Troubleshooting Tips

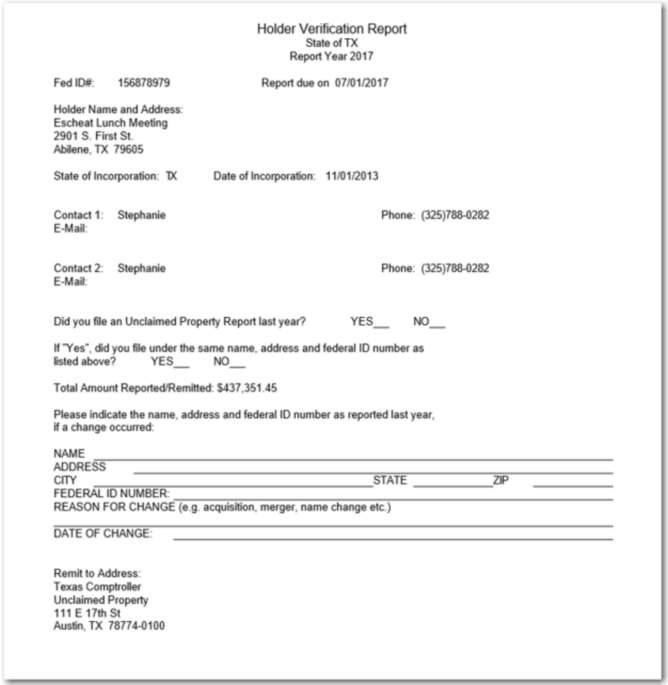

The system only creates the NAUPA file to upload to the state, we do not fill out any forms. We do create generic a Holder Verification Report located in the EDI Unclaimed Year file.

|

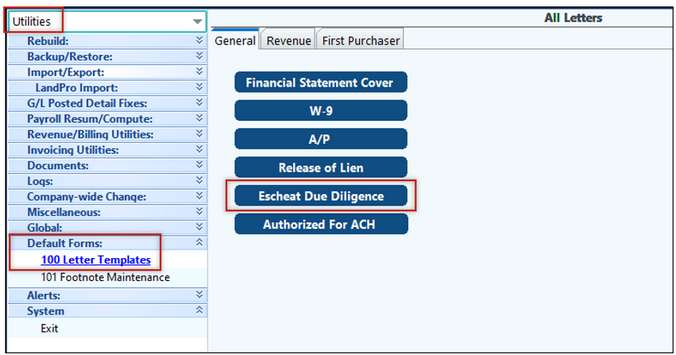

Yes, in Utilities > Default Forms > Letter Templates > Escheat Due Diligence.

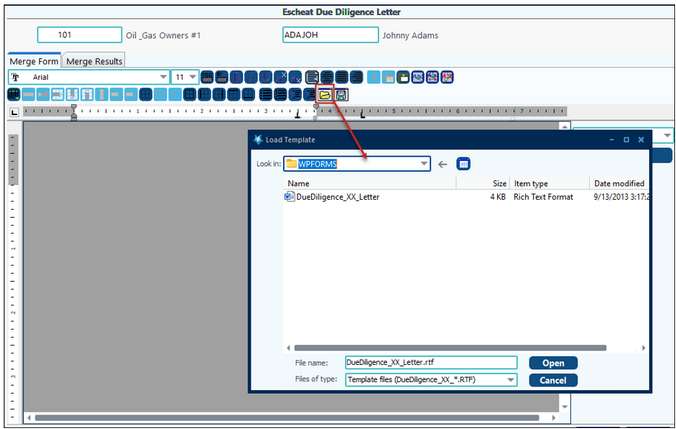

Use the Load File Template icon (looks like a file folder) to load a template.

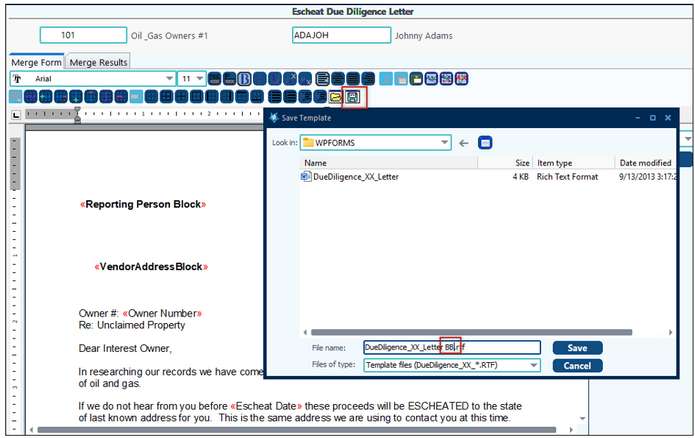

You will need to save your changed letter differently than the Pak Accounting original – ex. initials at the end, etc. because during the update process, original Pak Accounting forms will be updated as well, and you will lose your changes. Use the Save icon to make your changes. Make sure to add identifying characters such as replacing XX with the specific state of the letter (CA for California or TX for Texas) or adding your initials to the end of the file name. The name MUST start with “DueDiligence”. See Help for more information on how to make changes to letters.

