WolfeNet Revenue/Billing Electronic Data Exchange

The purpose of WolfeNet is to make data exchange between Operators and Investors as seamless and as easy as possible thus eliminating the need for extensive manual data entry, error corrections, etc. The WolfeNet process provides Pak Accounting operators the ability to send check stub and revenue/billing information electronically to their Pak Accounting investors! Pak Accounting investors can enjoy the convenience of downloading their check stub and revenue/billing information compared to entering the check stub and revenue/billing information manually each month.

Investor Setup (3 Steps):

Setup for Investors to begin using WolfeNet is a 3 Step process. You will need to complete these steps to complete your download process.

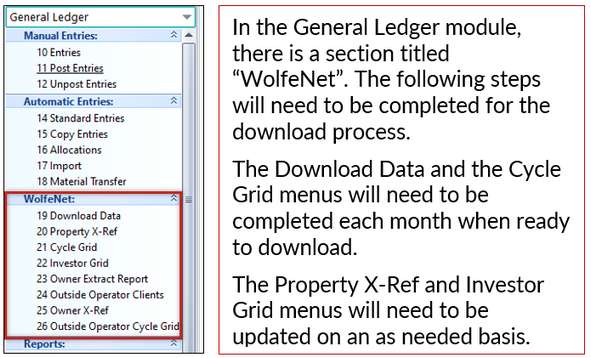

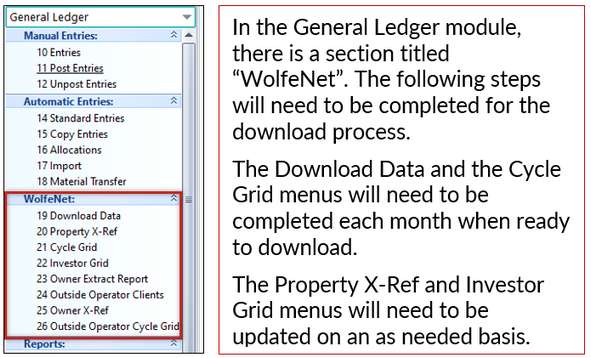

In the General Ledger menu you will see a section titled “WolfeNet”. Also see Operator Setup under Revenue Billing/Investor Interface.

Before beginning the first-time setup, you will need to download the file from your Operator. This will give you the information needed to set up the rest of the menu items.

Once on the screen, click on the List Files available to download. This will connect to the FTP site to determine which files have not been previously pulled in and list them on the screen.

From there, click on the Download button at the bottom of the screen. The accounts and properties are available for setup.

