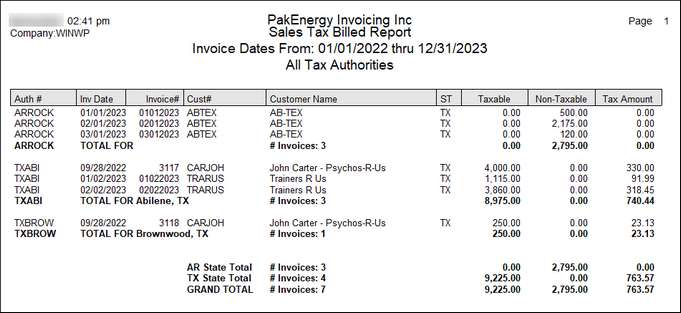

Before you begin to pay your Sales Tax you will need to determine if you are going to pay based on what you have already billed your customer, or are you going to pay based on the invoices you have received payment on: Sales Tax Billed or Sales Tax Collected/Outstanding.

This report produces a listing by invoice of both taxable and non-taxable items. Taxes charged are sub-totaled by taxing authority and a grand total indicates all taxes charged for the period. A state column has been added for convenience of knowing what state the taxing authority is in. If using the optional Use Tax feature, this report will print the proper Use Tax items as well. The option to "Print Each Invoice" or "File/Save As" will print/save invoices that had zeros for all amount fields (Taxable, Non-Taxable, and Tax Amount). The number of invoices will be displayed for all totals. The "Include Voided Invoices (on 2 lines)" will allow the invoice to be printed.

|

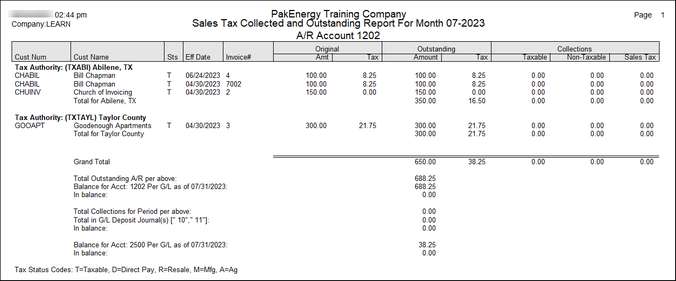

This report will generate a list of outstanding/collected sales tax. The A/R account will default to the one set up in Company Maintenance.

|

This report will allow you to reprint historical invoices from an invoice date range. This will be limited to non-zero updated invoices. |

This report provides information regarding invoices that have sales tax when the customer is coded as non-taxable. Additional information is provided on this report regarding the customer and the invoice to include the sales tax per part number, the status of the invoice, and the state. |