|

| Some of my owners’ Due Diligence Letters are not printing, I even checked the Ignore Minimum Amount. |

If owners have been previously escheated in the prior year, another Due Diligence Letter is not required. If a user really wants to print Due Diligence Letters, they can go to Utilities > Default Forms > Escheat Due Diligence Letter and print one for each owner they want to send a letter. |

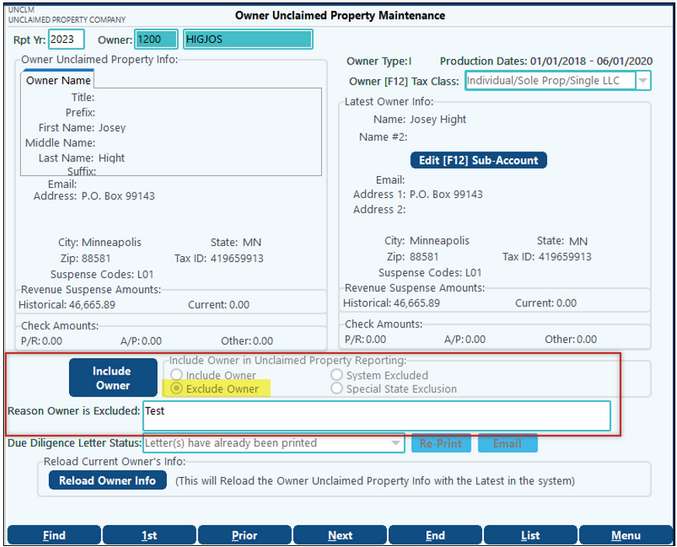

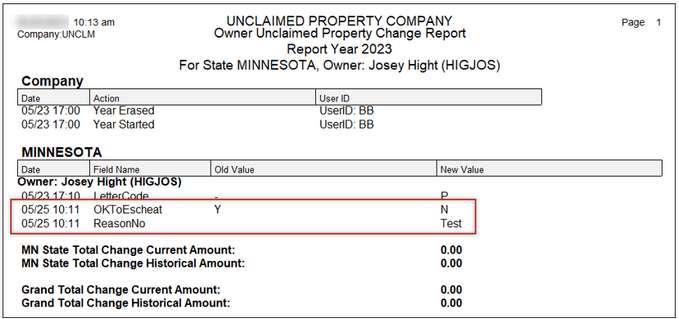

Look at the Comparison Report information to see what changed or look in Bank Reconciliation > Unclaimed Property Reporting > Owner Maintenance to see if Exclude Owner has been checked and the reason why.

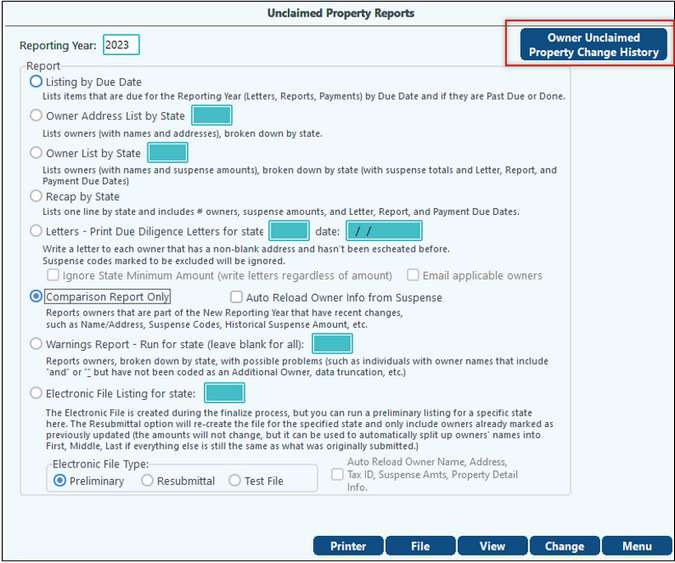

Or you can also run the Owner Unclaimed Property Change History Report.

|

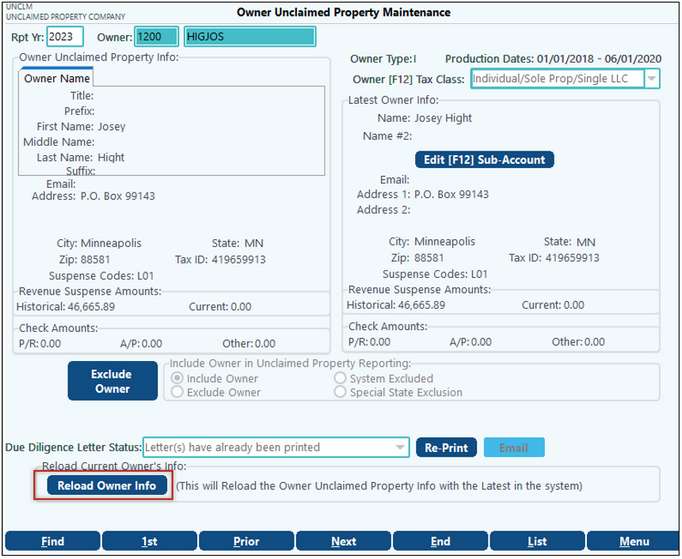

No, simply Reload Owner Info in Bank Reconciliation/Owner Maintenance. We do not recommend clients restarting their cycles.

