ATF checks can be used to record Vendor checks, drafts, deposits & Payroll Employee checks

Vendor Checks/Electronic Drafts:

The Vendor check and Electronic Drafts types are for entering after the fact payments to vendors. These payments will NOT be recorded in the Accounts Payable module.

Select the bank code to record the cash side of the entry.

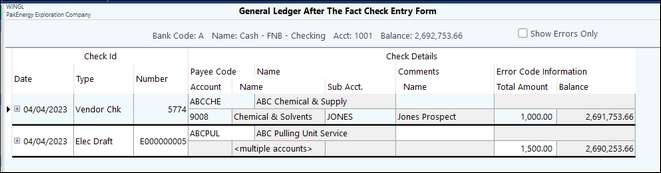

Once the “General Ledger After the Fact Check Entry Form” opens, you will see the G/L Balance of the cash account at the top of the screen. As each transaction is entered, a running total will show in the Balance column of the right side of the screen.

Enter the following information

Date of transaction |

Enter the date of the transaction. Each subsequent date will prefill with the previous entered date (can override). |

|---|---|

Type |

Vendor chk or electronic draft |

Number |

Enter the check number for vendor checks. A draft will automatically default to an E record. Note: the check number will automatically fill in the next check number from check history (can be overridden). |

Payee Code (i.e. Sub-Account) |

Enter the Sub-Account (not required). To skip Sub-Account enter past the field and type in a description in the name field. Note: a Sub-Account is required to print on 1099’s. |

Comments |

Enter any comments or description necessary.This will print in the description field in View Trend (F4) after the Payee Name. |

Account |

Enter the account number to record the transaction. If a default expense account is setup for a vendor it will automatically prefill. |

Sub Acct |

Enter if the account entered in previous step requires a Sub-Account. |

Total Amount |

Enter the total dollar amount of the check. NOTE: When using the calculator function in the "Amount" field on Payroll Checks, pressing F10 will cause the calculated amount to populate the field. |

Account Grid |

The entry can be recorded to one or multiple accounts/Sub-Accounts. If the amount is to be spread over multiple accounts, enter the multiple accounts then save. If the account is only the one account entered, select F10 to close grid. |

Use Post Checks to post the payments. The system will not allow you to post any entries with errors (i.e. invalid account/sub, split accounts that do not balance etc.)

Errors are documented on the entry screen in red and the detail information about the error is given in the Error Code Information field. The Show Errors only will only show transactions that have errors that will not allow them to post.

The Post process will create/post the entries in the general ledger and in check history in Bank Reconciliation.

Once updated you can complete bank reconciliations and process Year end 1099’s (if applicable).

NOTES:

•You cannot void a vendor entry after it is updated through the checkbook system. You must manually void the entry through general ledger and mark the check as void in Check history.

•Entries are recorded in A/P Hand Checks journal setup in Bank Account Master. (i.e. journal #71)

Additional information:

Vendor checks are recorded in Bank Reconciliation Check history as created by the Check book sub system. Payroll checks are recorded as created by the Payroll sub system.

Entering Voided checks

If a check amount is entered as zero, the check is assumed to be voided. When the check is posted it will go to Check History as a voided check. The entry will not post to the General Ledger.

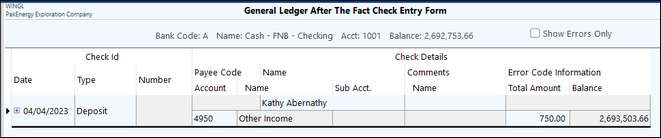

Deposits

The deposit type is used to record after the fact deposits to cash. The system automatically knows that a deposit is an increase to cash. You do NOT need to enter the amount as a Credit (i.e. with a minus sign).

