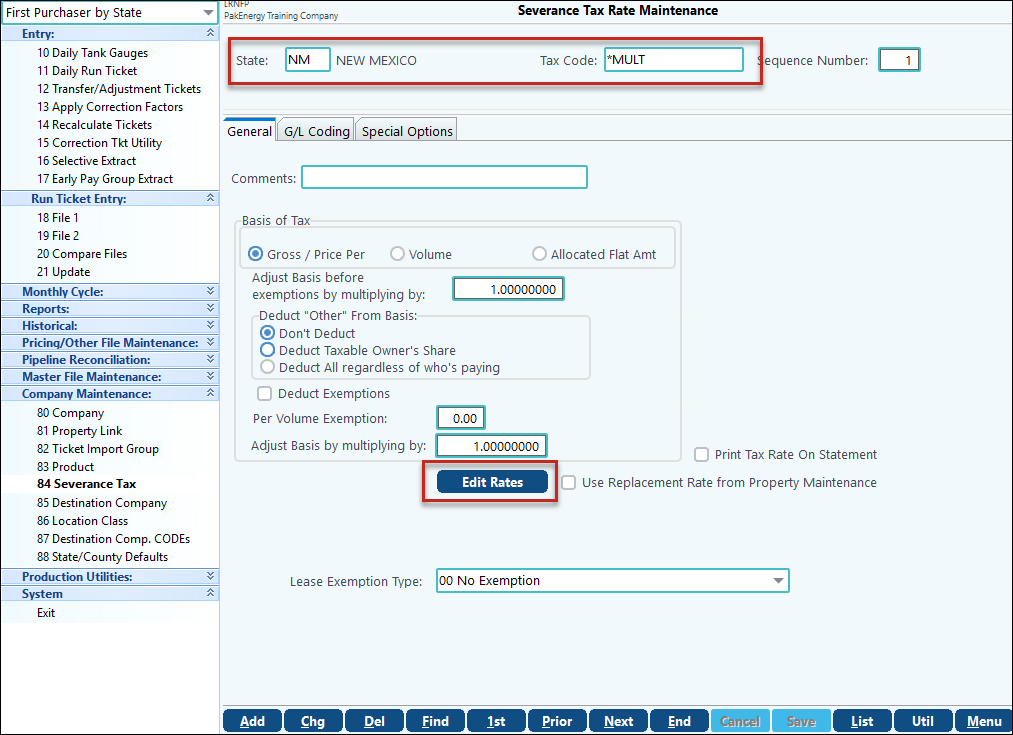

In order to import the many New Mexico tax rates, first navigate to Severance Tax Rate Maintenance. Then click on Add and enter in the NM in the "State" field, *MULT in the "Tax Code" field, and 1 as the Sequence Number. Then click on "Save" at the bottom of the screen.

