1042 Foreign Withholding

Foreign Person's U.S. Source Income Subject to Withholding. The 1042 forms are due March 15th.

Overview

•Users will need to file for a separate 1042 TCC number and enter this in the 1042 TCC: box on the 1099 Transmittal Maintenance.

•Users will need to verify they have entered their 9-digit Employer ID # (EIN), along with Dept. Title: on the 1099 Company Maintenance screen to be able to file the 1042-S.

•Below is a table that will help you to identify whether a 1042 is necessary or if a 1099 should be used.

1042 Process

1.Extract Revenue or AP 1099's. Those coded to Foreign Withholding on their Sub-Account Maintenance will automatically be routed to the 1042-Foreign Withholding/Recipient Maintenance.

2.Review the 1042-S Recipient Maintenance by running a listing. If the 1042's are corrected 1042's, mark the "Corrected" option at the top of the screen. Amounts should be in whole dollars per IRS regulations.

3.Run an Error Listing 1042. Correct any errors and run again until all errors are gone.

4.Export 1042 Transmittal. Take note of the file destination.

Recipient Maintenance

When Accounts Payable or Revenue 1099's are extracted, if there are any Sub-Accounts that were coded to Foreign Withholding on their Sub-Account Maintenance their tax form will be in the 1042-Foreign Withholding section of the 1099 module.

Box 1-Income Code - will be hard coded to 14 – Real property income and natural resources royalties

Box 3a Exemption codes and 3b Tax Rate (%) - determined by Owner Maintenance (F12) setting for Tax Class:

•Foreign Withholding will have an Exemption Code of 00 – Not Exempt and a Tax Rate of 30%

•Foreign Withholding- Exempt - will have an Exemption code of 01-Effectively connected income and a Tax Rate of 00.00%

Note - There are other Box 3a Exemption codes available, but they must be manually selected from the drop-down list in the 1042-S Payee Maintenance.

Box 13b Recipient’s Country Code - will need to be manually selected using the drop-down arrow. This information does not extract from Owner Maintenance.

Unique Form Identifier – Beginning in 2017, withholding agents will be required to assign a unique identifying number to each Form 1042-S they file. This identifying number is used, to identify which information return is being corrected or amended when multiple information returns are filed by a withholding agent with respect to the same recipient.

•The unique identifying number cannot be the recipient's U.S. or foreign TIN.

•The unique identifying number must be numeric.

•The length of a given identifying number must be exactly 10 digits.

•The identifying number must be unique to each original Form 1042‐S filed for the current year.

•As owners are added to the 1042-S Payee maintenance (manually or by extract), the system automatically assigns a Unique Form Identifier starting with number 0000000001. If an owner is added and then deleted from Payee Maintenance the number assigned to that Payee Maintenance will be skipped.

Revisions Submitted- shows number of Amended returns that have been printed/transmitted (see Print 1042-S Corrections for more info).

Edit button- address allows you to change the address in the Sub-Account maintenance and replace the 1042 address with the new address if desired. This may also be done in F12, but a new extract will be needed for the new address to be used.

Find button- on the bottom of the screen allows a lookup display of all the extracted records.

List button- on the bottom of the screen prints the recipient information with the amounts.

*Note- Any manual changes made in 1042-S Maintenance will be overridden if Revenue 1099s are re-extracted.

Error Listing 1042-S

Selecting the "Error Listing" option on 1042-S menu will produce an edit listing that lets you know if there are any errors and provides company totals. The error listing is run by clicking on “Printer”, “File” or “View” on the “1042-S Error Listing” screen.

All errors need to be corrected prior to printing or submitting 1099's/1042-S.

View/Print the 1042 Error Listing for any problems that may need to be corrected. This report will also provide the totals for the 1042's to include the 1042 Total and the Federal Withholding Total. If an Employer's EIN is blank, the Error Listing will alert you. This is a required field in the transmittal file.

