There are two methods for transferring money between accounts.

METHOD 1:To properly transfer funds between cash accounts, it is necessary to setup special journals and a clearing account. This will ensure that the transfer of funds does not cause any bank reconciliation problems later.

Setup:

1.Add two journals to the Journal Maintenance in the General Ledger module: one for transfer drafts and one for transfer deposits.

2.Set up a clearing account for the transfer of funds. For example, the clearing account could be account 1055-Transfer Clearing Account (Asset type account).

Example:

1. For the account that the money is being transferred out of, make an entry in the General Ledger module / Unposted Entries. The entry should be coded to the transfer draft journal. Move the money from the Cash account to the Transfer Clearing account.

2. Another entry will be necessary to move the funds from the Transfer Clearing account to the cash account it should be in using the Transfer Deposits journal.

Entries created in the General Ledger as seen in View Trend (F4)

A. Entry from the Cash Account being reduced to the Transfer Clearing Account.

Transfer Clearing Account |

Debit |

|

Cash account monies are coming out of |

Credit |

B. Entry from the Transfer Clearing Account to the Cash Account the funds are being deposited in.

Cash Account monies are going into |

Debit |

|

Transfer Clearing Account |

Credit |

When reconciling the bank statement for the month in the bank reconciliation cycle, the transfer of funds out of the 1001-Cash Account can be seen on the Cleared List located on the Reconcile Bank Stmt screen/ Checks button.

When reconciling the bank statement for the account that the funds were deposited into, the deposit will be seen on the Reconcile Bank Stmt Screen/Deposits button.

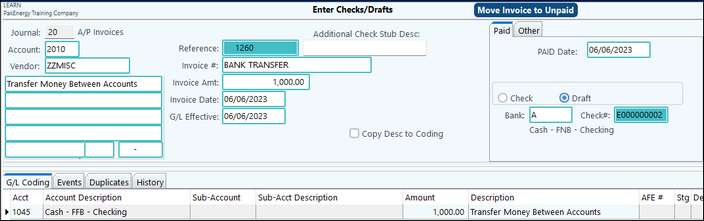

METHOD 2: This method is to use the A/P module and the Deposit entry module in tandem. Again with an eye toward moving the money and retaining the Bank Reconciliation module's ability to easily track the movement. First, you would use Accounts Payable / Enter Checks/Drafts to make the draft entry coding it to the Cash Clearing account as shown below.

Using the ZZMISC vendor, we are able to use the A/P module without setting up a dummy vendor to handle the movement of monies between accounts. The entry is coded to the Cash Clearing account. The second part of the equation is to create the deposit entry. Using the deposit entry module, create the deposit from the 1045 account to the 1010 account as shown below.

Below is the net effect on the clearing account at the end of the transaction process.

Jrnl 20 (Funds Transferred into Cash Clearing Account) |

Debit |

|

Jrnl 10 (Funds being transferred our of Cash Clearing Account) |

Credit |