Definitions commonly associated with the Fixed Assets Module:

ACRS (Accelerated Cost Recovery System) – applies to property that was placed in service prior to 1987. It is a method of calculating the depreciation of assets for tax purposes. This is a straight line method of calculation that looks at the value of the asset to determine which class the asset belongs to. These assets would be set up as straight line and use the life determined by the user.

AMT (Alternative Minimum Tax) – uses a combination of 150 declining balance and straight-line method which results in a slower rate of depreciation than the standard MACRS (200 declining balance, 150 declining balance, and straight line). AMT is used for tax purposes. The purpose of AMT is to slow the rate of depreciation spreading out the costs over a longer period of time.

Accumulated Depreciation – is the amount of depreciation that has already been recorded for an asset. This is typically a contra asset account on the balance sheet that determines the “net book value” of an asset. Also known as the remaining value of an asset (cost – accumulated depreciation = net book value)

Alternative Depreciation System (ADS) – uses specified lives and the straight line method for depreciating an asset. This may be used in place of the regular depreciation (MACRS) when specified by taxpayer.

Asset – property owned by a company that has a value and could be utilized to satisfy debt requirements/obligations. Assets are recorded in the Asset section of the Balance Sheet.

Depreciation – a reduction in the value of an asset with the passage of time due to wear and tear.

Half-Year Convention (Mid-Year Convention)- This is the convention utilized for most assets (other than real estate). Half-year convention uses July 1 as the date to start computing depreciation regardless of the date the asset was actually placed in service. This means the first year and last year of depreciation the asset will have ½ of the allowable depreciation. If an asset is placed in service and sold in the same year, then, there will not be any depreciation for that asset.

MACRS (Modified Accelerated Cost Recovery System) – is the current tax depreciation system in the United States. Under this system, the capitalized cost (basis) of tangible property is recovered over a specified life by annual deductions for depreciation. In Pak Accounting, entries can be booked monthly, quarterly, half year, or yearly. MACRS utilizes declining balance or straight line methods depending on the IRS class code.

MACRS 150 (150% declining balance) – this is a method for calculating depreciation in which the asset has 150% of the depreciation in the first year of life in comparison to the straight line calculation. This is the most common calculation for the AMT book. See table below for an example utilizing the half year convention:

Formula first year = Cost x (1/life) x 150% x convention (see below):

Depreciation in subsequent years = (cost – accumulated depreciation) x (1/life) x 150%

MACRS 200 (double declining balance) – this is a method for calculating depreciation in which the asset has double the straight line depreciation in the year that it is placed in service. Depending on the life the percentage decreases each year until it is equal to straight line. Once it comes in line with straight line the remaining depreciation is calculated based on the straight line method of depreciation. Example of MACRS table for 200 double declining with a half year convention (standard convention):

Formula first year = Cost x (1/life) x 200% x convention (see below):

Depreciation in subsequent years = (cost – accumulated depreciation) x (1/life) x 200%

Mid-Month Convention – this is the convention that is utilized for real estate transactions. Mid-month convention means that the depreciation will start calculating on the 15th (or middle day of month) regardless of the date that the asset was placed into service. The standard monthly depreciation rate would be half in the first and last months of an assets life.

The following are the decimals that should be utilized in the calculation of depreciation depending on whether it is the first year or the year the asset is disposed, if the disposal occurs prior to the asset being fully depreciated (if the asset is placed in service and disposed/sold in same year, then, there is zero depreciation calculated on the asset):

NOTE: These are the decimals for the year. This will then be calculated down to a monthly depreciation.

Mid-Quarter Convention – this convention is used when a company places more than 40% of their new assets in service in the last quarter of the year. When this happens ALL assets (non-real estate assets) must use the mid-quarter convention. This means that an asset is considered to be placed in service in the middle of the quarter in which it was placed in service. Percentages are used for the depreciation of the asset based on the quarter it was placed in service.

The following are the decimals that should be utilized in the calculation of depreciation depending on whether it is the first year or the year the asset is disposed, if the disposal occurs prior to the asset being fully depreciated (if the asset is placed in service and disposed/sold in same year, then, there is zero depreciation calculated on the asset):

NOTE: These decimals are for the year. This will then be calculated down to a monthly depreciation.

Monthly Convention – this should only apply to the GL or user defined books, because it is not one of the 3 conventions accepted for tax purposes. The monthly convention allows for a full month of depreciation in the first month that an asset is placed into service regardless of the date placed in service.

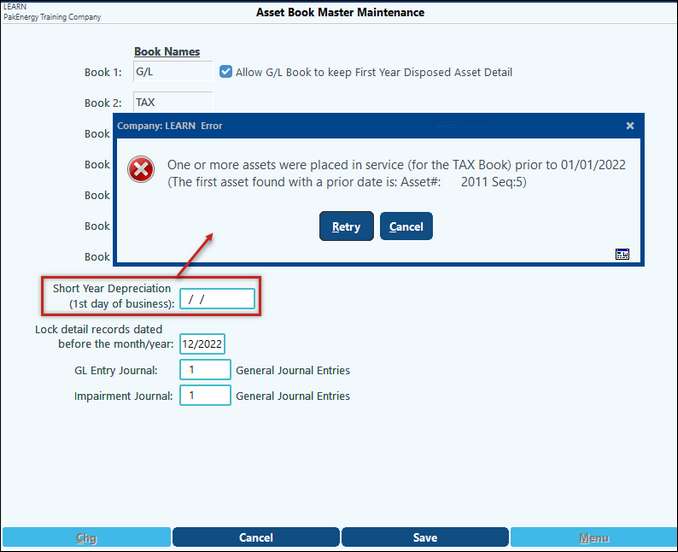

Short Year Depreciation – This is tied to a Short Tax Year. A company may have a short tax year during the first year of business to keep the tax years the same as a calendar year vs having a fiscal year end. Pak Accounting supports this type of Short Year Calculation. An existing business may have short tax year if they go from a fiscal year to calendar year or vice versa. The system will validate that the “Short Year Depreciation (1st day of business)” is not more recent that the oldest asset in the system. There is a message that pops up when adding a “Short Year Depreciation (1st day of business)” date, since this will prompt a recalculation of all the assets that were placed in service during that first year: