What is Australian GST?

The Goods and Services Tax (GST) in Australia is a value added tax of 10% on most goods and services transactions. GST is levied on most transactions in the production process, but is refunded to all parties in the chain of production other than the final consumer. A business must charge its customers GST on the goods and services it provides, but is entitled to a refund of any GST it pays for its expenses (these are called Input Tax Credits). A Business Activity Statement must be lodged several times a year by the business, along with a payment for the net amount of GST owed to the tax office (if more GST is paid than collected, a refund is paid by the tax office instead).

Some goods and services (notably salaries, wages, fresh food, and real estate) are exempt from GST. Other goods and services (rental income and financial services) are "input-taxed", which means that GST is not charged on the sale, but GST paid by that part of the business is not eligible to be claimed as an input tax credit.

From: http://en.wikipedia.org/wiki/Goods and Services Tax (Australia)

Australian GST Setup

To "turn on" Australian GST, check the box for "Enable Australian GST and enter an account number in the "Net GST Tax due/owed Account." Each account in Account Maintenance (F11) will have a "GST Tax Code" field at the bottom of the screen where a code can be chosen to associate entries with entries coded to this particular account.

Pak Accounting Features:

1.GL Chart of Accounts – can indicate default GST code to associate with entries coded to this account.

2.GST code Report (found in the General Ledger module, under the reports section) – prints transactions for selected date range by GST tax code. Used to complete the BAS (Business Activity Statement)

3.View Trend Detail by Account – Can view and/or change the GST tax code associated with a transaction

4.G/L Transaction: The transactions in the posted detail, unposted detail, A/P entry, and deposit entry will have a GST code. The Account Master will also have a default GST code. When a transaction is posted, it will be assigned the default GST code from the account master, but that can be changed from View/Trend with a right click option.

a.Entries with a GST code (taxable) – when the entries are posted, the expense amount is broken out between GST and expense. The GST part is coded to the Company’s GST account.

b.When a GST code is changed in View Trend (F4) / View Detail by Account, the same thing as above will happen-the expense amount is broken out between GST and expense. The GST part is coded to the Company’s GST account.

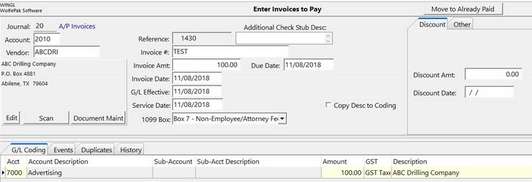

Invoice Entry

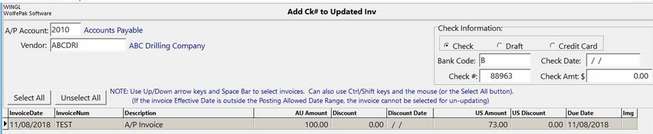

Add Payment to the Invoice

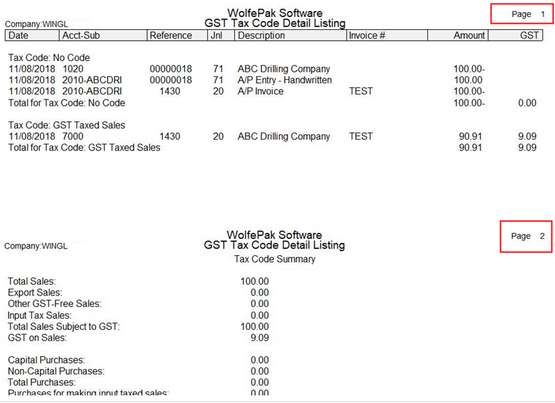

GST Tax Code Detail Listing

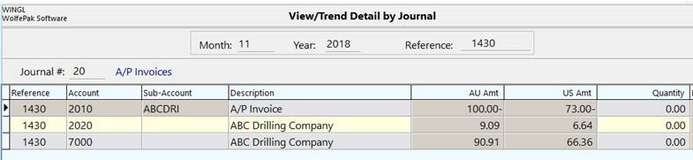

View/Trend

|

Also See: Payroll Australian Options