|

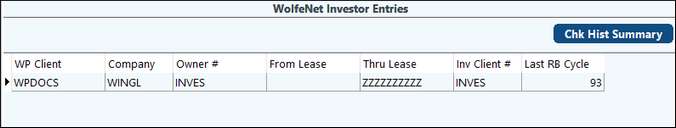

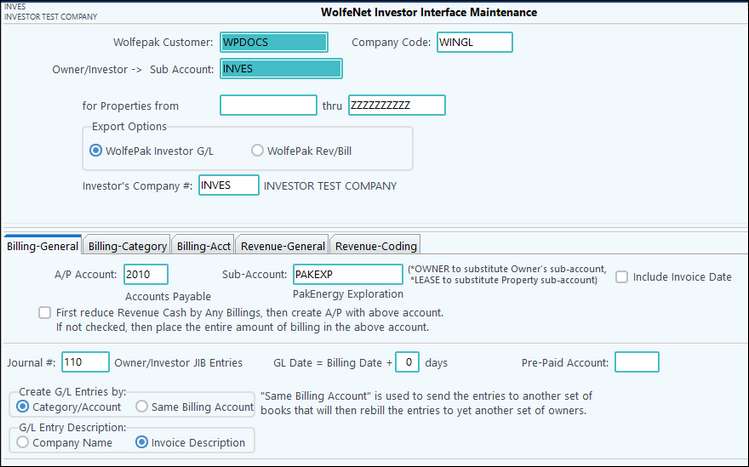

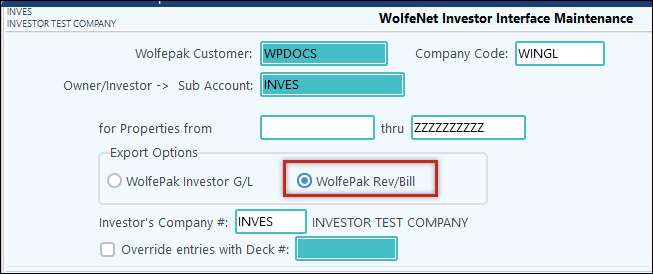

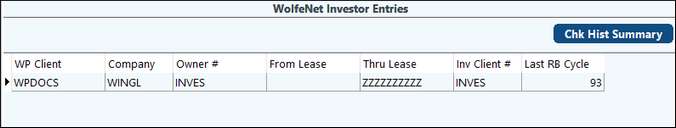

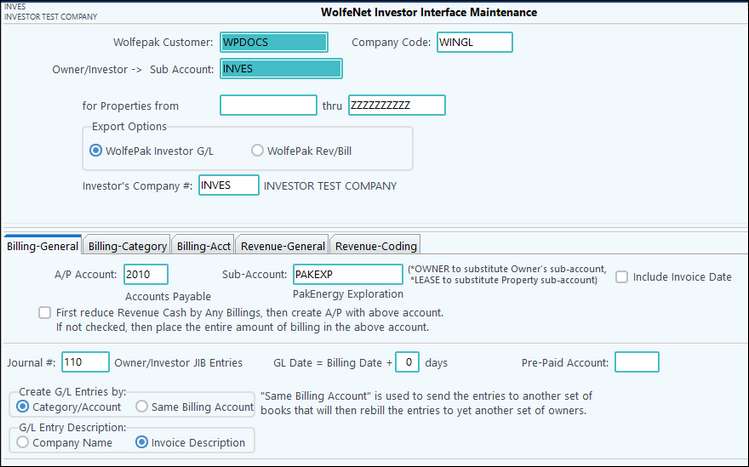

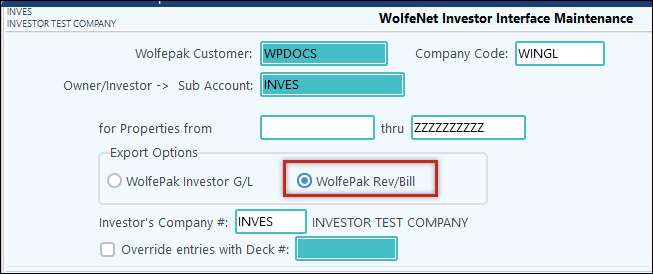

For each Pak Accounting Client (Operator) that you receive entries from, you will need to set up a WolfeNet Investor Entries Maintenance Screen. WolfeNet Investor Grid will allow you to Add/Change how you are booking the entries that you are receiving from your operator. This setup will tell the system which account #’s you want to post to when recording your incoming WolfeNet entries each month.

To add the first Operator, click on the menu item ‘Investor Grid’, then click Add New at the bottom of the screen.

WolfePak Customer

|

Operator’s Pak Accounting Customer Account Number from their Help – About screen.

|

Company Code

|

The Operator’s Company Code. This is the company code in which they run their cycles.

|

Owner/Investor Sub-Account

|

The Operator’s Sub-Account Code for your company.

|

for Properties from

|

The default set as “ “ thru “ZZZZZZZZZZ”. This setting will allow the entries for all properties you have invested in with this operator to import. (TIP: keying in a specific lease code range will prevent entries for properties not included in this range from importing.)

|

Export Options

|

The option WolfePak Investor G/L is used to capture just your share of the income and expenses from the operator. The WolfePak Re/Bill option is selected if you want to capture the 100% revenue and billing amounts.

•You must be licensed for the Revenue/Billing module to use this option because you will need to run a cycle to create the entries to your income and expense accounts.

•The 100% amounts can be captured whether or not you need to further bill or distribute revenue to your investors. You must be licensed for the Revenue/Billing module to use this option |

