Australian Payroll Withholding and Year-End Reporting

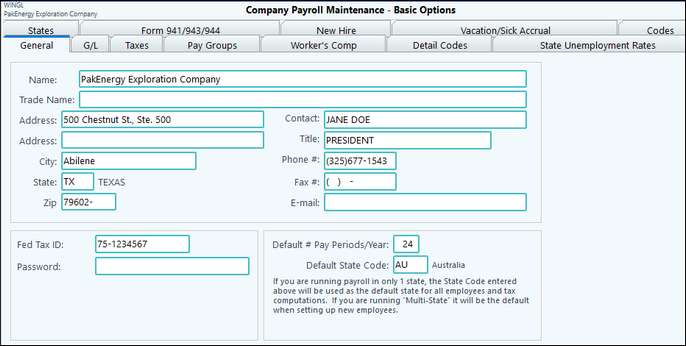

Payroll/Basic Options > General tab

a) Change the Default State Code to AU (Australia)

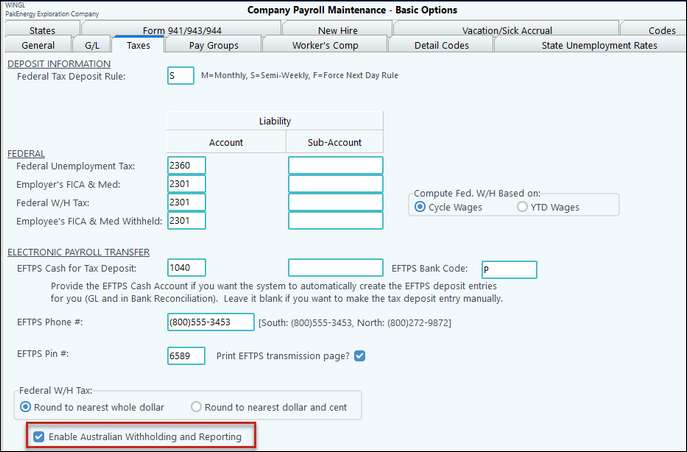

Payroll/Basic Options > Taxes tab

b) Enable Australian Withholding and Reporting by checking the box

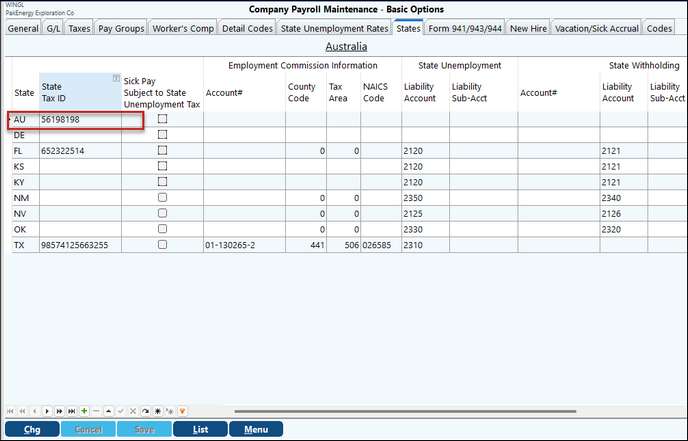

Payroll/Basic Options > States tab

c) Add AU as a State. Fill in appropriate IDs and Account numbers.

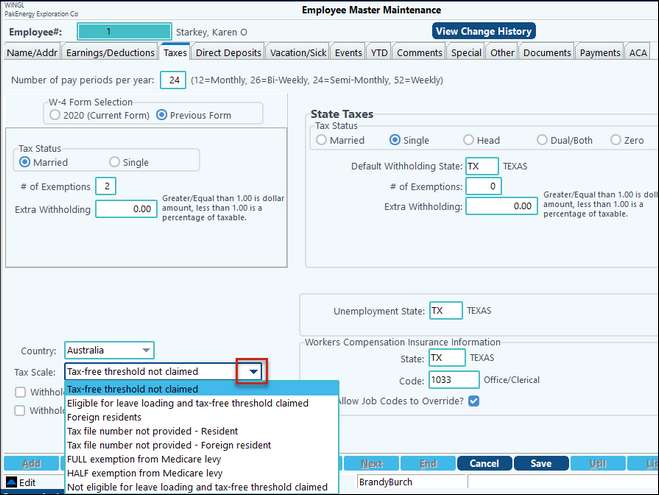

Once this feature is enabled, then the employee master will have a place on the Tax tab to indicate the country. If the country is Australia, then the other options specific to Australia W/H are shown (i.e. Tax Scale & Pay Flood Levy).

The State Taxes on the employee detail will need to be set to AU to indicate that Australian tax rules apply.

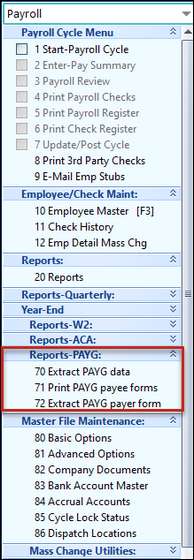

Once you close out of Pak Accounting and log back in, there will be a new section for the Australian system (PAYG) that will have an extract and two forms.

Also See: Australian GST Tax