Overview

The optional Pak Accounting Consolidation module will consolidate multiple companies together in summary form under one company code. During the consolidation process, there are "From" (subsidiaries) companies and an "Into" (parent) company. The Subsidiary companies are usually normal set of books. The Parent company is a newly defined company used in printing the consolidated statements. The consolidation process will summarize subsidiary company(s) activity by account for the Parent company's books. The system will use the Subsidiary company's company code as the Sub-Account when summarizing into the Parent company.

NOTE: All companies that are to be consolidated must have the same fiscal year.

To set up consolidation:

| 1. | The subsidiary (from) companies will not have any additional consolidated information in them. Just use normal Pak Accounting routines. (Hint: To help with consolidation use a similar chart of accounts and P & L range for each subsidiary to be consolidated.) |

| 2. | Create the parent (into) company. Fill out the information on the Company Maintenance > Optional Add-On Tab. Turn on the Consolidation feature only in this parent company (Change Company type to consolidated). |

| 3. | Enter the Sub-Table in the Consolidation Sub-Table field in the Company Maintenance > Optional Add-On Tab. The Sub-Table will automatically be created in Sub-Table maintenance. |

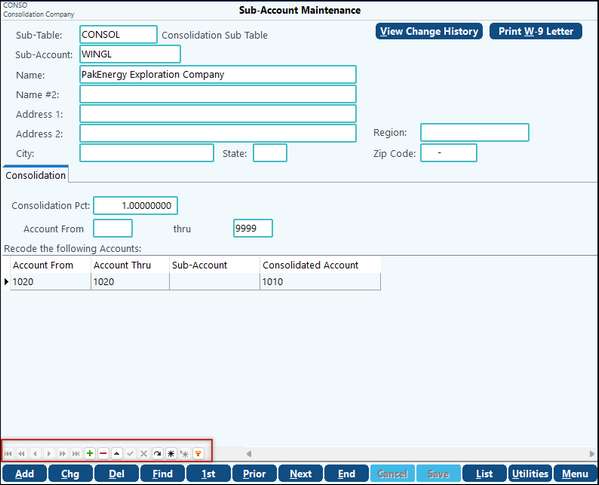

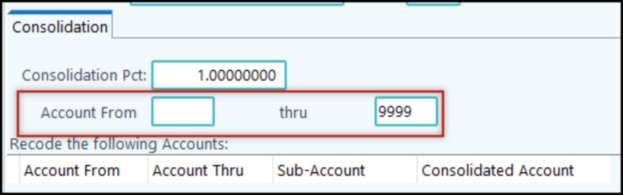

| 4. | In Sub-Account Maintenance [F12], under the Consolidation Sub-Table, set up each subsidiary using the company code of the subsidiary as the Sub-Account. On the Consolidation tab, any accounts that need to be combined (recoded) on the Consolidated financial statements enter in the recode box (i.e. inter-company accounts). This grid contains additional features for easy navigation within the recode grid. The black asterisk "*" is the "save bookmark" button that will allow you to move back to a previously saved row. The "filter" button will enable a filter to be created for the existing data on the screen. |

5. Set up or import report definitions to be used in printing financial statements in the Consolidated company.

How do I Consolidate?

Each time you go into the parent (consolidated) company the system will ask you if you want to consolidate now. You will need to consolidate every time there are changes made to the subsidiary companies.

After the consolidation is completed, financial statements can be printed under Financial reports.

How do I make adjustments?

You will not be able to make adjustments to the individual consolidated companies. You must set up a separate Sub-Account to make entries.

| 1. | In Sub-Account Maintenance, setup a Sub-Account for adjustments. |

| The Consolidation Percentage must be 0 (zero). |

| 2. | Make any intercompany adjustments in Entries Maintenance. |

Possible Error in Consolidation:

•Skipped because Account range is blank. The Account From/Thru must NOT be blank. If not entering in a specific range, enter 0000-9999.

NOTE: Pak Accounting provides the ability to consolidate into the primary currency of the consolidation company.

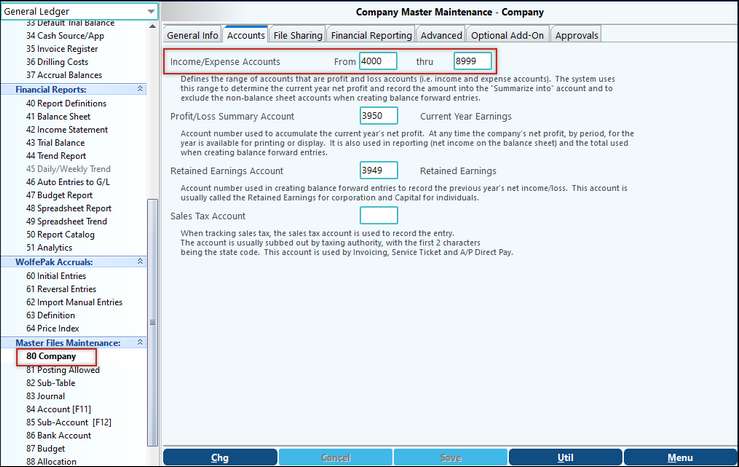

•The P & L Range needs to be the same in all the companies, including the Consolidation company.

