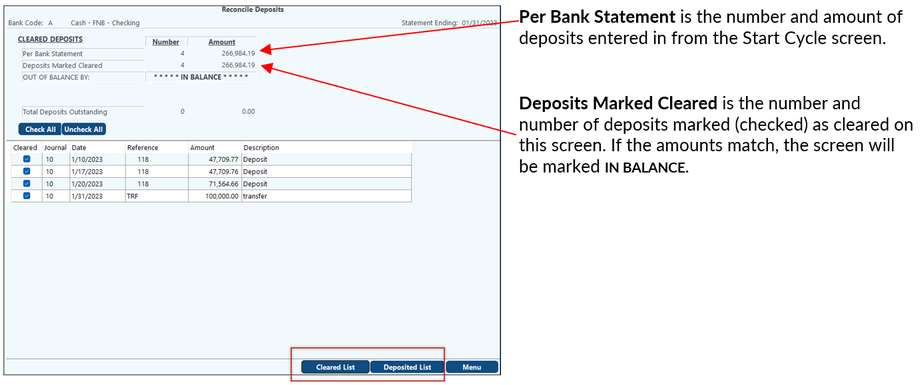

The current cycle deposits, reported by your bank, were entered in the Start Cycle screen. The actual G/L deposits are summarized from all entries in your cash account with a deposit journals source (specified in Bank Account Master Maintenance). If the amounts match, the screen will be marked"In Balance".

NOTE: In some cases, having the Reconcile Deposits screen out of balance may not indicate a serious error. If the Reconcile Bank Statement screen is in balance, the 'errors' can be ignored. However, if the Reconcile Bank Statement is out of balance, you can use the Reconcile Deposits & Reconcile Checks screen to help locate the problem.

Normal Behavior

• Deposits are automatically marked cleared if within the date range of the reconciliation cycle. Uncheck the cleared box to mark a deposit as outstanding.

•The deposit screen looks back 70 days from the beginning date of the cycle for editing meaning that these deposits can be marked outstanding or cleared.

•Anything older than 70 days will be automatically marked cleared. If that item does not belong on this cycle then a Journal Entry may be needed to correct the issue.

•It also looks forward 7 days from the ending date of the cycle.

Finding Problems with Deposits:If the Deposits Don't Balance

This indicates the deposits in the deposit journal do not match what you entered on the Reconcile Deposits screen. Make sure all these deposits are accounted for: either cleared, or outstanding.

•The Cleared List will provide a list of all deposits that have been checked as Cleared. You can use this list to tick and tie.

•The Deposited List selection can list all deposits regardless of if cleared or not.

•Make sure you entered the correct amount from the bank statement on the screen.

•Review your cash account to check for deposits that may have been entered from a journal other than your normal deposit journal.

NOTE: The Check all and Uncheck All buttons are on the deposit screen to aid you if your deposits are out of balance and you need to uncheck all deposits to be able to clear them per the bank statement.

The bank cleared a check (or deposit) for the wrong amount. They fixed it but it won't show until my next bank statement.

Do a Journal Entry for the difference in the General Ledger module / Entries. Offset the cash account to a clearing account. If you know the date of the correction you can use the "Create Reversing Entries" option to create a second entry dated next month to account for the bank correction. This will ensure that you don't forget to make the entry the following month.