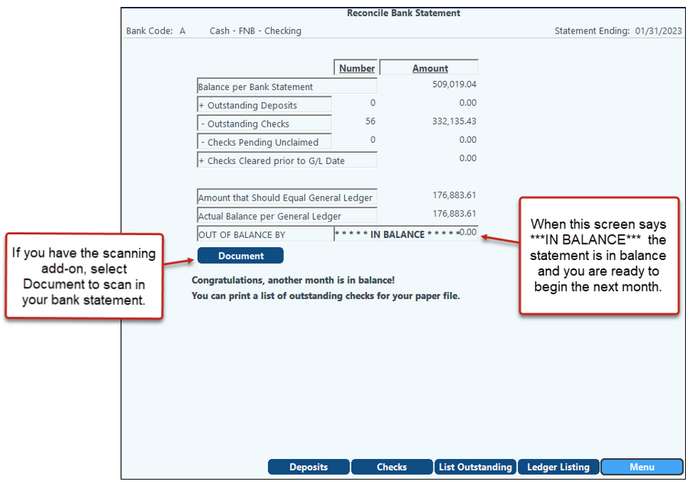

This screen takes the bank balance, adds in the outstanding deposits as entered on the Reconcile Deposits screen, then subtracts the checks still outstanding on the Bank Reconciliation file. The result should be a balance that matches the cash balance in G/L. At the bottom of the screen, you can select to List Outstanding, to print the screen information plus outstanding checks and deposits.

If the account is out of balance, the difference will display as out of balance by: ***. If it's in balance, it will be marked "***IN BALANCE*** and the cycle is completed, and you're ready for the next cycle.

NOTE: If the statement ending date being reconciled is either today's date or in the future, the cycle will not be flagged as being in balance. The screen will display ***In Balance So Far***. This will keep the cash account from being locked down if daily bank reconciliations are being performed.

Checks printed prior to G/L Date - An amount will show here only when a check is written one month, but was marked cleared in a prior month (basically cleared before it was recorded), this is very rare. Note, the amount cannot be changed manually.

The Deposits and Checks tools can be used to help find problems with the reconciliation.

When the statement is in balance, it's a good idea to use the menu option List Outstanding to print a hard copy of the balanced reconciliation. Store it with the bank statement as a permanent record.

A Ledger Listing can be printed to help reconcile the bank statement or to keep as a hard copy of the ledger activity for the month.

Print Prior Entries - this button on the bottom of the screen only appears when an entry has been made to the cash account in a prior period that has already been reconciled. The listing prints the entries so that you can decide whether they are recorded in the proper period. However, generally the prior period entry will have to be moved to a different period.