Investor’s Company #

|

Your Company Code

|

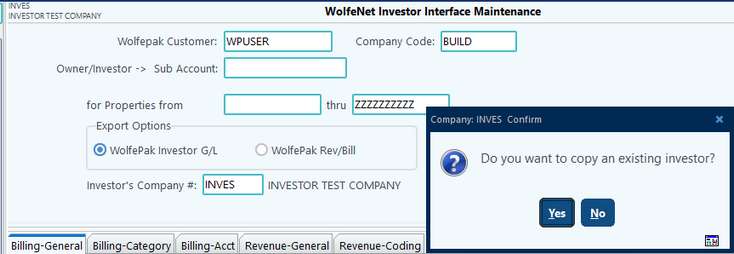

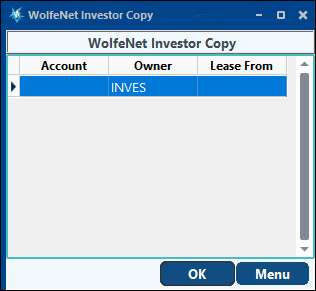

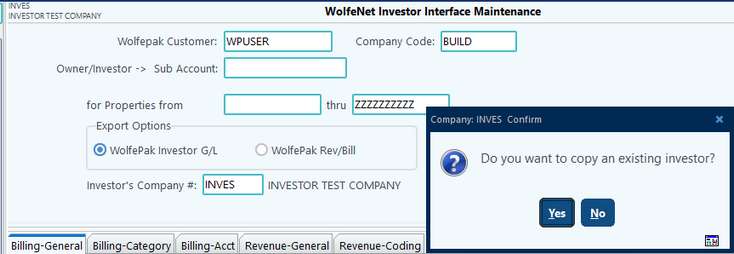

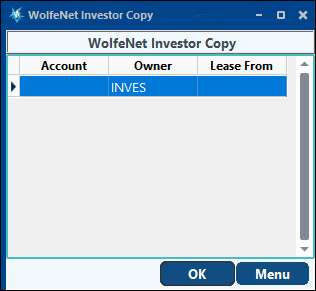

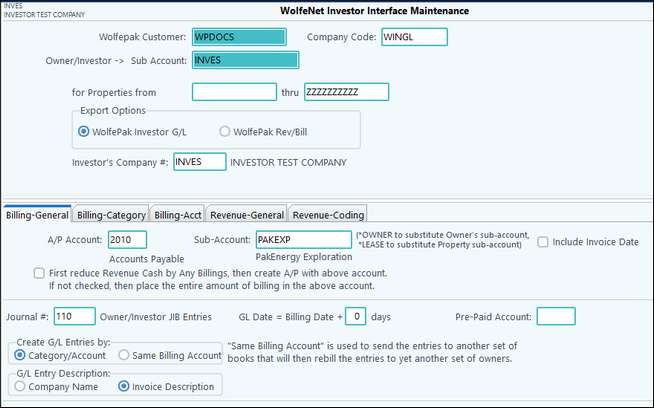

Copying Investor Setup:

Once you have an initial investor set up with the account information for the WolfePak Investor G/L and/or WolfePak Rev/Bill, you can copy the bottom portion that has the account set up.

You will need to enter in the unique information for the Pak Accounting Client, Company, and Owner Sub-Account. Once you tab out of the Property range field, there will be a pop up box asking “Do you want to copy an existing investor?”

Copying an existing owner can save you time and effort if it is similar to the one you are needing to set up. However, if this owner will be set up uniquely, you may not want to copy.

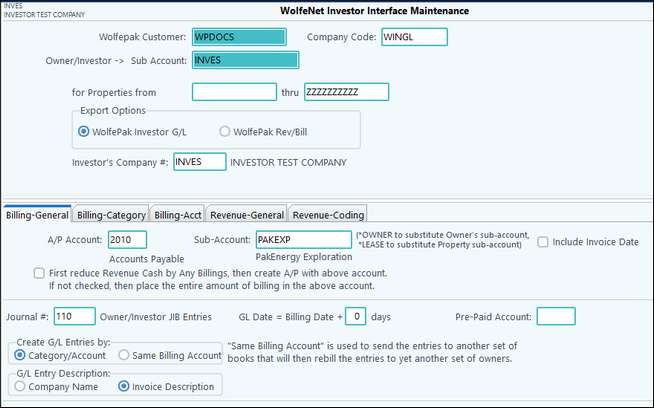

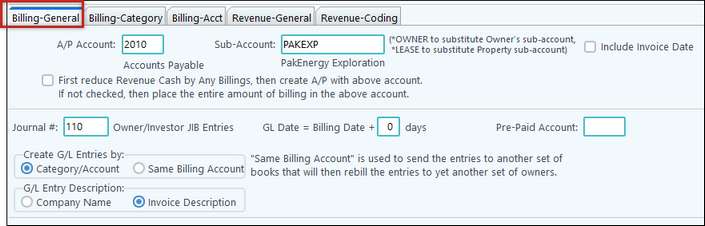

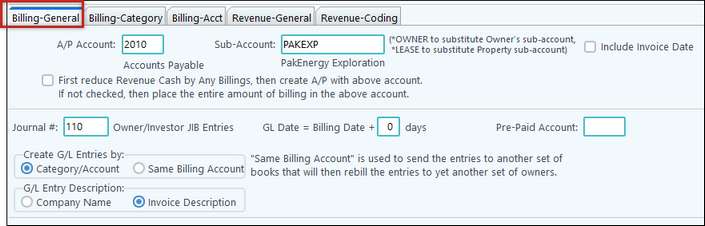

Billing-General Tab:

A/P Account/Sub-Account

|

Defines the account for Billing (A/P) the Billing Expense entries to be offset to. The Sub-Account will be the company/vendor that the payment will go to.

|

Include Invoice Date

|

If this option is checked, entries will be created for each invoice billed by the operator which will retain the original entry’s production/service date and invoice date.

|

First reduce Revenue Cash by any Billings…

|

This option can be used if you are a netted working interest owner. When checked and the revenue exceeds the billing and you get a check for the netted amount, an entry for the check amount will be posted to the account number on the Revenue/General tab in the Rev Offset Account box. If the billing exceeds the revenue, the entry for the netted amount will be posted to the account in the A/P Account.

|

Journal #

|

Recommend each Journal Number be unique for easier audit trails.

|

G/L Date + Billing Date

|

Allows an adjustment to the journal date by adding the number of days (positive or negative) from the Cycle Billing Journal Date.

|

Prepaid Account

|

Enter a Prepaid Offset Account when using AFE Prepayments. This is the Pre-Paid offset account when the operator has applied your cash call payments to your billing. This is normally the asset account you charged when you wrote the cash call check to the operator.

|

Creates G/L Entries by

|

Category/Account will use the “Billing-Category” and “Billing-Acct” tabs when creating entries. The option “Same as Billing Acct” will create entries to the exact same billing accounts as the Operator’s in order to run another billing cycle. This option creates entries to the billing accounts for the investor share only. No entries are created for billing deleted interest. If your billing accounts are not the same as the operator’s and you do not want billing deleted interest entries, use the Category/Account option. You can then use the Billing-Acct tab to set up the cross-reference between your billing accounts and the operator’s billing accounts.

|

G/L Entry Description

|

Company Name - the description will be the name of the company that sent the JIB entries.

