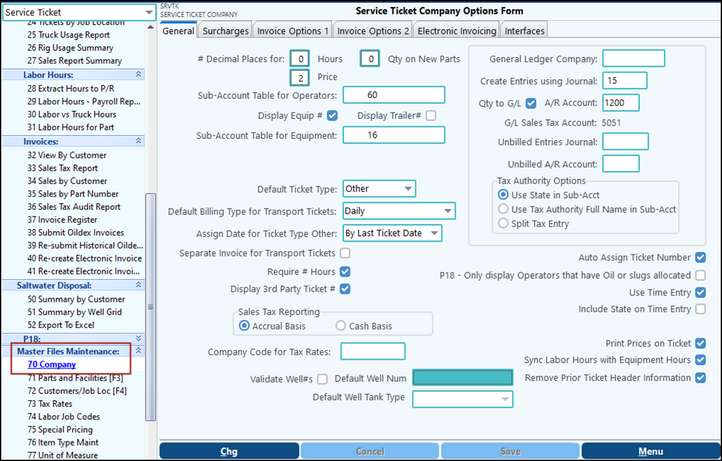

Company Maintenance |

|

|---|---|

# Decimal Places for hours |

# of decimal places to use when entering labor hours on tickets. The maximum is 8. |

# Decimal Places for Qty on New Parts |

# of decimal places to use when entering labor hours on tickets. The maximum is 8. |

# Decimal Places for Price |

# of decimal places to use when entering part quantities. They system will default to 2, but it can be 2, 3, or 4. |

Sub-Account Tbl for Operators |

Sub-Table for operators / customers. |

Display Equip # |

If selected, the equipment # will appear on generated invoices. |

Sub-Account Tbl for Equipment |

Sub-Table for equipment. |

Default Ticket type |

Default ticket type to be used when entering tickets: Transport or Other. (Transport is normally used for Saltwater hauling and Other is normally used for well service companies) Note: “Other” tickets are automatically held for that location. When the last ticket is entered, you can release the last one and it will release all outstanding tickets for that location. |

Default billing type for Transport Tickets |

Identify the billing type to use when entering tickets. Daily, weekly, monthly or Hold until completion. Can be set on a customer basis and/or well basis. |

Assign date for ticket type other |

Identify the default option. Last ticket date is for “other” type tickets only. The invoice date will be the date on the last ticket entered or it will allow you to assign a date. |

Separate Invoice for transport tickets |

If selected, service ticket types “Transport” and “Other” for the same job location will print on separate invoices. |

Require # Hours |

If selected, equipment hours will be required to be entered on each ticket |

Display 3rd Party Tkt# |

If selected, it will allow you the option to enter a third party ticket on your enter tickets. It will also allow the Locate Third Party Tickets option to be displayed. |

Sales Tax Reporting |

Select the type of reporting for sales tax: Accrual basis or Cash basis. |

Company Code for tax rates |

If sharing tax rates with another Pak Accounting company, enter the company code. |

Validate Well# |

If selected, ensure the well does exist. Improve well validation on Service Tickets. |

Default Well Num/ Default Well Tank Type |

If the company option to validate wells is on, these fields will need to be populated. These fields allow the user to define a default well number value and a default tank type that can be used when adding a new Customer Job Location. |

Auto assign ticket number |

Pak Accounting will automatically assign a sequential ticket number. |

P18 – only display operators |

See Saltwater Facility documentation. |

Use Time Entry |

Select if you are using the payroll export feature. |

Include state on Time Entry |

Select if you want the state identified. |

|

|

G/L Company |

Identify the G/L company where the general entries will be recorded. Used when you have multiple billing companies. |

Create Entries using journal |

Identify the journal to use when creating entries in general ledger. See Journal Setup in General Ledger documentation. |

Qty to G/L |

If selected, the system will include quantities in the quantity field when creating entries in General Ledger (i.e. barrels or hours). |

A/R account |

Identify the A/R account in the chart of accounts to use for recording service ticket receivables. This account is used with the customer Sub-Table. |

Sales Tax Acct |

Sales tax account is identified in General Ledger/Company. Tax Rates are set up in menu item #73 Tax Rates. |

Unbilled Entries Journal* |

Must be separate journal number than your Create Entries using Journal number. (*This feature recognizes income based on the ticket information and not when tickets are invoiced. If feature is selected, it can not be reversed. Contact your Customer Success Team for assistance.) |

Unbilled A/R Acct* |

The Unbilled A/R Acct, must be separate than A/R Acct listed above. This Unbilled A/R Acct must be subbed by your customer Sub-Table. (*This feature recognizes income based on the ticket information and not when tickets are invoiced. If feature is selected, it can not be reversed. Contact your Customer Success Team for assistance.) Journal entries will be booked at the ticket level. When these options are used, a new menu item will appear- Update Tickets. This menu item creates the entries to the General Ledger. If changes are made to a ticket. The system will created the entries for the changes made. |