For Income Tax purposes, you may want your books on a Cash Basis. Easily done! Set up a separate journal for these types of entries. This can be done in a Consolidation company if tracking at an Account level, or in a Combination company if tracking at a Sub-Account level.

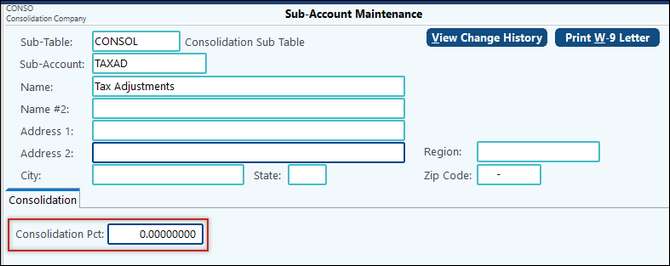

In our example, we used company CONSO, our consolidation company, to make these adjustments. We setup a special Sub-Account for those adjustments with one option changed so that we could create journal entries. (This is also how you can do elimination entries in the Consolidating company).

This Sub-Account also needs to be set up as a company, but no transactions need to exist in this company. In our example company we turned on File Sharing. You will need to set up this company, but it will have no transactions.

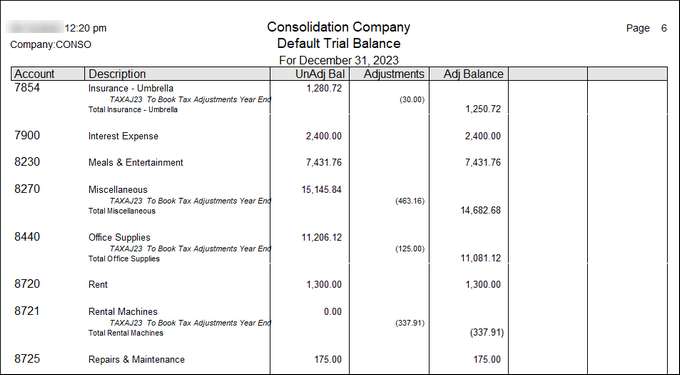

You may print out a Working Trial Balance to assist you with accounts that need to be adjusted or we have other reports that can assist you as well.

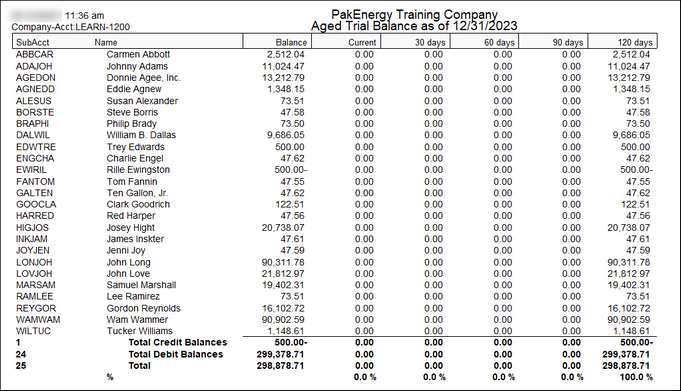

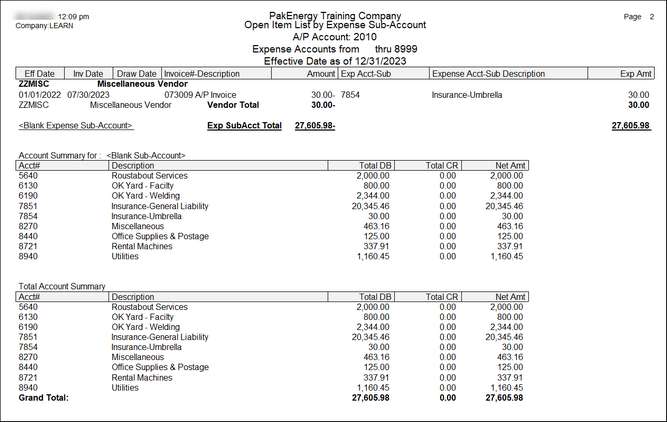

Examples of listings that can be used – you need to adjust your Accounts Receivable and your Accounts Payable. Run an Aged Trial Balance (in the Accounts Receivable module) for your Accounts Receivable balances and an Open Item by Exp Sub-Acct (OI-3 under Reports in A/P) in your actual company for those accounts.

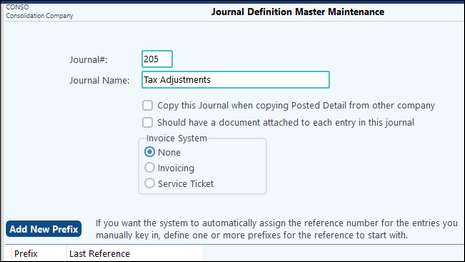

Set up a specific journal to handle your adjustments.

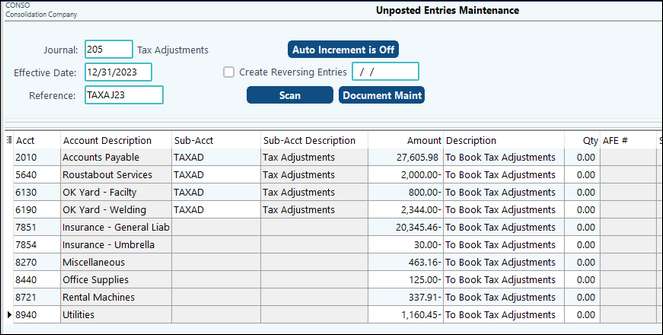

Create your Journal Entries in the consolidation company. Example of one journal entry created:

Once you have created the journal entries needed, you may run the Default Trial Balance with the option of the special journal selected in the Adjustments column with the “Print Adjustment on report, Jrnl(s):” 205