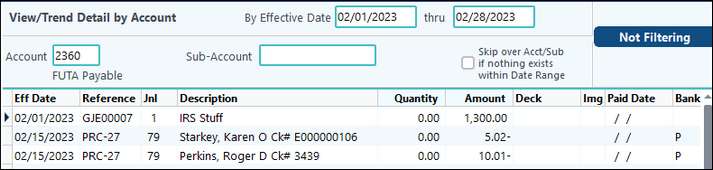

On a quarterly or annual basis, a balancing process should be run on your Payroll Liability Accounts. These type of accounts should be checked periodically. This is an easy look after processing payroll. Go to View Trend (F4), find your Account- 2360 in our case. The account balance won’t be zero, but you can see the balance of that account. Most of these accounts are paid on a quarterly basis, some are paid on a monthly basis. Depending on what month you pay those in, some of those accounts may be zero at some point.

In our case, it does have a positive balance for February. Why? If you double click on February 2023, you will see that there was a Journal Entry made for the Internal Revenue Service. The user would need to see why this entry was made. It is more than likely an error. Did you over pay your taxes??