WolfePak Investor G/L Only

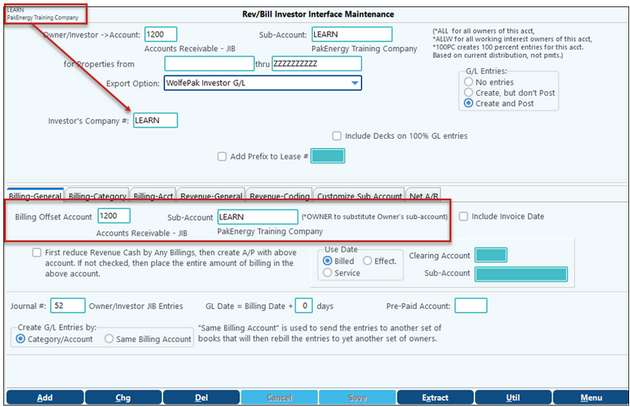

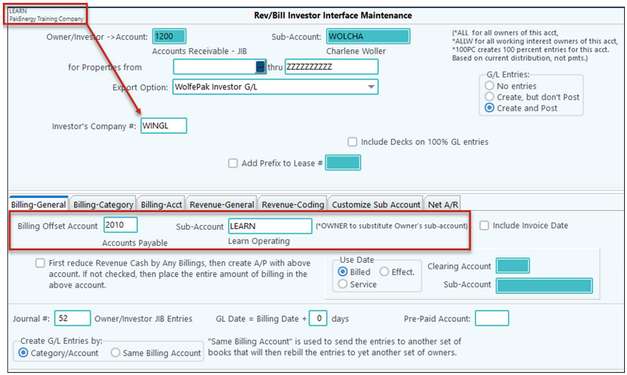

For Billing, if your company owns part of the property you are billing, you can direct the company's share of the charges to the appropriate Expense Accounts in the proper books instead of allowing them to remain in Accounts Receivable. You can similarly set up affiliate entries and send to another set of books. We recommend each Journal Number be unique for easier audit trails.

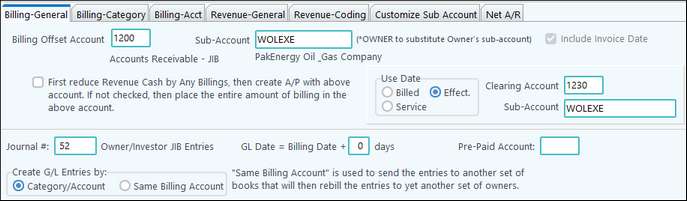

Billing General tab

Billing - General tab |

|

|---|---|

Billing Offset Account / Sub-Account |

Our Share: The account should match the same Account/Sub-Account that the Rev/Bill cycle used and defined in the DOI maintenance. (Typically the A/R account) Investor Share: For journal entries sent to an affiliate's books, use a Cash, Accounts Payable, or Inter-company type account as needed. See Internal/External Examples below. |

Include Invoice Date |

If option is checked, then the original entry's production date and invoice date will be retained. |

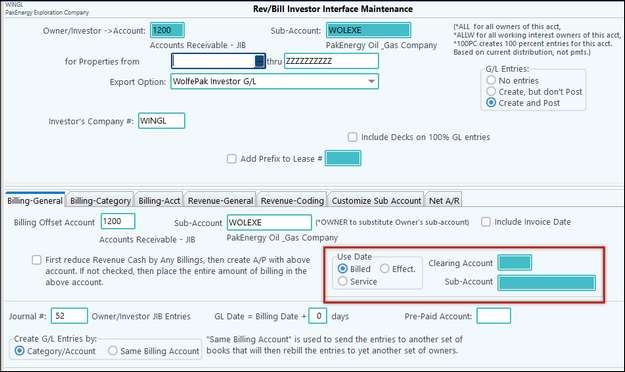

Use Date |

This option effects how the billing entries will hit in General Ledger. Billed - the entries for billing will be recorded using the Billed Date of the cycle. Service - the entries for the billing will be recorded using the Service Date of the billing entry/invoice (if Service Date is being used in A/P). Effective - the entries for the billing will be recorded using the Effective Date of the billing entry/invoice. If Service or Effective date is selected, enter in an Account/Sub-Account clearing account for the accrual entries. This account will typically be an A/R Account that has an Owner Sub-Table attached to it.The clearing account will account for the timing difference. See Use Date Examples below. |

