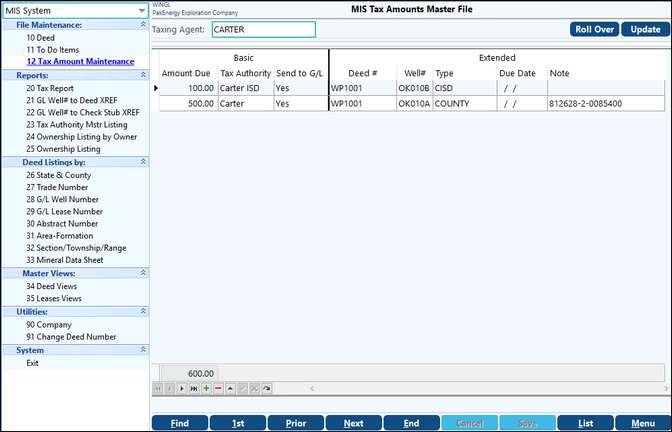

Set up a tax screen for each tax agent.

The idea is to add/update all the tax statements you get in each year and then be able to run a list of the ones you are expecting the following year and be able to check them off the list when you receive them. The ones that aren’t checked off, are the ones that someone would start inquires about.

Deed – Taxes |

|

|---|---|

Taxing Agent |

Enter the tax agent (vendor) to whom taxes will be paid |

Amount Due |

Enter the annual amount due. |

Tax Authority |

Enter the account (i.e. property) number. This is your property # at the taxing authority, not a Pak Accounting property #. |

Send to G/L |

Yes, will post the entry to the A/P in General Ledger as an open item upon selecting update. No – will not post to the G/L |

Deed # |

Associated deed #, must be defined. |

Well # |

Optional. Fill if you want the entry to record by well #, otherwise it will record by deed #. |

Type |

Type of tax paying. Tax types are defined in a Sub-Table |

Due Date |

Due date to put on the A/P invoice. |

Note |

Additional notes for informational purposes |

Roll Over |

To save time, select roll over to bring forward prior year posted line items. Make any changes to the amount due (before or after the rollover), and the due date will roll forward one year. |

Update |

Updates to the G/L any marked as Yes for Send to G/L. Posts to the G/L as an open item A/P. After updated, screen will change to Posted. |