Invoice Description - the description will be the vendor information.

|

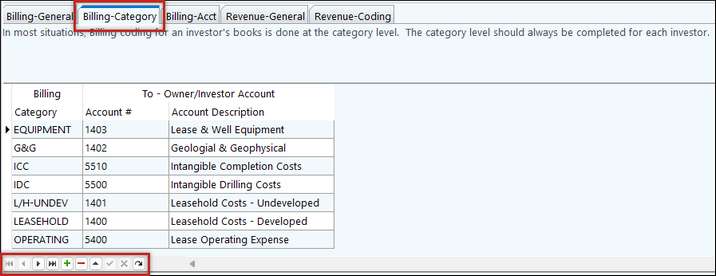

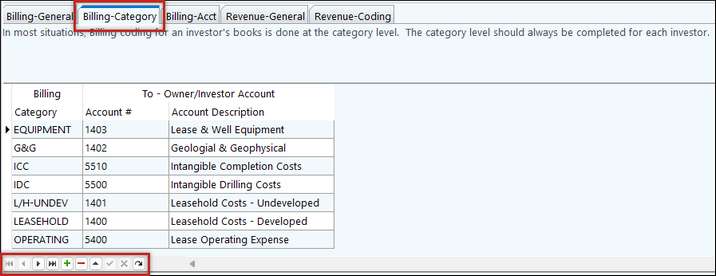

Billing-Category Tab:

Enter each “Billing” category & the expense account to be coded to.

Tech Tip: if you selected the Same Billing Acct option, you do not need to complete this section.

Billing-Acct Tab:

This allows a customized account level coding that will override the “Billing-Category” account. This grid can be used to capture entries at the G/L account level instead of the category level for the specified accounts. The Operator’s billing account goes in the left column and your account number goes in the right column.

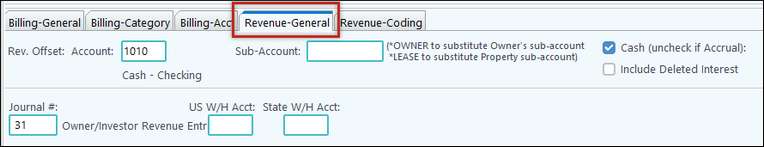

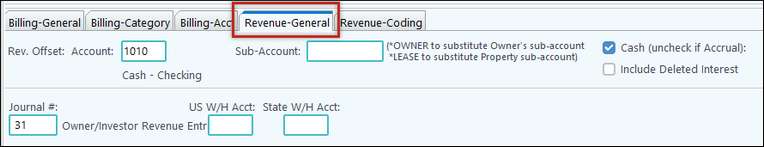

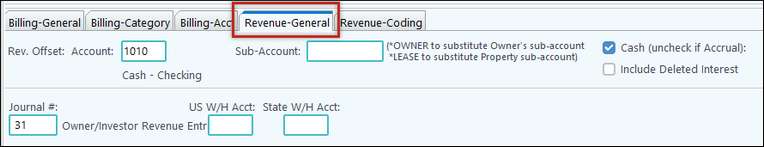

Revenue-General Tab:

Rev Offset Account/Sub-Account

|

Defines the account for the Revenue to be offset to. This is typically the cash/bank account the check will be deposited to if a check is received.

|

Cash (Uncheck if Accrual)

|

Cash will record entries using the check date for the G/L effective date.

Accrual will record entries using the production month.

|

Include Deleted Interest

|

Used with the “WolfePak Rev/Bill” Export Option to include Deleted Interest Entries for Revenue Disbursement.

|

Journal#

|

The journal number to be used to record the income entries. This should be unique.

|

US W/H Acct

|

Defines the account to be used to record Federal Witholding Taxes deducted from the revenue received from the operator.

|

State W/H Acct

|

Defines the account to be used to record State Witholding Taxes deducted from the revenue received from the operator.

|

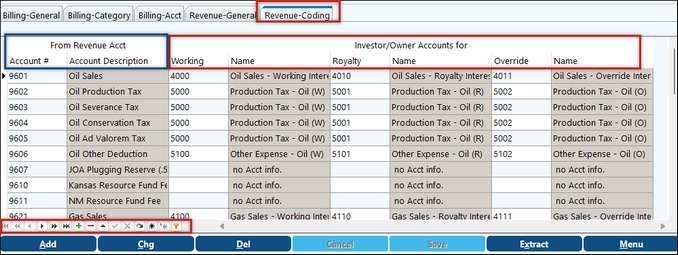

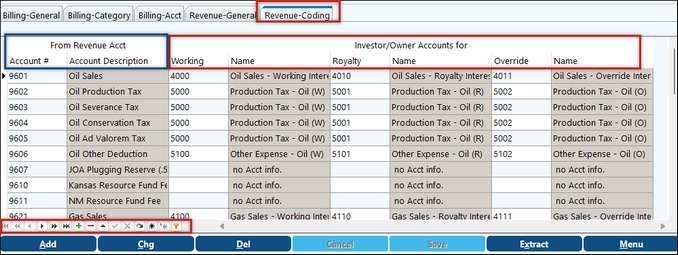

Revenue-Coding Tab:

From Revenue Acct

|

displays all Revenue Accounts the Operator may be using.

|

Investor/Owner Accounts for

|

Displays the Revenue account numbers the operator is using. Enter YOUR account numbers for each interest type.