Journal |

Journal number to record the entry (should be a unique journal) |

GL Date = Billing Date + __ days |

You can adjust the journal date by adding "x" number of days to the cycle's billing journal. |

Pre-Paid Account |

The AFE prepayment account. This will allow the investor interface entries to properly account for any AFE prepayments on the investor's set of books. |

Create G/L Entries by |

Category/Acct will use the Billing Category and Billing Acct tabs to create G/L entries. Same Billing Acct will use the same billing accounts as the operator to code all JIB entries. |

Internal Example

External Example In this example, I’m tracking another set of books in a different company. When the Investor Interface entries are made into the other company, it will automatically create an A/P Invoice so they can pay it.

|

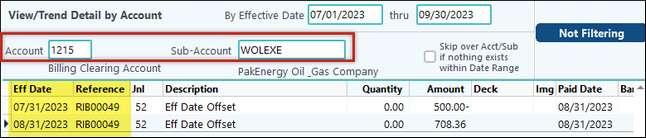

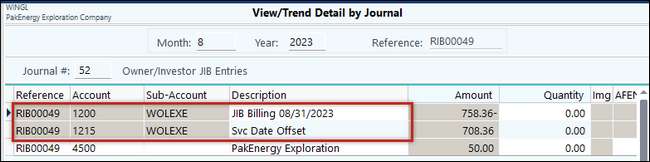

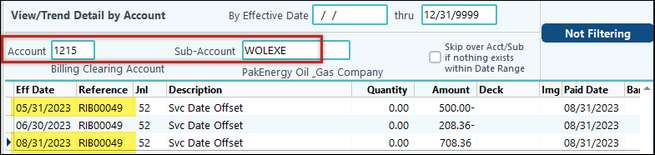

These examples will showcase the Use Date options.

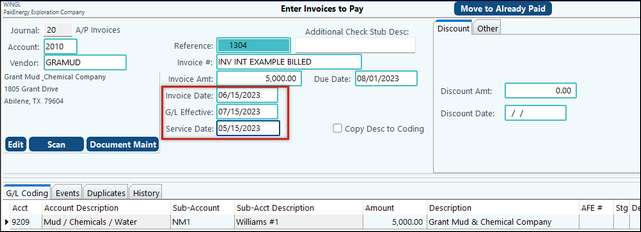

Test Example: I have an A/P invoice that has an Effective Date of 07/2023 and a Service Date of 05/2023.

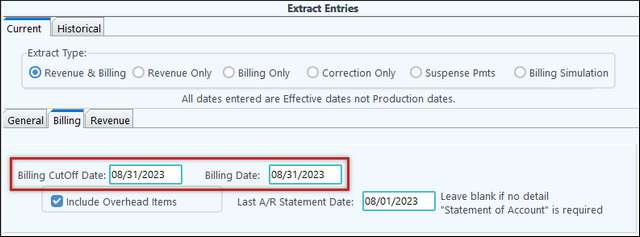

My billing cycle will have a Billing Date of 08/2023

If Investor Interface is set to Billing Date Option, everything will hit the A/R as normal.