|

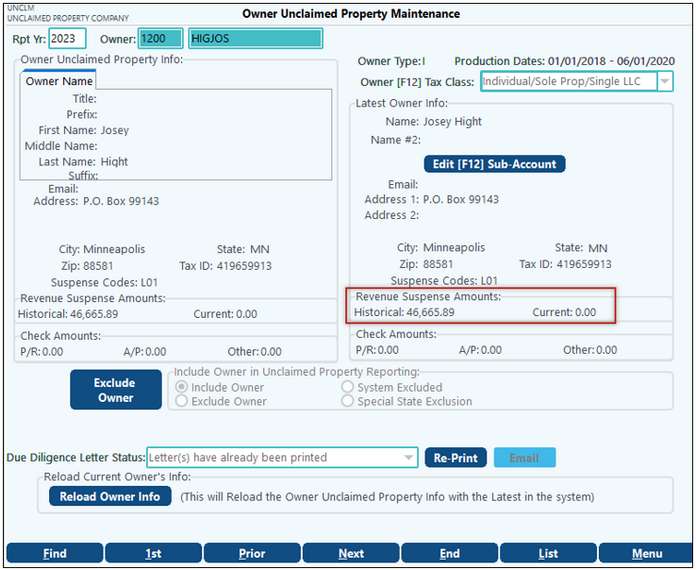

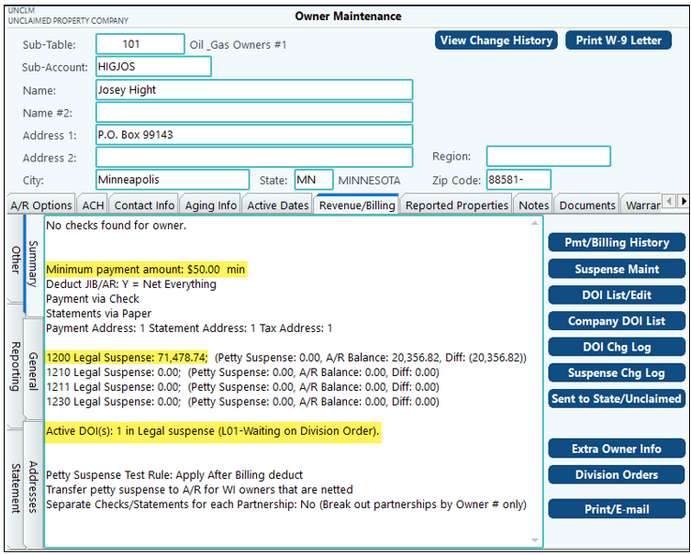

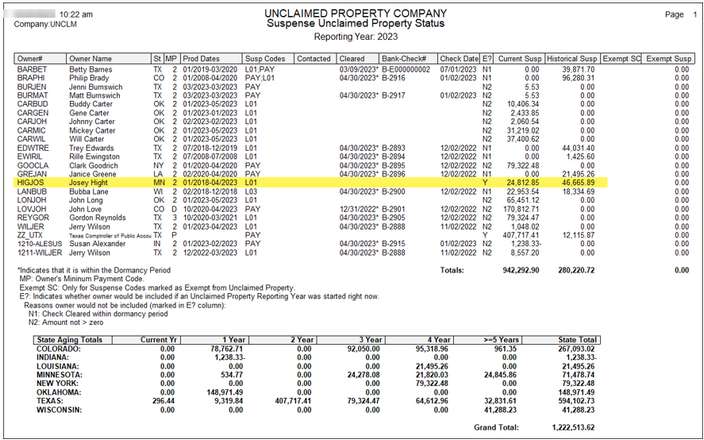

The owner could have Suspense due to being Minimum Pay in F12, but the suspense has met the State requirement, because the date is old enough on the suspense and the amount has met the state minimum. The client can run a flush cycle to pay the owner(s) or change the Suspense code on the suspense to a Suspense code that is exempt from Escheat. As shown on our report earlier, HIGJOS is pulling in on the Escheat report for 46,665.89 due to MN being noncurrent pay. She is set to minimum pay of 50.00 in F12, the Suspense code is L01 – Waiting on Division Order, and not exempt from Escheat, so in this case the client may want to make the L01 Exempt or create a new Exempt Suspense Code, so as not to send the monies to the state. It shows suspense of 71,478.74, but only 46,665.89 meets the state timeframe requirements as MN is not a Current pay State.

If a state is Current Pay, like TX, it would pull all suspense.

|

The Suspense Master Listing pulls all suspense and Escheat only pulls according to the state requirements. Need to verify run dates for all the amounts from the Suspense Listing with the amounts that are pulled during the Escheat process, and then verify what the State requirements are in Utilities. (HIGJOS for example)

|