If you do not want to track your interest types separately, you can use the same account number for each interest type. For example: you could use 4000 for oil sales-working and 4010 for oil sales for both royalty and overrides.

|

Export Option –WolfePak Rev/Bill

This option allows you to capture the 100% amounts from the operator. Entries created using this option will post to the Revenue and Billing accounts. It also allows you to override the deck the operator has on the transactions to the deck code you use. However, if you have multiple deck codes, you will need to change the decks on the imported entries.

Since the transactions will be posted to Revenue and/or Billing accounts, you will need to run Revenue/Billing cycles. If you do not have an Investor Interface set up in the Revenue/Billing module for the internal owner, you will also need to set that up.

Billing - General Tab:

A/P or Cash Account/Sub-Account

|

Defines the account for Billing (AP), Cash or Clearing account for the billing expense entries to be offset to.

|

First reduce Revenue Cash by any Billings, the create A/P with above account. If not checked, place the entire amount of billing in the above account.

|

This option can be used if you are a netted working interest owner. When checked and the revenue exceeds the billing and you get a check for the netted amount, an entry for the check amount will be posted to the account number on the Revenue/General tab in the Rev Offset Account box. If the billing exceeds the revenue, the entry for the netted amount will be posted to the account in the A/P Account.

|

Include Invoice Date

|

If this option is checked, entries will be created for each invoice billed by the operator which will retain the original entry’s production/service date and invoice date.

|

Journal#

|

The journal number to be used to record the billing/expense entries. This should be a unique journal.

|

GL Date + Billing Date

|

Allows an adjustment to the G/L Effective Date by adding the number of days (positive or negative) from the cycle billing date.

|

Pre-paid Account

|

This is the Pre-Paid offset account when the operator has applied your cash call payments to your billing. This is normally the asset account you charged when you wrote the cash call check to the operator.

|

Create G/L Entries by

|

Category/Account will use the “Billing-Category” and “Billing-Acct” tabs when creating entries. This is the option most commonly used.

The option “Same as Billing Acct” will create entries to the exact same billing accounts as the operator’s in order to run another billing cycle. If your billing accounts are not the same as the operator’s billing accounts, use the Category/Account option and set up the cross reference for the account numbers on the Billing-Acct tab.

|

Revenue - General Tab:

Rev Offset Account/Sub-Account

|

Defines the account for the Revenue to be offset to. This is typically the cash/bank account the check will be deposited to if a check is received.

|

Cash (Uncheck if Accrual)

|

Cash will record entries using the check date for the G/L effective date.

Accrual will record entries using the production month.

|

Journal#

|

The journal number to be used to record the income entries. This should be unique.

|

US W/H Acct

|

Defines the account to be used to record Federal Withholding Taxes deducted from the revenue received from the operator.

|

State W/H Acct

|

Defines the account to be used to record State Withholding Taxes deducted from the revenue received from the operator.

|

Revenue - Coding Tab:

From Revenue Acct

|

Displays the Revenue accounts the operator is using.

|

To Revenue Acct

|

Defines your Revenue account that corresponds to the operator’s Revenue account.