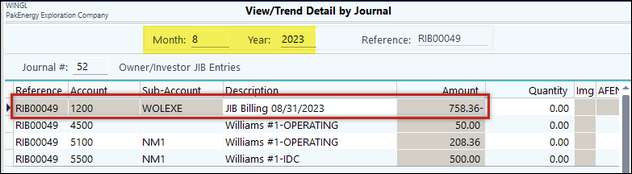

If the Effective Date Option is selected. The 1200 A/R Account will still show the 08/2023 date, but when we drill down we see the clearing account has been used. For this invoice, the offset will be in July, which was the Effective Date of the A/P Invoice.

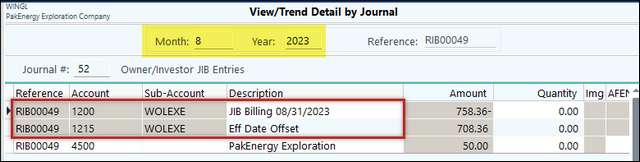

If the Service Date Option is selected. The 1200 A/R Account will still show the 08/2023 date, but when we drill down we see the clearing account has been used. For this invoice, the offset will be in May, which was the Service Date of the A/P Invoice.

|

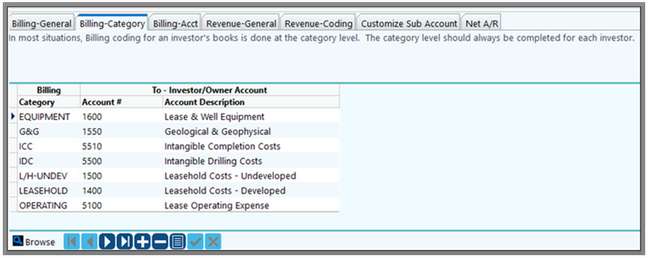

Billing-Category tab

Billing - Category |

|

|---|---|

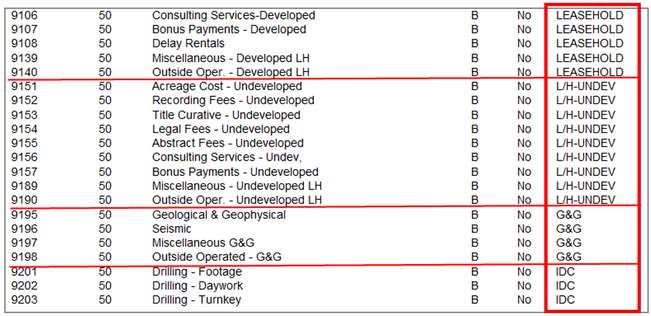

Billing Category / Account # |

If individual accounts are not defined on the Billing-Acct tab, then expenses will default to the setup on this tab. The Expense Accounts for each Billing Category that will be used to be coded to the investor G/L. |

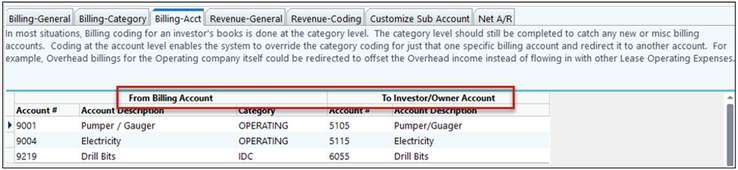

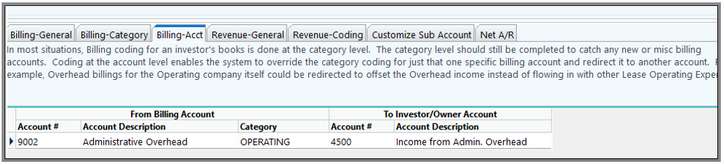

Billing-Acct tab

Example: Offset the internal owner’s share of Overhead Expense to the Overhead Income Account, thus reducing the Overhead Income.

Billing - Acct |

|

|---|---|

Billing Account From/To |

This allows a customized account level coding that will override the “Billing-Category” Account.

|

Example: Offset external owner shares that need to be broken out and not lumped together within a category. On the left-side of the screen will be the billing accounts from the cycle. On the right-side of the screen will be the accounts from investor company.