Note – There is a warning if the user has multiple records with multiple error codes. The system rolls all Payee records up into 1 record when creating the transmittal. Thus, if ALESUS has an exemption code of 01 on one record and exemption code of 02 on another, one of these codes will not be reported to the IRS. Because of this, the 1042-S error listing will alert the user if an owner has multiple exemption codes (same thing happens for the Recipient state and Chp. 3 Tax Rate).

Print Form 1042-S

Print Type

•Plain Paper - will print on regular copy paper and includes 1042-S Instructions. This option should be used to print:

oCopy B for Recipient – Mask SSN should be used

oCopy C for Payer – does not print instructions and prints 2 recipients per page

•Preprinted Forms - does not print the form, only prints the information to print on the preprinted form.

oShould be used when printing the Copy A for the IRS.

oWhen printing the Copy A for the IRS the Mask SSN should be left unchecked.

Mask SSN - if checked will only print the last four digits of a Payee’s SSN. If unchecked, will print Payee’s entire SSN. EIN numbers will always print the entire number regardless of setting.

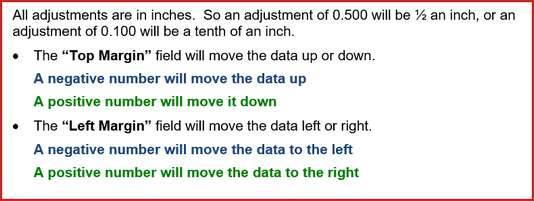

Printer Offsets-used when printing Preprinted Forms. Not all printers will print perfectly the first time and adjusts to the printer settings may need to be made.

•It is recommended when printing Preprinted forms to print on plain paper and hold the paper up to the preprinted form until the printing aligns to the preprinted form so that forms are not wasted.

•Between Forms Adjustments- Negative numbers Decrease space/ Positive numbers Increase space.

Printing Corrected 1042-S Forms- Printing corrected 1042-S forms works the same way as printing other corrected forms.

First, make any necessary changes to the data and perform a new extract or manually make the changes in the Recipient Maintenance (not recommended). Then, in the Recipient Maintenance change the option from Original to Corrected (this is a manual change).

Finally, in the Print 1042-S screen change the option from Original to Corrected, select the Print. (Only recipients whose Recipient Maintenance is marked as Corrected will be printed).

The Form will be marked as Amended with an Amendment number and have the same Unique Identifier number as the original form.

When printing a Corrected/Amended Form users will receive the following pop-up with a question:

•Selecting Yes to this question will reset the Corrected Flags and Flag the Recipient Maintenance>Revisions Submitted to increase and the Amendment number on the form to increase. This option should be used if printing a 2nd or 3rd Corrected/Amended Form(s).

•Selecting No does not increase the Revisions Submitted number on the Recipient Maintenance or Amendment number on the form.

Export 1042 Transmittal

This option will create the electronic file for the IRS. The path to the extracted file is given one the file has been created (OK has been selected). Take note of the Destination of the file: GLN32\XXXXX\EDI\ where "XXXXX" is the company code. If the file is a corrected file, mark the option for corrected.

Corrected transmittal - First, make any necessary changes to the data and perform a new extract or manually make the changes in the Recipient Maintenance (not recommended). Then, in the Recipient Maintenance change the option from Original to Corrected (this is a manual change).

Finally, in the Export 1042 Transmittal screen change the option from Original to Corrected and select Ok. (Only recipients whose Recipient Maintenance is marked as Corrected will be included in the Corrected Transmittal file):

When transmitting a Corrected/Amended file, the user will receive the following pop-up with a question:

•Selecting Yes to this question will reset the Corrected Flags and Flag the Recipient Maintenance>Revisions Submitted to increase and the Amendment number on the form to increase. This option should be used if transmitting a 2nd or 3rd Corrected/Amended file(s).

•Selecting No does not increase the Revisions Submitted number on the Recipient Maintenance or Amendment number on the file.