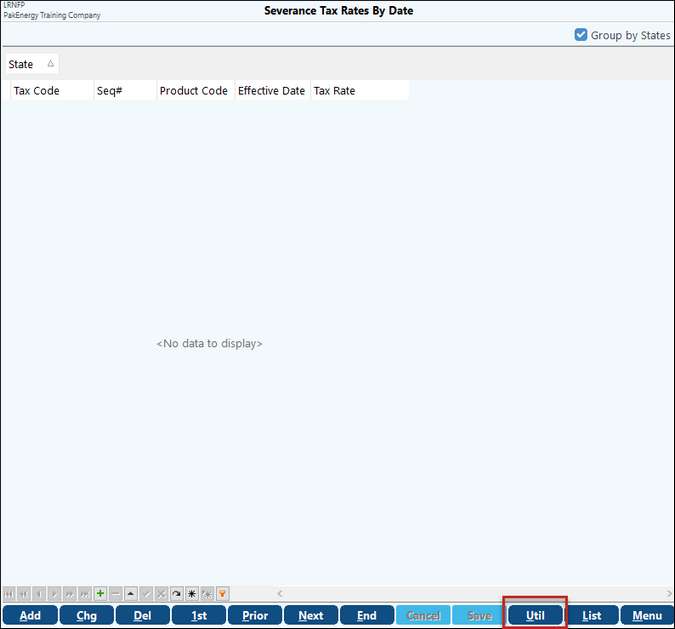

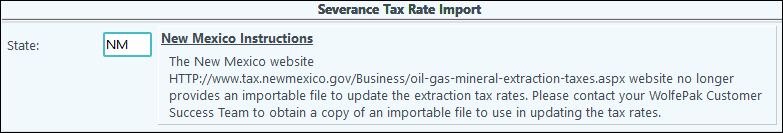

Click on the "Utilities" button to see the instructions for importing the tax rates for New Mexico. You will have to visit the listed website and download the Oil and Gas Tax Rates as an XLS File in order to import it into Pak Accounting.

Click OK at the bottom of the Import screen to browse to the saved file. Once Imported you will receive an overview screen that will let you know if the import was successful and if there were any errors. Click on Menu to close out of the Import and go back to the Tax Rate page.

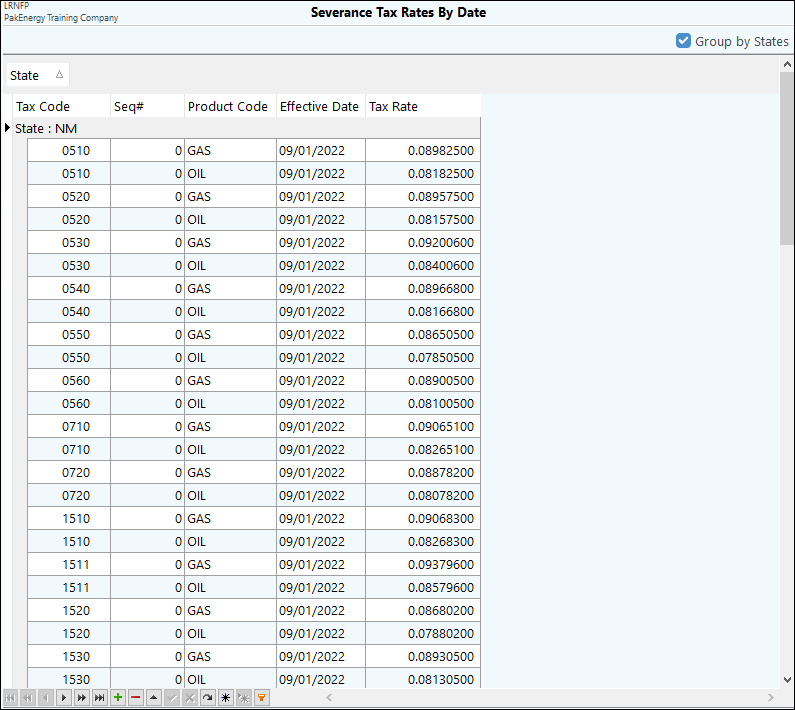

After it successfully imports, you will be able to see the Tax Rates.

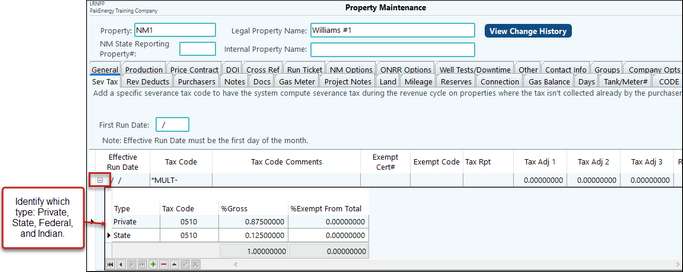

Once the file has been imported, navigate to the Property Maintenance >Severance Tax tab and find the property.

•Enter *MULT as the Severance Tax Code.

•Next, click on the "+" sign to expand the menu

•Enter the Type, Tax Code, % Gross, and % Exempt from Total (if necessary).

NOTE: The % Gross and the % Exempt from Total must equal 100%