Enter the following information:

Date of transaction |

Enter the date of the transaction. Each subsequent date will prefill with the previous entered date (can override). |

|---|---|

Type |

Deposit |

Number |

The number field is automatically grayed out |

Payee Code |

The Payee code is automatically grayed out. The system currently does not support open item deposit entry through checkbook entry. |

Comments |

Enter any comments or description necessary.This will print in the description field in View Trend (F4) after the Payee Name. |

Account |

Enter the account number to record the transaction. The entry can be recorded to one or multiple accounts/Sub-Accounts. If the amount is to be spread over multiple accounts, use the + button to expand the grid. |

Sub Acct |

Enter if the account entered in previous step requires a Sub-Account. |

Total Amount |

Enter the total dollar amount of the deposit. |

Account Grid |

The entry can be recorded to one or multiple Accounts/Sub-Accounts. If the amount is to be spread over multiple accounts, enter the multiple Accounts then Save. If the account is only the one account entered, select F10 to close grid. |

Use Menu item #31 to post the payments. The system will not allow you to post any entries with errors (i.e. invalid account/sub, split accounts that do not balance etc.)

Note: Entries are recorded in the deposit journal setup in Bank Account Master. (i.e. journal #10)

Payroll Check

The Payroll check type is for entering after the fact payroll. The transactions will be updated to not only the general ledger and check history, but also they will flow into the payroll system for quarterly and annual payroll reporting needs.

Note: Payroll > Master File Maintenance > Basic options > G/L Tab option for Create G/L Entries MUST be set to YES for the ATF Payroll entries to post to the G/L.

Enter the following information:

Date of transaction |

Enter the date of the transaction. Each subsequent date will prefill with the previous entered date (can override). |

|---|---|

Type |

Payroll Chk |

Number |

Enter the check number for employee checks. Note: the check number will automatically fill in the next check number from check history (can be overridden). |

Payee Code (i.e. employee Sub-Account) |

Enter the employee number to record the entry. The employee must be setup in Employee master before beginning. |

Comments |

Enter any comments or description necessary.This will print in the description field in View Trend (F4) after the Payee Name. |

Account |

Enter the account number to record the transaction. The entry can be recorded to one or multiple accounts/Sub-Accounts. If the amount is to be spread over multiple accounts, use the + button to expand the grid. |

Sub Acct |

Enter if the account entered in previous step requires a Sub-Account. |

Total Amount |

Enter the total dollar amount of the check. |

Account Grid |

The account field will expand for you to enter the payroll information. Enter the amount for each payroll detail code for the check. Note: the Soc Sec and Medicare will automatically be calculated based on the gross salary (unless manual override is active). After everything is entered the Fed W/H will be calculated based on the difference to equal the total check. Note: Earning codes expense coding option must be set to E, D, or F, the A or L options are not supported with ATF Payroll. |

Use Post Checks. The system will not allow you to post any entries with errors (i.e. invalid account/sub, split accounts that do not balance etc.) Errors are documented on the entry screen in red and the detail information about the error is given in the Error Code Information field.

Also, after the fact payroll will not post if a payroll cycle is currently in progress. You must clear or post the current cycle.

The Post process will create/post the entries in the general ledger, in check history in Bank Reconciliation, and in Check history in Payroll. A separate cycle is created for each date of check book entries. For example, if you post payroll checks for 2 sets of dates, 2 cycles will be created in payroll.

Once updated you can complete bank reconciliations and process quarterly and annual payroll reporting (i.e. 941’s, W-2’s, etc).

NOTES:

•Payroll checks are voided through the payroll system in Check History. Additionally, tax amounts are not allowed to be manipulated by more than ten cents.

•When running a payroll cycle through the Payroll module, in relation to the TWC report (Payroll module, #45-State Unemployment) the "Start/Stop"dates of the cycle have to include the 12th of the month for the number of employees to be pulled into the TWC report. When the payroll is run "After the Fact," the check dates are used as the start/stop dates. Unless everyone were to be paid on the 12th of the month, they will not show up when running the TWC Report.