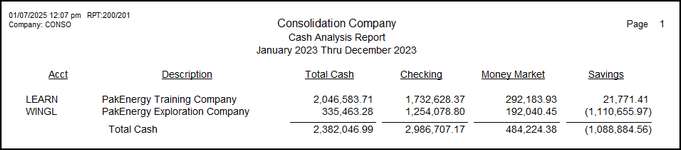

Cash Reporting

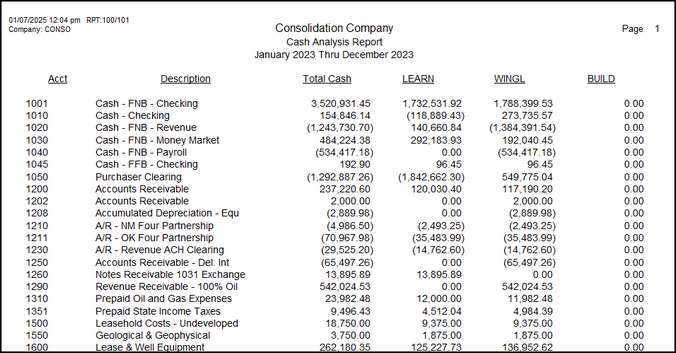

The company manager wants an easy way to get the cash balance of all your companies’ cash accounts by company. Financial Reporting with the Consolidation Module makes this easy. The user can create reports quickly to consolidate those accounts.

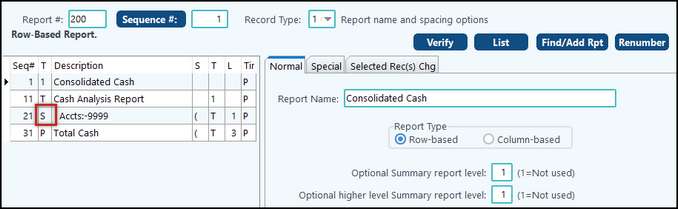

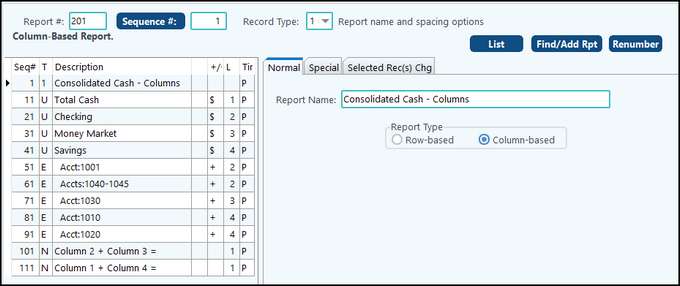

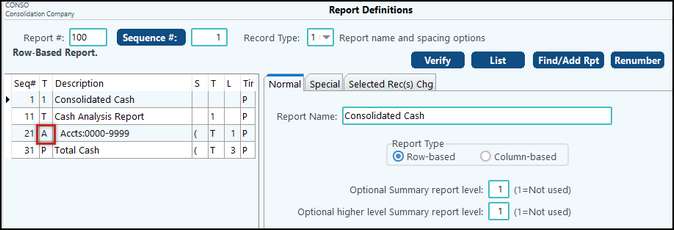

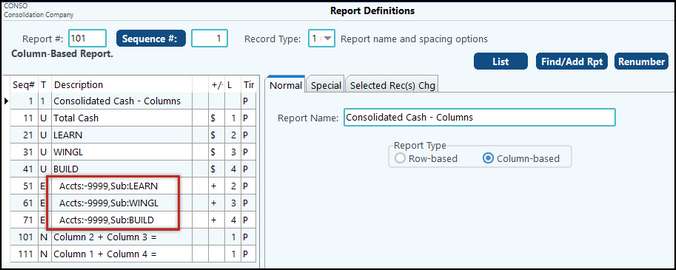

All you need are two report definitions—one for Rows and one for Columns.

Example 1: List of accounts (or other report definitions) as rows with the companies as columns.

Example 2: Companies as rows, and report definitions as columns.