Before beginning see Post Finalization Review

Unclaimed Property Payment Cycle

Revenue/Billing

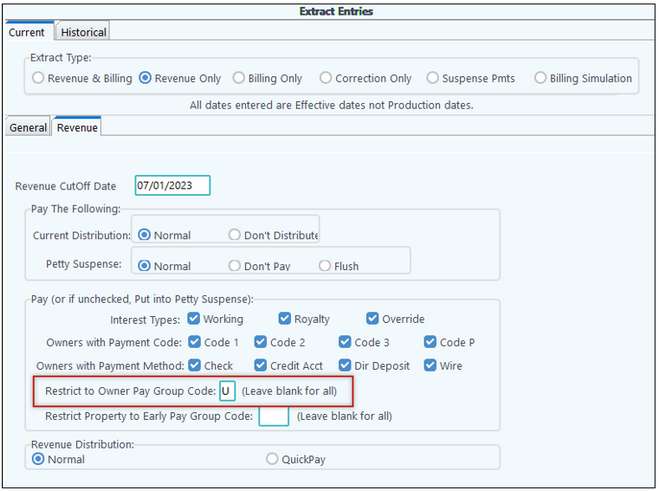

Now that you have completed your unclaimed cycle for xx state you are ready to pay that state. To do that you need to run a Revenue cycle. On the Revenue tab, enter in the letter “U” in the Restrict to Owner Pay Group Code field.

The Status Listing, Distribute/Combine, and Pre-Check Reports will not show any activity.

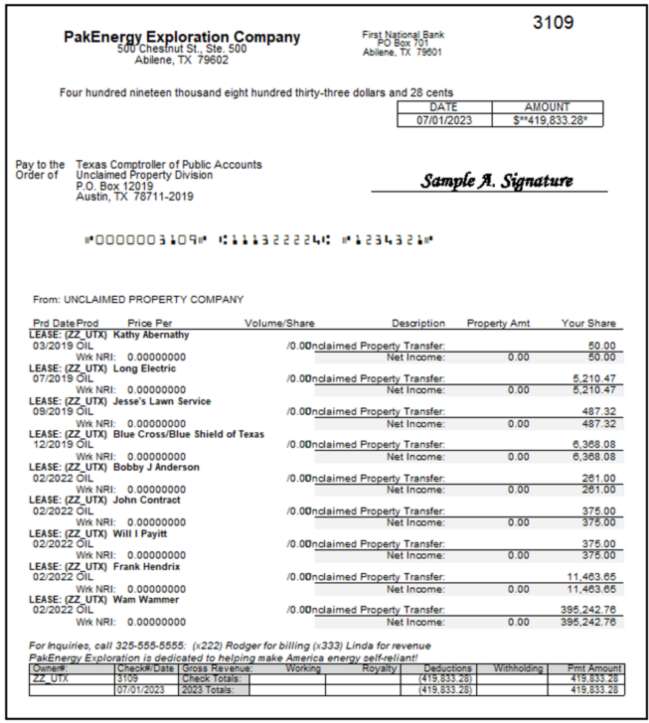

Depending on the amount being reported, you might need to wire or ACH the money to the state (check the state’s unclaimed property website).

Run your cycle like you would normally, print checks, after check reports and update your cycle.

The states check stub will show a summary line per owner. Remember you are sending an electronic file to the state that was created during the Finalize Unclaimed Property Utility.

Payroll or Accounts Payable

If escheating Payroll or Accounts Payable, and you do not have the Revenue/Billing module, then an Accounts Payable invoice will be created. Pay this invoice with a draft, the same as any other invoice that was paid online.