|

|

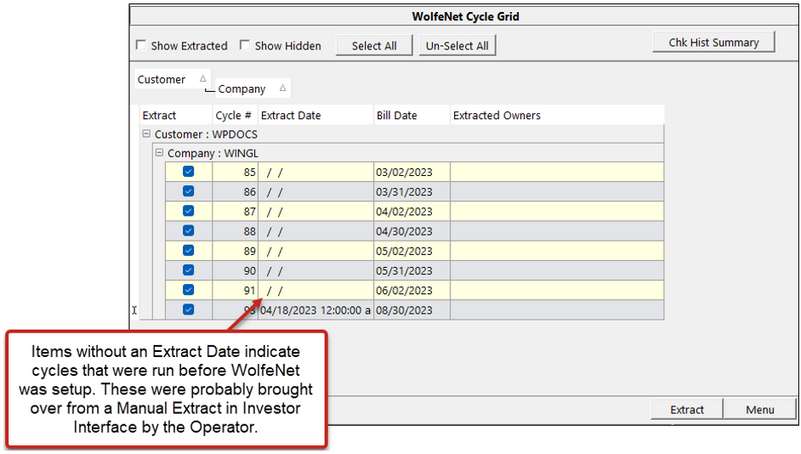

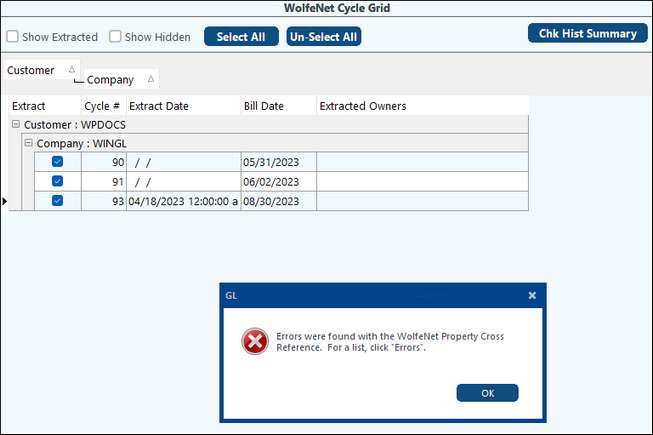

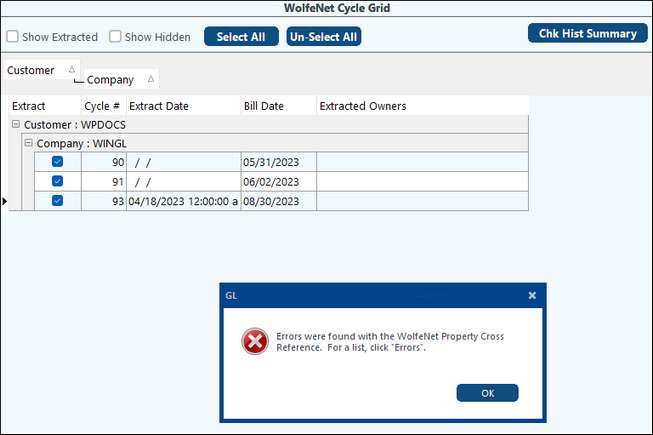

3A: Cycle Grid

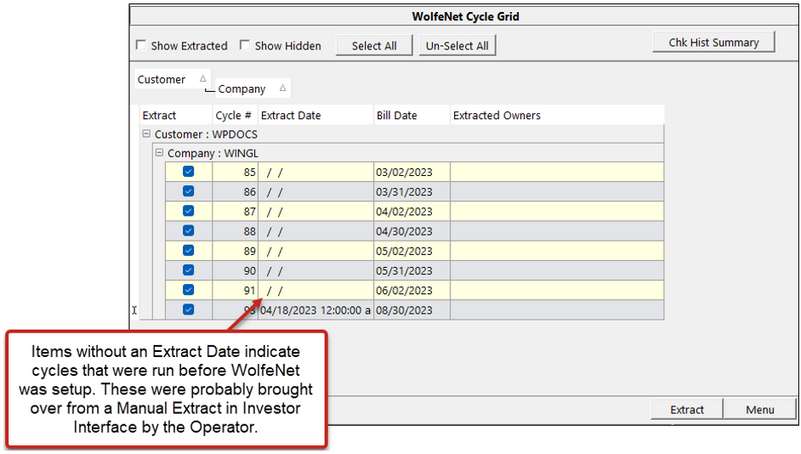

For first time setup you will need to go into the Cycle Grid, select the cycles you would like to extract, and click Extract at the bottom of the screen. There will be an Error message about the Property Cross-Reference. Click OK on the message. The properties will then populate in the Property X-Ref screen.

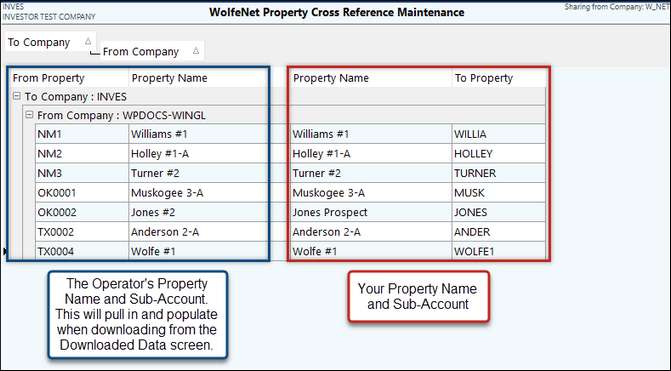

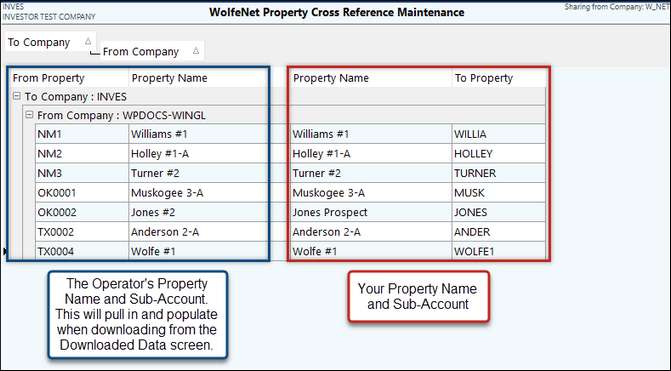

Step 3B: WolfeNet Property X-Ref.

This section will display all the Operator’s Property codes and Property names. You will need to do a one-time setup to cross reference your Purchaser’s Lease #’s and names with YOUR leases. This will need to be maintained on a monthly basis as new properties are acquired and added to the download.

Frequently asked questions:

Question: Does this need to be set up every time?

Answer: No, this only needs to be set up once and the Pak Accounting will remember this for future cycles.

Question: My property code does not match the operator’s property codes. What do I do?

