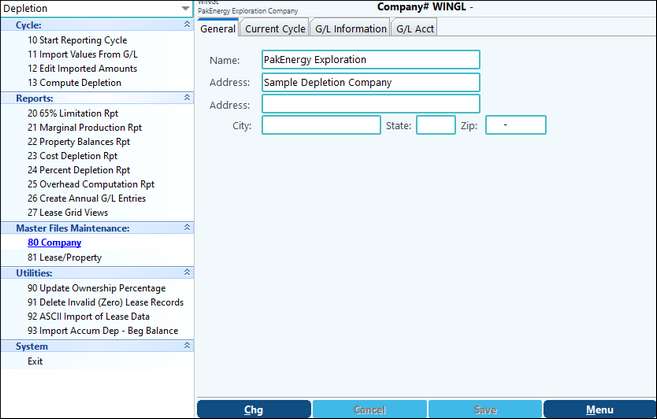

The Company Setup is used to dictate the environment for the calculation of depletion across all leases. Company Master Maintenance divides this process into four tabs.

General Tab - Fill in the Depletion Company Name and Address. This is a user define tab.

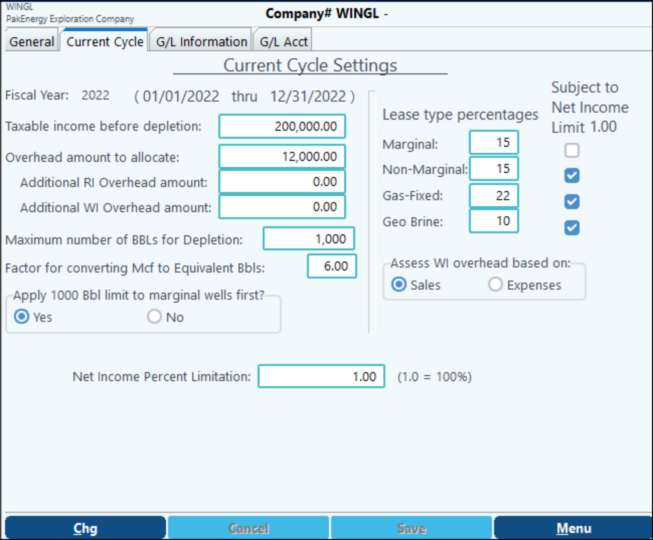

Current Cycle Tab - factors that affect the overall depletion calculation. Information needed; the company's total taxable income, any overhead allocation that's not already in the general ledger, the conversion factor used by the company to convert MCFs to BBLs and whether to apply the 1000 BBL limit to marginal wells first, effectively taking the higher depletion amounts when the 1000 BBL limit is exceeded, are User defined. The remainder of the information of Current Cycle is mandated by law and should be taken from the appropriate IRS publication.

Current Cycle Tab |

|

Fiscal Year |

The Fiscal Year for the current cycle, set on Start Reporting Cycle |

Taxable Income before Depletion |

The taxable income before depletion |

Overhead Amount to Allocate / Additional RI Overhead amount / Additional WI Overhead amount |

The overhead amount to allocate that IS NOT already recorded in the General Ledger. If there is an additional overhead that should be allocated to only RI or WI, fill in the amount in the appropriate field. |

Assess WI Overhead based on |

Sales or Expenses, if you have an additional WI overhead defined, choose how to assess the WI basis in order to correctly allocate the additional overhead amount. |

Maximum number of BBLs for Depletion |

Maximum number of BBLs for Depletion |

Factor for converting MCF to equivalent BBLs |

The conversion factor used by the company to convert MCFs to BBLs |

Apply 1000 BBL limit to Marginal Well first? |

Yes or No to apply the 1000 BBL limit to marginal wells first (effectively taking the higher depletion amounts when the 1000 BBL limit is exceeded |

Lease Type Percentages / Subject to Net Income Limit of 1.00 / Net Income Percentage Limitation |

These fields are mandated by law and should be taken from the appropriate IRS publication |

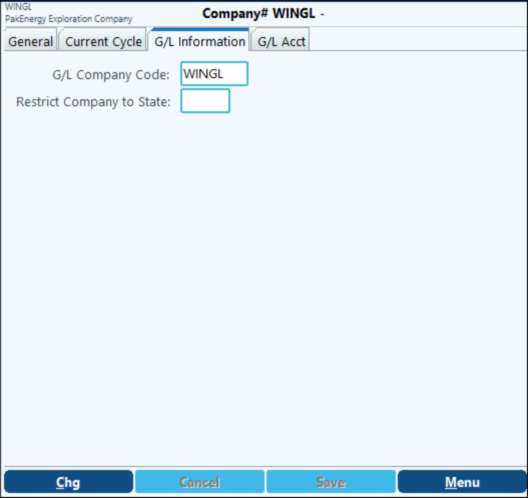

GL Information Tab

Fill in the G/L Company Code and if the Depletion module should only consider one state, fill in the necessary state.

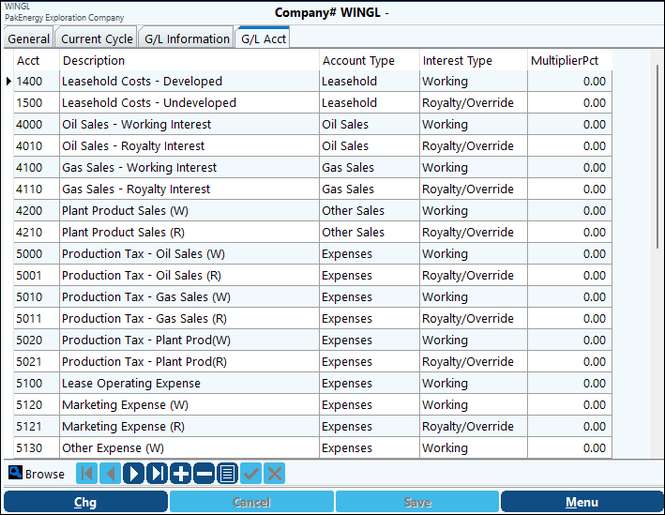

The G/L Account tab is where the G/L account numbers for Working and Royalty Income and Expenses are defined.

Note: To aid in the data entry process, a listing of the prior fiscal year's depletion schedule on a lease by lease basis showing lease #, lease type, and ending balances for: Carryovers, Leasehold, Reserves, and Accumulated Depletion will be advisable.