The 940 Form is used to report Federal Unemployment information to the IRS. It is an annual form run at the end of a year. It must be filed by January 31st of each year. The form is a 2-page form.

•If the company owes money, the system will print out a voucher.

•Also, if you file unemployment in multiple states, or the state you file in has a credit reduction, the system will also print the Schedule A form.

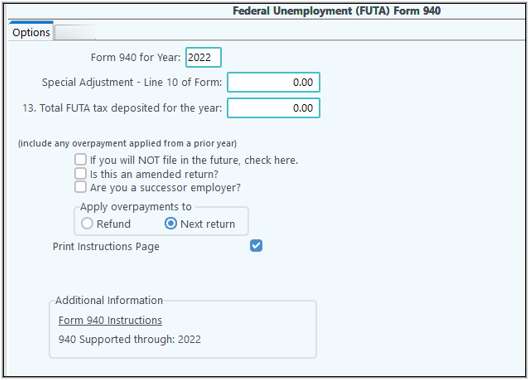

On the menu you enter the amount of deposits made in the # 13 Total FUTA tax deposited for the year line. You can uncheck the “Print Instructions Page” option, and only the forms needed will print.

•If this is your last 940 and you do not plan on filing in the future, check the box, and it will check the box on the return

•If the 940 you a printing is an amended return, check the box, and it will check the box on the return

•Apply overpayments to: Mark how you want an overpayment, if any, to be applied, Refund the money or apply it to the next return.

•Print instructions page - checking this box will include the instructions page.

This report will warn you if there are any errors but will allow you to print with errors. It will make an adjustment in the "Exempt Payment" portion of the report.