Service Ticket – accrual date based on ticket dates

If you want to use the ticket dates as the GL Effective Date, then when the tickets are assigned to an invoice, the date used there is the Invoice Date.

It will work similar to the Purchaser Clearing Account. When the tickets are created, they will be added to a clearing account of your choice (you may want to create a new one to keep the entries separated). Then when you assign the tickets to the invoice, it will zero out the clearing account and then post the entry with the invoice date to the income or parts account.

1.Create a new unique Unbilled Entries Journal to use for Service Ticket

2.Create an Unbilled A/R Account, attach your Customer Sub-Table. (a clearing account, much like a purchaser clearing account)

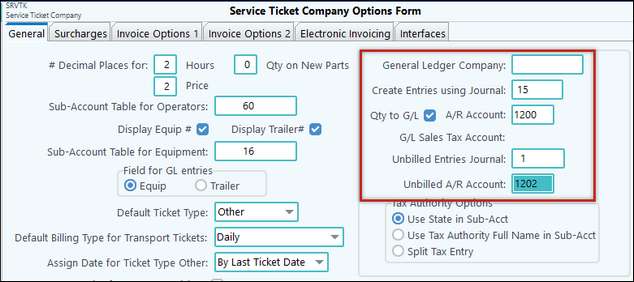

3.Go into the Service Ticket Company - Master Files Maintenance - General tab - in the top right corner of the screen, fill in the following fields:

•Create Entries using Journal:

•AR Account:

•G/L Sales Tax Account:

•Unbilled Entries Journal:

•Unbilled A/R Account:

(Again, once you populate these fields there is no going back unless you do a restore from a backup.)

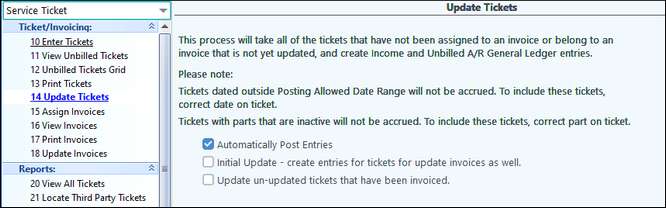

Once these are filled in, a new option appears in the Service Ticket Menu:

What basically happens is when you create tickets, you will have ticket dates on them of February 1, February 2, and February 3, for example. Then, when you “Update Tickets”, this process will take the entries and post them into the ‘clearing account’ that you create with the February 1, February 2 and February 3 date as the GL Effective Date. When you actually assign the tickets to an invoice, another entry happens to zero out the clearing account and offset account – like income or parts.

If changes are made to a ticket, the system will create the entries for the changes made. There is an option to automatically post the entries and to Update un-updated tickets that have been invoiced which will look for tickets that need to be updated instead of just the open tickets.

If you update tickets and Pak Accounting tells you that the entries are in the G/L unposted entries, then it is advisable to correct the problem with the entry at once. If you have more tickets to update, they will also be sent to the G/L unposted entries even is there are no errors. This is generally due to the entries having the same journal numbers and the same date when validating causing the system to keep these entries grouped together.