Answer: Pak Accounting does not require the Investor’s Property Code to match the Operator’s Code. A usual cause for a difference includes the Sub-Account length setting. For example: The Operator may use a length of 10 characters while the Investor only uses 6 characters.

The WolfeNet Setup is complete at this point!!!

|

Month to Month Process

For subsequent months, usually only step 1 and step 4 need to be done unless you have new properties. If you have new properties, you will need to add them to your cross-reference screen in Step 2. The system will notify you if you have a missing property that needs to be set up. You can run the Owner Extract Report to ensure what has or has not been extracted.

Step 1: Download new cycles from the Download Data menu

Step 2: Update Property X-Ref if you have any new properties.

Step 3: Select the cycles and Extract on the Cycle Grid menu

Cycle Grid

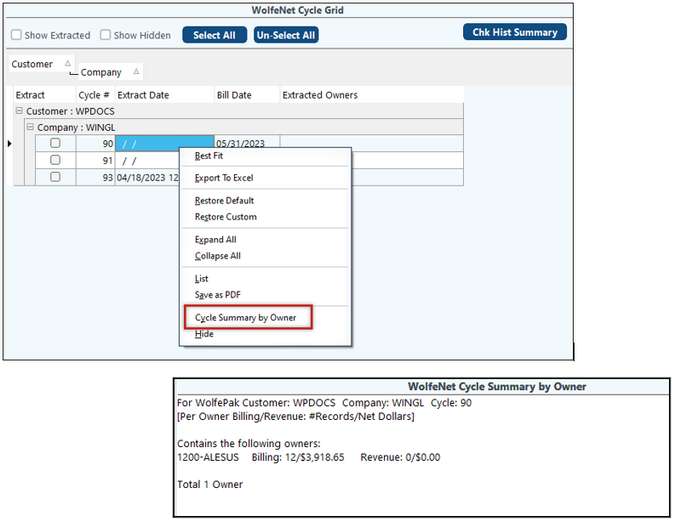

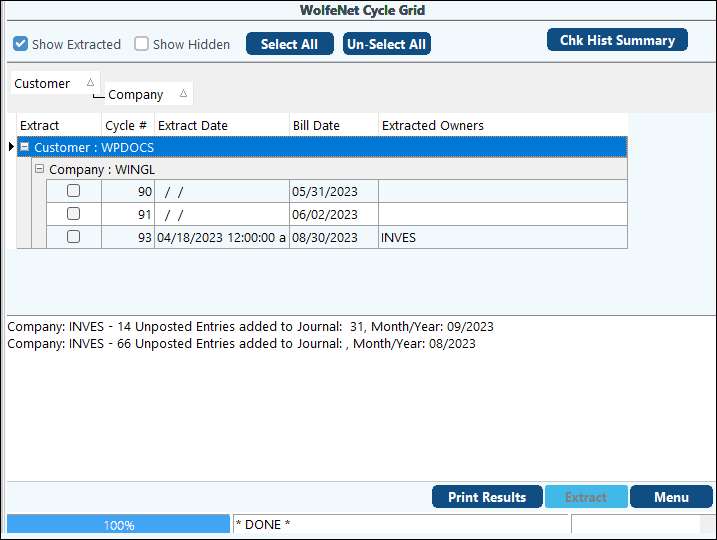

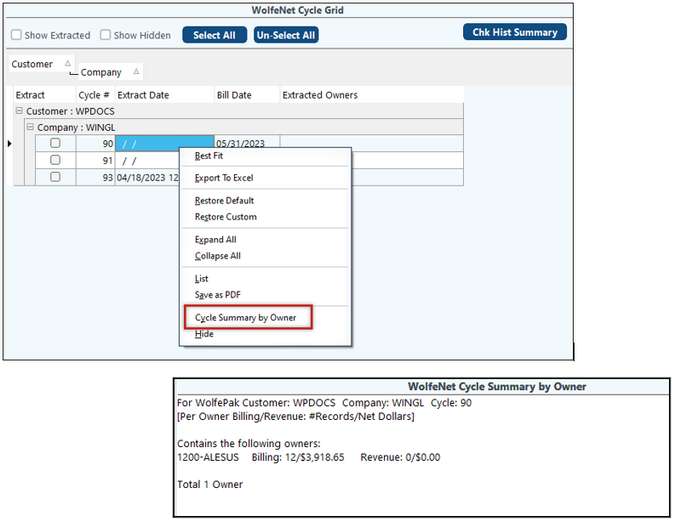

This option will extract any/all cycles downloaded from the operator. This grid will allow you to select all or certain cycles from which you are ready to create General Ledger entries. Extracting will generate G/L Entries to the unposted file for you to review and post. Right click a selected line for a Cycle Summary by Owner.

