The Unpaid/Unbilled report will give you a reminder of the amounts that have been coded to a Joint Interest Billing or Revenue Payable account, but haven’t been billed or paid as of the cut-off date.

Unbilled Amount

The Unbilled section of the Unpaid/Unbilled Report checks that the amount billed equals the billing offset account. The total “not billed” should match the “Unbilled – JIB” line on the current asset portion of your Balance Sheet. The billed accounts should ALWAYS stay in balance unless someone has posted something directly to the billing offset account, or coded to the billing account with a billed date. This is not a recommended procedure as it will produce an error on the report (See below). Review any outstanding amounts on a monthly basis to see if they are on hold or if the lease is on hold. If it is management's intent to not bill the outstanding amounts, they need to be moved to the appropriate expense account or have the invoice reversed out, etc.

Unpaid Amount

The Unpaid section of the Unpaid/Unbilled Report checks that the amount paid equals the revenue offset account. The total not paid should match the “Revenue Payable” line on the liability portion of your Balance Sheet. The paid accounts should ALWAYS stay in balance unless someone has posted something directly to the revenue offset account, or coded to the revenue account with a paid date. This is not a recommended procedure as it will produce an error on the report (See below). Review any outstanding amounts on a monthly basis to see if they are on hold or if the lease is on hold. If it is management's intent to not pay the outstanding amounts, they need to be moved to the appropriate income account or have the entry reversed out, etc.

Pending Billing Corrections

This report also includes a column that displays any pending billing corrections that were done but not included in the billing cycle. This column is notifying you that you have the "reversal" entries waiting to be processed through to the owners from a billing correction. If you have completed a billing cycle after you have done a billing correction, then this should show as zero.

Unless you uncheck the option, the Unpaid/Unbilled report will run at the completion of every cycle. However, the report can also be run at any time from the Revenue/ Billing menu > #30 Reports > Property tab > P-31 Unpaid/Unbilled in addition to the Update/Post Revenue/Billing cycle.

NOTE: The Unpaid/Unbilled report will separate the Errors from the Unpaid/Unbilled report itself.

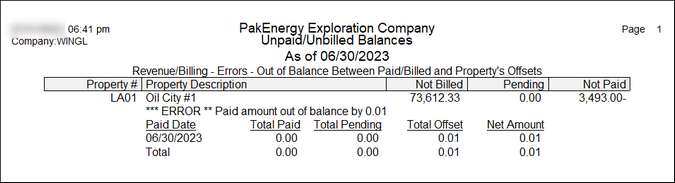

Example of Unpaid / Unbilled Report with Errors:

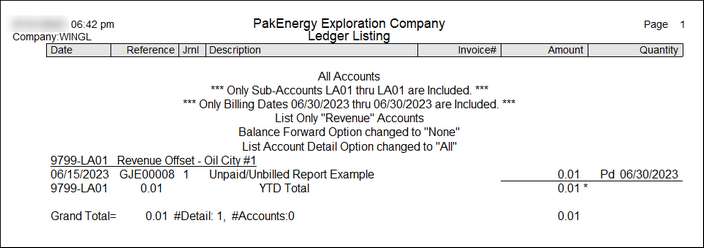

In the event that your report has an error in it, a second report will automatically generate after this one prints. The second report is a Ledger Listing for all the transactions that make up the out of balance amount.

Note: All the options used to generate the Ledger Listing are listed on the report. This enables you to manually recreate the listing adding additional filter criteria if that will help in your analysis.

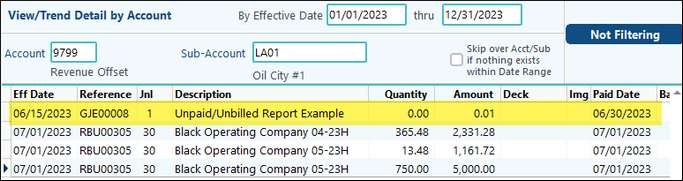

Example of how to further research an issue.

To further research this matter, you can go into View Trend (F4) and find acct 9002 Sub-Account LA01 and view the period with the error.

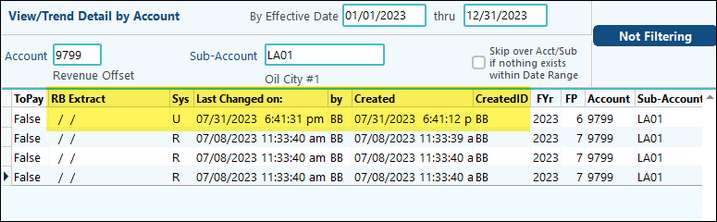

In View Trend (F4), scroll across to see when the transactions were created (or move the columns) and who created them. We can see that user BB made a manual Journal Entry into this account. We would need to ask the user for the reason before determining the best way to correct the issue.

What do we know? What are our clues?

1.We know the Journal Code, Reference, Description, doc image.

2.Our clues are Whom & when was the entry created, also Last Change UserID/Date & Time.

3.Our clue is RBExtract Date/Time on transaction (This is true on accounts 9000-9598 and 9600-9698, the offset accounts will not have a date in this field).

Some issues that can cause an error to appear on the Unpaid/Unbilled report.

•If entries are manually made to the Billing Offset and Revenue Offset accounts.

•If the G/L entries failed to post when the cycle was updated, and someone manually deleted or changed the entries prior to posting the entries (which is what happened in this example.)

•

BEST PRACTICE: If you don’t observe good, date-cutoff for new transactions, you can suddenly have unbilled transactions earlier in the month, where before you didn’t have any. Use the Posting Allowed Date Range to keep back dated entries from being posted.