price Index Number through Early Pay Group should be grayed out and blank, if you can enter data into these fields then your Purchaser Type is set up incorrectly.

•Est BBL Per Day: Optional field.

•Billing Hauling Rate Code: designate the applicable Hauling code. See Hauling Rate Code for setup instructions.

•Freight Bill To: Designate who the freight bill is sent to. (Note: Sub-Account code-uses the Sub-Table linked to the Freight bill to account)

Billing Hauling Rates:

Maintenance screen access is located under Pricing/Other File Maintenance/Billing Hauling Rate.

•Rate code: is a unique alpha and or numeric value with a maximum length of 10 characters.

•Description: Optional field that can be used to further describe the rate code.

•Min # Bbls per Load: Allows you to charge a minimum BBL amount no matter if the load is smaller. The calculation will use the defined BBL if it is under this amount.

•Calculation Basis: For fees based on the volume of oil designate whether Gross or Net Volume should be used.

•Surcharge Options: Allows you to set up a surcharge based on fuel prices.

Price Index:

The price of fuel would be documented on a specific price index. Populate the price index number if applicable. If a new price index is necessary one can be added at Pricing/Other File Maintenance\ Price Index.

Price Type: Fuel surcharges can be based on a daily price or the monthly average.

Base Fuel Price: The surcharge triggered price. A fuel charge will be assessed if fuel prices rise above the base fuel price.

Miles: Fuel surcharges are billed on a per mile bases. You can adjust the miles used for the surcharge by applying a multiplication or a division factor.

Mileage Rates: Used for mileage based charges. Populate the thru miles and rates as applicable. For example if our Hauling agreement calls for a fee of $0.50 per mile for the first 100 miles and $0.75 thereafter. We would set up the first line item (click the “+” to add a new line) with 100 entered under “Thru Miles” and .5 under “Rate”. For line two we would enter 9999 under “Thru Miles” and .75 under “Rate”.

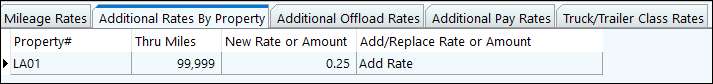

Additional Rates by Property: Allows you to code a property specific fee per barrel that can vary based on miles. For example all loads picked up from Property LA01 have an additional fee of $0.25 per mile. We would set this up the following way.

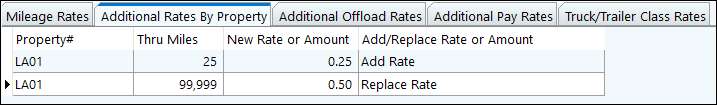

If the rate varies by miles then additional lines can be added. For example there may be an additional property specific $0.25 fee per barrel if the distance traveled is less then 25 miles but a $0.50 fee per barrel for distances greater than 25 miles.

Hauling Rates: There are several Hauling Codes that are pre loaded. Additional Property specific Hauling Codes can be set up under Master File Maintenance \ Hauling Code Maintenance and then linked to each property via the Property Maintenance\Production Tab. The Hauling code also has to be setup on the Billing Hauling Rate Maintenance\ Hauling Rates Tab. The effective date can be used to initiate a new rate. If a rate is going to expire then the rate will need to be removed when it is no longer applicable or add a new effective date for the new rate should be entered. The Range thru field is only available with the preloaded hauling codes: “Based on Gravity, pays Add’l $ Amt per Load” and “Based on Gravity, pays # BBLs per load”. In the “Value” column enters enter the applicable rate or factor. Calc method can be set to “Additional Add-on”, “Designate # BBLs for load”, “Rate or Factor”, set as applicable.

Note: There is a “Test” button on the bottom of the Billing Hauling Rate Maintenance screen where you can enter in “what if” data to test your surcharge settings.

Once the contract is setup, it must be added to the Property Maintenance Price Contract tab.