Pak Accounting Fixed Asset Impairment

Impairment of an asset is the decrease in the fair value of the asset below its recording cost and is unrecoverable. Impairment can be caused by events such as damage or goodwill. The decrease in fair value results in a decrease of asset value on the balance sheet and a loss on the income statement. The journal entry for impairment is a debit to the impairment expense account and a credit to the asset.

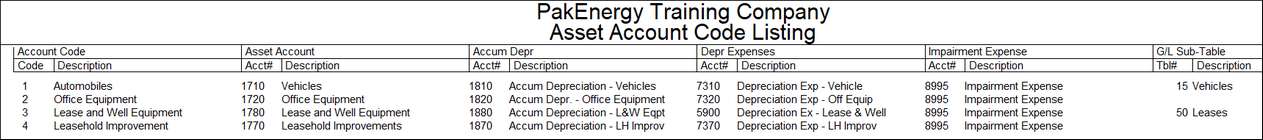

1.Have an impairment expense account in the Account Codes for the books that can record impairment. Run the Asset Account Code Listing found by clicking on the List button at the bottom of the screen. The listing will list your Impairment Expense Account along with other pertinent information.

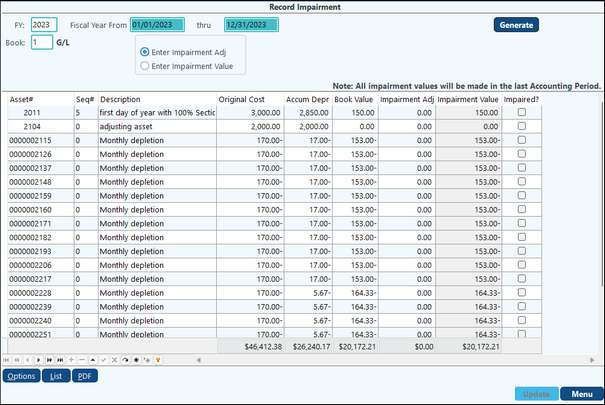

2.Go to Fixed > Assets > Record Impairment.

3.Select the needed options

a.Choose the Year and Book that will have the impairment.

b.Choose whether to enter the Impairment Adjustment of the Impairment Value.

4.Click the Generate button.

5.The assets will populate the grid for you.

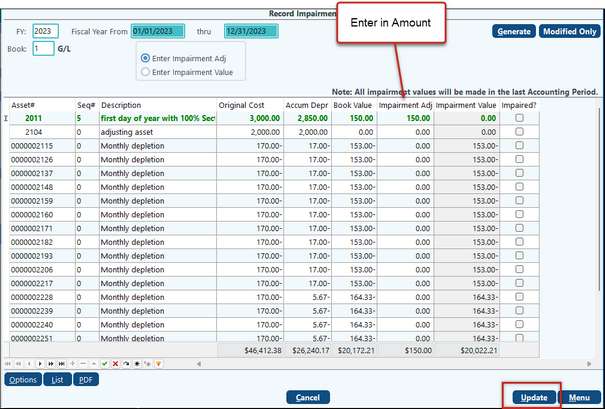

•To record impairment values or adjustments, click in the needed field and enter in the amount.

6.You have options to save a listing of the assets, export to excel or save the list to a PDF file by clicking on the Options button at the bottom of the screen and selecting the option you want.

7.Click the Update button for the system to record the impairment on the assets. The GL entries still have to be generated at this point.

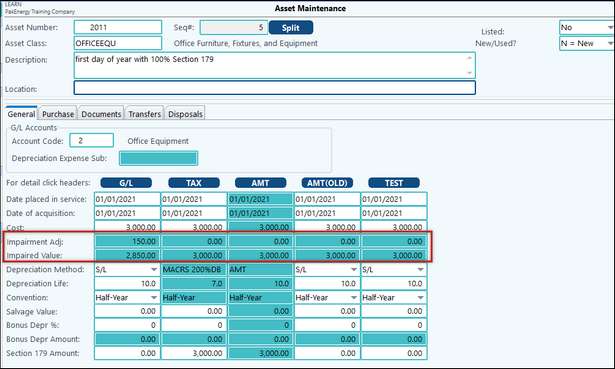

The asset will also retain the impairment information on the book that the impairment was recorded on.

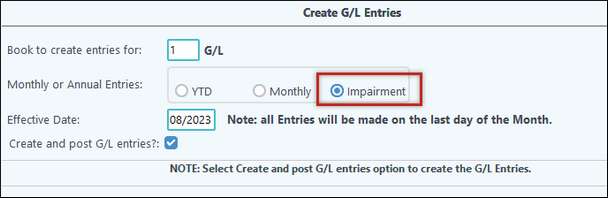

8.To create the GL Entries, go into Fixed Assets > #20 Create GL Entries, click on the Impairment button, and click on View to generate the entries.

The entries can be viewed in F4-View Trend.