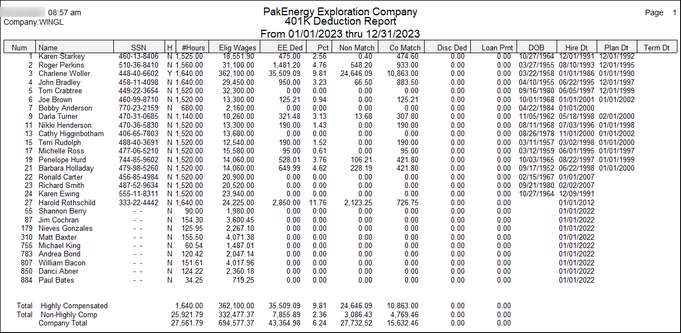

The 401(k) deduction report lists 401(k) information for each employee being paid. The information can be printed by payroll cycle or by date range. The sequence of the report can be by employee #, employee name, department+ emp #, or by social security #.

When the option is selected for the Roth Column, your detail code for employee deduction must start with a "R."

NOTE: The number of hours is calculated for both hourly and salaried employees on this report. The hours for salaried employees is calculated using annual hours of 2080 divided by the number of pay periods.

Impute Hours for Employees with Eligible Wages but no hours - ability to specify if hours are not to be imputed for employees getting paid that have no hours.