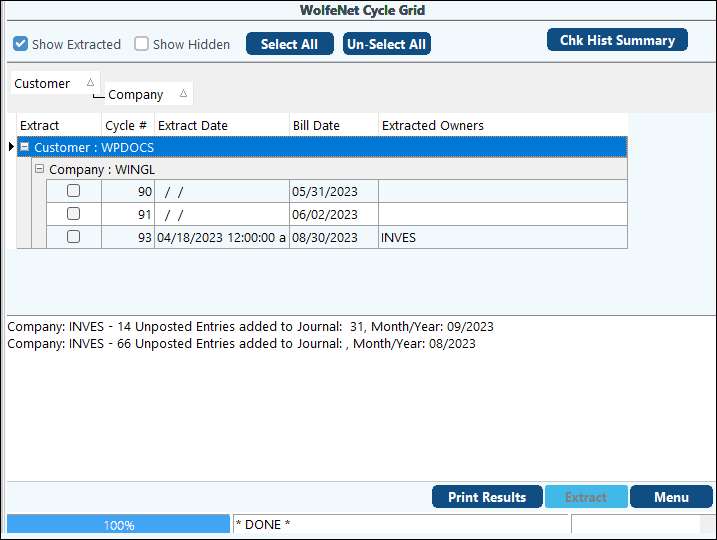

When ready, select the cycles you need and click on Extract. Once the process is completed, you’ll receive a message regarding the Unposted Entries. You can click on Print Results to print out this message.

From here, you can go to #10 Entries to review and post your entries.

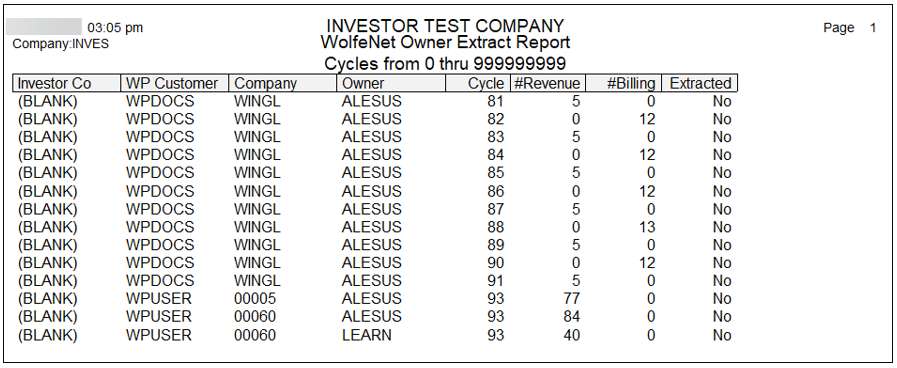

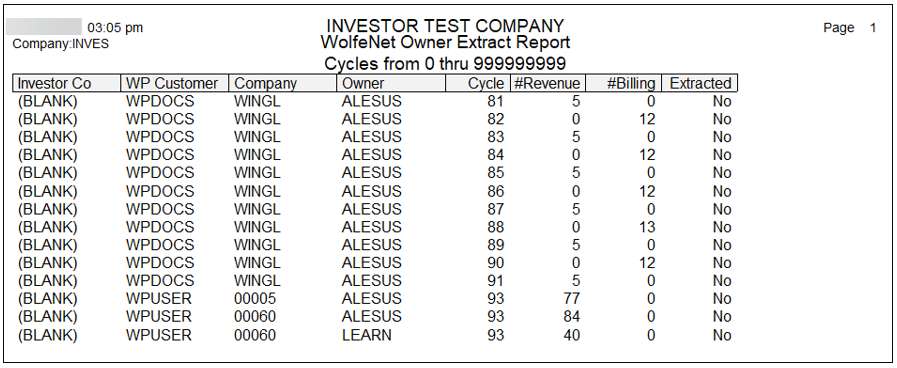

Owner Extract Report:

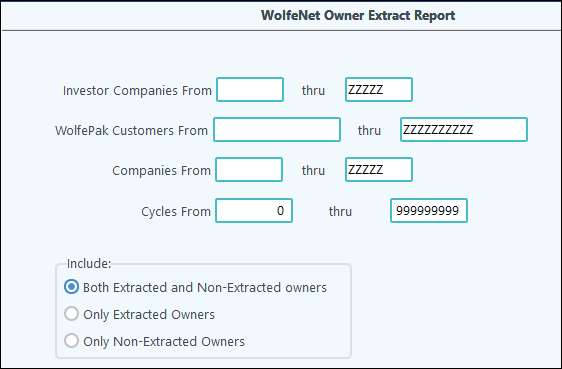

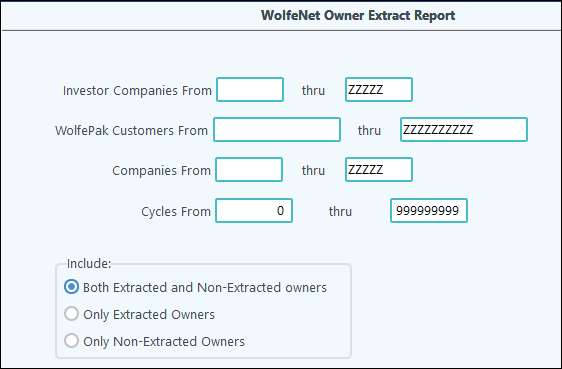

This menu item will provide a report that can be customized for you to see what has been extracted (or not) from WolfeNet. This can be narrowed down by Investor Company (what internal company is it hitting), WolfePak Customer (who did it come from), Companies From (what company sent it), and even narrowed down to the Cycle.

Also see WolfeNet Operator Setup