Generating Interest Charges (or Finance Charges) is an option within Accounts Receivable that allows you to charge interest to those customers who have not paid their account balances. Interest charges will only be applied to customers who have the “Charge Interest” box checked in Sub-Account Maintenance.

It is necessary to do some initial setup of basic information prior to the use of this option. Setup requires two steps:

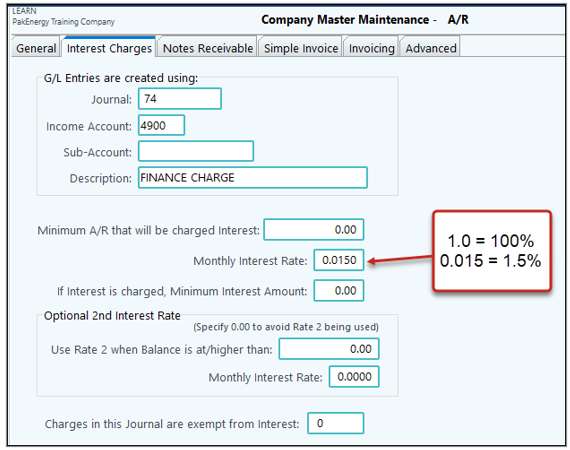

1.Company AR Entry Options/Interest Charges (see setup below). This is where the “behind the scenes” system information will be kept (i.e the rate and balance limits). Typically, once you’ve entered this info you will not have to do it again.

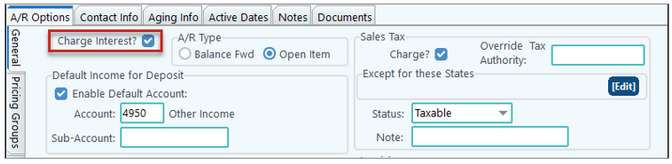

2.Customer Sub-Account Info. This is where all of the information you could possibly want on your customer(s) is kept. You will need to check the “Charge Interest” box for every customer that you want to charge interest.

Setup

Interest charges can be generated for those customers that have not paid their accounts. The rate and other various information about the generated charges can be found on Company A/R Entry Options / Interest Charges tab. See below:

Interest Charges |

|

|---|---|

Journal |

Enter the journal number to use when posting the interest charges. |

Income Acct/Sub-Acct |

Enter the account/Sub-Account combination you want entries coded to for the interest charges. |

Description |

Enter the description to use when posting the interest charges. |

Minimum AR that will be charged interest |

The minimum outstanding balance that will generate interest. |

Interest: Monthly |

The monthly interest rate to be charged to a customer with a balance greater than the minimum AR. |

If interest is charged, Minimum Interest Amount |

When charging interest, this is the lowest amount that will be generated. |

Optional 2nd Interest Rate |

Used if you will have two interest rates. Leave 0 to avoid using Rate 2. |

Charges in this Journal are exempt from interest |

Any charge in the specified journal will be exempt from interest charges. Only fill in a journal if you do not want the entries in that journal to be used to compute the interest. |

Customer Sub-Account Info. This is where all of the information you could possibly want on your customer(s) is kept. You will need to check the “Charge Interest” box for every customer that you want to charge interest.

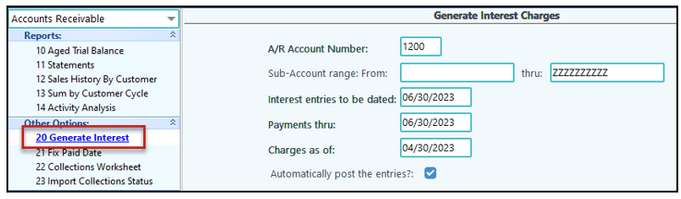

Use

After all information is entered, click on OK to process and record the Interest Charges. Reference numbers are automatically generated for the General Ledger Entry.

Generating Interest |

|

|---|---|

AR Account Number |

The AR account number that contains the balances to generate interest from. |

Sub-Account range |

Range of Sub-accounts to include when charging interest. |

Interest entries to be dated |

Effective date of the charges when recording to the General Ledger. |

Payments thru |

Excludes payments from customers after this date. |

Charges as of |

Includes AR charges up through this date. |

Automatically post the entries? |

After interest entries are generated, check the box to automatically post the entries to the General Ledger. Unchecked will leave the entries in General Ledger / Entries. |

After all information is entered, click on OK to process and record the Interest Charges.

NOTE: Reference numbers are automatically generated for the General Ledger for the entry. See next number assignment.

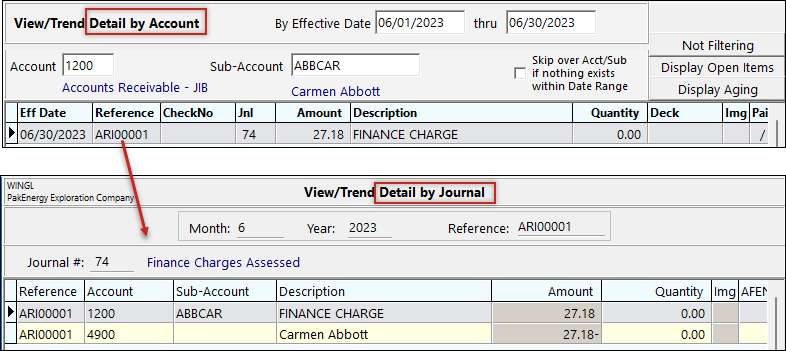

Viewing

Each owner will have an entry into their A/R account, offset into the Income Account.